Student Tips for Filling Out Form 8843 International Students 2020

Understanding the 2018 MN M1NR Form

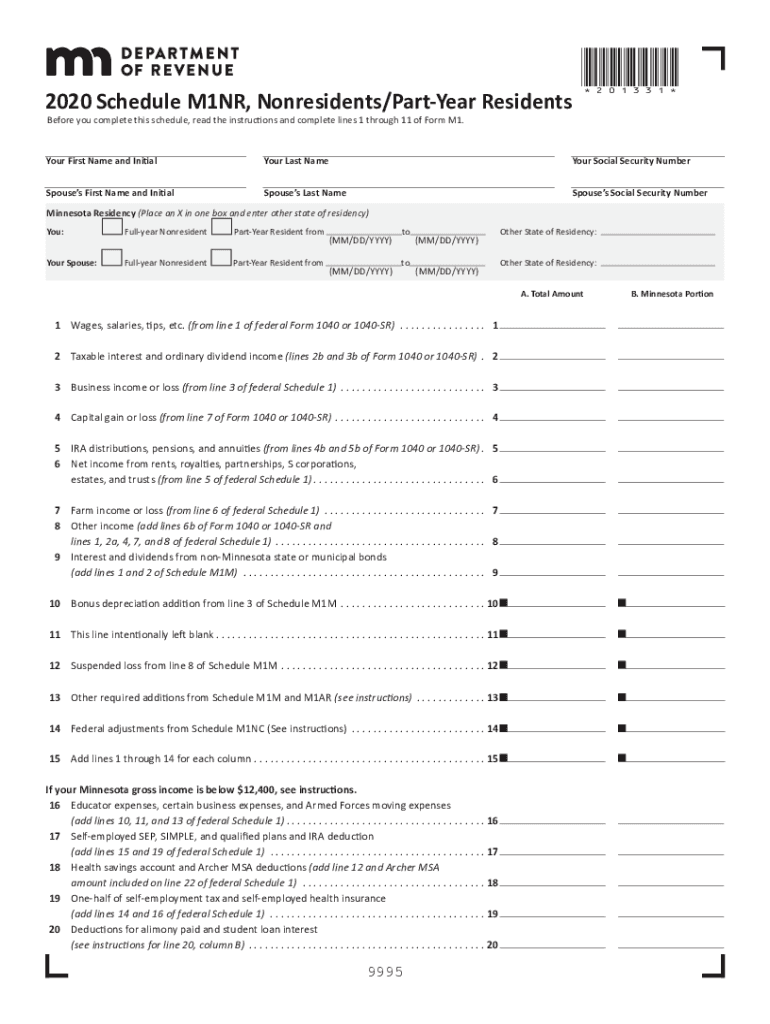

The 2018 Minnesota M1NR form is specifically designed for non-resident individuals who earn income in Minnesota. This tax form allows these individuals to report their Minnesota-sourced income and calculate their tax liability accordingly. It is crucial for non-residents to accurately complete this form to ensure compliance with Minnesota tax laws and avoid potential penalties.

Key Elements of the 2018 MN M1NR Form

When filling out the 2018 M1NR form, there are several key elements to consider:

- Personal Information: Include your name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN).

- Income Reporting: Report all Minnesota-sourced income, including wages, interest, dividends, and rental income.

- Deductions: Identify any deductions you may qualify for, which can reduce your taxable income.

- Tax Calculation: Calculate your Minnesota tax based on the income reported and applicable tax rates.

Steps to Complete the 2018 MN M1NR Form

Completing the 2018 MN M1NR form involves several steps to ensure accuracy:

- Gather all necessary documents, including W-2s and 1099s that report your Minnesota income.

- Fill out your personal information accurately at the top of the form.

- Report your total Minnesota-sourced income in the designated section.

- Apply any eligible deductions to reduce your taxable income.

- Calculate your tax liability using the provided tax tables.

- Review the completed form for accuracy before submission.

Filing Deadlines for the 2018 MN M1NR Form

The deadline for filing the 2018 MN M1NR form is typically April 15 of the following year. However, if this date falls on a weekend or holiday, the due date may be extended to the next business day. It is important to file on time to avoid late fees and interest on any taxes owed.

Form Submission Methods for the 2018 MN M1NR

There are several methods available for submitting the 2018 MN M1NR form:

- Online Submission: You can file your form electronically through approved tax software that supports Minnesota tax forms.

- Mail Submission: Print the completed form and send it to the Minnesota Department of Revenue at the address specified in the form instructions.

- In-Person Submission: You may also deliver your form in person to a local Minnesota Department of Revenue office.

Penalties for Non-Compliance with the 2018 MN M1NR Form

Failure to file the 2018 MN M1NR form on time, or inaccuracies in reporting income, can result in penalties. These may include fines and interest on unpaid taxes. It is essential to ensure that all information is accurate and submitted by the deadline to avoid these consequences.

Quick guide on how to complete student tips for filling out form 8843 international students

Effortlessly Complete Student Tips For Filling Out Form 8843 International Students on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the correct form and securely retain it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Student Tips For Filling Out Form 8843 International Students on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and Electronically Sign Student Tips For Filling Out Form 8843 International Students with Ease

- Locate Student Tips For Filling Out Form 8843 International Students and click Get Form to begin.

- Utilize the provided tools to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Student Tips For Filling Out Form 8843 International Students and ensure excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct student tips for filling out form 8843 international students

Create this form in 5 minutes!

How to create an eSignature for the student tips for filling out form 8843 international students

The way to generate an electronic signature for your PDF in the online mode

The way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

How to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the significance of the 2018 mn m1nr for businesses?

The 2018 mn m1nr is crucial for businesses as it outlines essential tax filing requirements for the year. Understanding these regulations helps ensure compliance and can potentially save businesses from incurring penalties. Utilizing solutions like airSlate SignNow can simplify the signing and submission process associated with the 2018 mn m1nr documentation.

-

How can airSlate SignNow help with the 2018 mn m1nr documentation?

airSlate SignNow allows users to easily create, send, and eSign documents related to the 2018 mn m1nr. Its intuitive interface simplifies the process of filling out necessary forms, which aids in timely submissions. This can enhance efficiency and reduce the stress associated with meeting tax requirements.

-

What are the pricing options for airSlate SignNow for handling the 2018 mn m1nr?

airSlate SignNow offers flexible pricing plans that suit businesses of all sizes. You can choose from monthly or annual subscriptions based on your document signing needs, including those related to the 2018 mn m1nr. Each plan includes various features that enhance the document handling experience.

-

Does airSlate SignNow integrate with other software for managing the 2018 mn m1nr?

Yes, airSlate SignNow offers seamless integrations with numerous applications, making it easier to manage your 2018 mn m1nr alongside other business processes. Whether you use CRM, project management, or other document management tools, airSlate SignNow can integrate smoothly, enhancing workflow efficiency.

-

What features of airSlate SignNow are beneficial for the 2018 mn m1nr?

Key features of airSlate SignNow that benefit users dealing with the 2018 mn m1nr include automated workflows, templates, and real-time tracking. These tools help streamline the document signing process and maintain compliance with tax requirements. The ability to access signed documents securely further adds to its advantages.

-

Is airSlate SignNow suitable for small businesses managing the 2018 mn m1nr?

Absolutely! airSlate SignNow is designed to be cost-effective and user-friendly, making it an ideal solution for small businesses tackling the 2018 mn m1nr. Its affordable pricing and essential features ensure small businesses can efficiently manage their document needs without breaking the bank.

-

How does airSlate SignNow ensure security when signing the 2018 mn m1nr?

AirSlate SignNow prioritizes security with advanced encryption and secure cloud storage for all documents, including the 2018 mn m1nr. This ensures that sensitive information remains protected from unauthorized access. Additionally, the platform complies with various industry standards, reinforcing trust in its security measures.

Get more for Student Tips For Filling Out Form 8843 International Students

Find out other Student Tips For Filling Out Form 8843 International Students

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT