Azdor Govformstax Credits FormsCredit for Contributions Made or Fees Paid to Public Schools 2021

Understanding the Arizona Tax Form 322

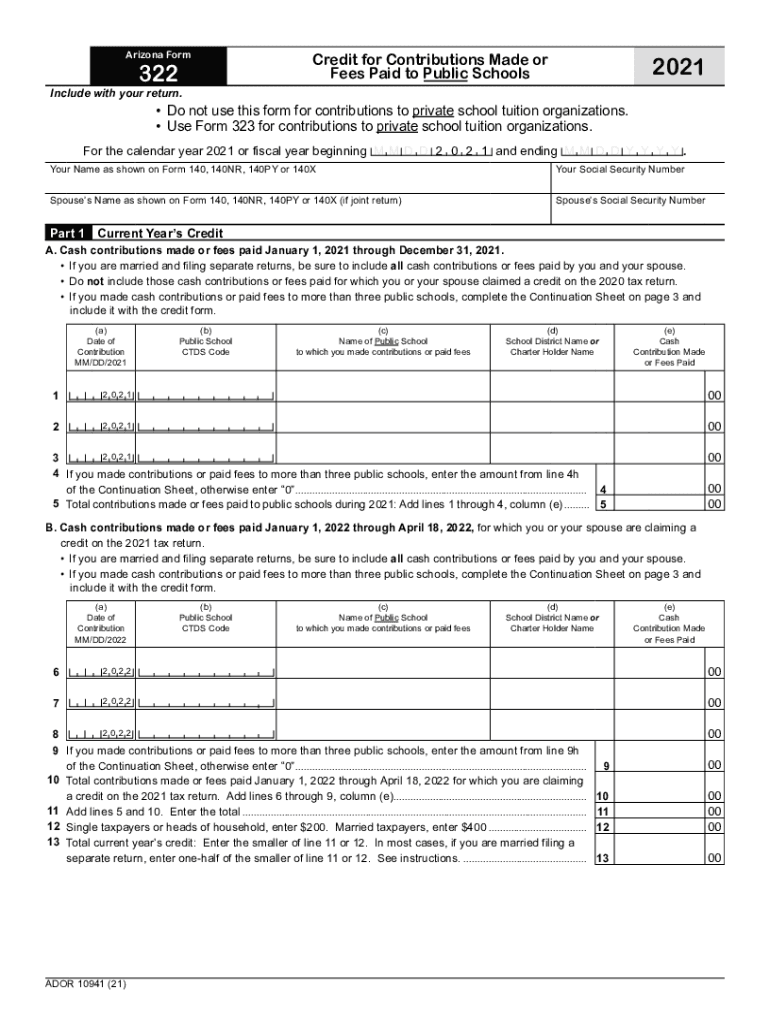

The Arizona tax form 322, officially known as the Credit for Contributions Made or Fees Paid to Public Schools, is designed to allow taxpayers to receive a credit for contributions made to public schools in Arizona. This form is particularly relevant for individuals who wish to support educational initiatives while also benefiting from tax credits. The form is part of Arizona's efforts to encourage community investment in public education.

Steps to Complete the Arizona Tax Form 322

Completing the Arizona form 322 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation regarding contributions made to public schools. This may include receipts or confirmation letters from the schools. Next, fill out the form with your personal information, including your name, address, and taxpayer identification number. Be sure to accurately report the total amount contributed, as this will determine the credit amount. Finally, review the form for any errors before submitting it to the appropriate tax authority.

Eligibility Criteria for Arizona Tax Form 322

To qualify for the tax credit associated with form 322, taxpayers must meet specific eligibility criteria. Contributions must be made to a public school in Arizona, and the funds should be used for extracurricular activities or character education programs. Additionally, there are limits on the amount that can be claimed based on filing status. Individual taxpayers and married couples filing jointly may have different maximum credit amounts, so it is essential to check the current guidelines to ensure compliance.

Legal Use of Arizona Tax Form 322

The Arizona tax form 322 is legally binding when completed correctly and submitted according to state regulations. It is crucial to adhere to the guidelines set forth by the Arizona Department of Revenue to ensure that the contributions are recognized for tax credit purposes. The form must be filed with the taxpayer's annual tax return, and keeping copies of all documentation related to contributions is advisable in case of an audit.

Filing Deadlines for Arizona Tax Form 322

Timely submission of the Arizona form 322 is vital to ensure that taxpayers receive their credits. The form should be filed along with the annual state income tax return, which typically has a deadline of April 15 each year. However, if taxpayers file for an extension, it is important to note that the form must still be submitted by the extended deadline to qualify for the credit.

Form Submission Methods for Arizona Tax Form 322

Taxpayers have several options for submitting the Arizona tax form 322. The form can be filed electronically through approved e-filing software, which often streamlines the process and reduces errors. Alternatively, taxpayers may choose to print the completed form and submit it by mail to the Arizona Department of Revenue. In-person submissions are also possible, though less common. Regardless of the method chosen, ensuring that the form is submitted by the deadline is essential for credit eligibility.

Quick guide on how to complete azdorgovformstax credits formscredit for contributions made or fees paid to public schools

Complete Azdor govformstax credits formsCredit For Contributions Made Or Fees Paid To Public Schools effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Azdor govformstax credits formsCredit For Contributions Made Or Fees Paid To Public Schools on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to alter and eSign Azdor govformstax credits formsCredit For Contributions Made Or Fees Paid To Public Schools without breaking a sweat

- Find Azdor govformstax credits formsCredit For Contributions Made Or Fees Paid To Public Schools and click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to submit your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Azdor govformstax credits formsCredit For Contributions Made Or Fees Paid To Public Schools and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct azdorgovformstax credits formscredit for contributions made or fees paid to public schools

Create this form in 5 minutes!

How to create an eSignature for the azdorgovformstax credits formscredit for contributions made or fees paid to public schools

The best way to make an e-signature for a PDF online

The best way to make an e-signature for a PDF in Google Chrome

The way to create an e-signature for signing PDFs in Gmail

The best way to generate an e-signature straight from your smartphone

How to make an e-signature for a PDF on iOS

The best way to generate an e-signature for a PDF document on Android

People also ask

-

What is form 322, and how can it benefit my business?

Form 322 is a document used for specific administrative and regulatory processes. Utilizing airSlate SignNow allows businesses to easily create, send, and sign form 322, streamlining operations and reducing paperwork bottlenecks. This leads to improved efficiency and faster turnaround times for important documents.

-

Is there a cost associated with using the form 322 feature in airSlate SignNow?

Yes, there are various pricing plans available for airSlate SignNow that include the ability to manage form 322. These plans are designed to cater to different business needs, making it affordable for small businesses and scalable for larger organizations. You can choose a plan that fits your budget and requirements.

-

Can I customize form 322 using airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize form 322 according to their specific needs. You can modify fields, add branding, and tailor the document layout to create a professional and personalized experience for signers.

-

What integrations are available for form 322 in airSlate SignNow?

airSlate SignNow offers a range of integrations with popular applications such as Google Drive, Salesforce, and Dropbox to streamline your workflow. This means you can easily access, send, and track form 322 directly from your favorite tools, enhancing productivity and collaboration.

-

How secure is the signing process for form 322 with airSlate SignNow?

The security of form 322 signed through airSlate SignNow is a top priority. The platform uses industry-standard encryption and authentication methods to ensure that your documents are safe and compliant with legal regulations, providing peace of mind for businesses and signers.

-

Can I track the status of form 322 once it has been sent?

Yes, airSlate SignNow provides real-time tracking for form 322. Users can easily monitor the signing status, see who has viewed or signed the document, and receive notifications, which helps in managing follow-ups and deadlines effectively.

-

What types of businesses can benefit from using form 322 with airSlate SignNow?

Form 322 can be beneficial for various types of businesses, including those in finance, healthcare, and education. Any organization that requires efficient document handling and eSignature solutions can take advantage of airSlate SignNow to enhance their processes and client interactions.

Get more for Azdor govformstax credits formsCredit For Contributions Made Or Fees Paid To Public Schools

- Georgia suspension form

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497303539 form

- Ga odometer disclosure statement form

- Ga odometer form

- Promissory note in connection with sale of vehicle or automobile georgia form

- Ga bill sale boat form

- Bill of sale of automobile and odometer statement for as is sale georgia form

- Contract cost fixed form

Find out other Azdor govformstax credits formsCredit For Contributions Made Or Fees Paid To Public Schools

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple