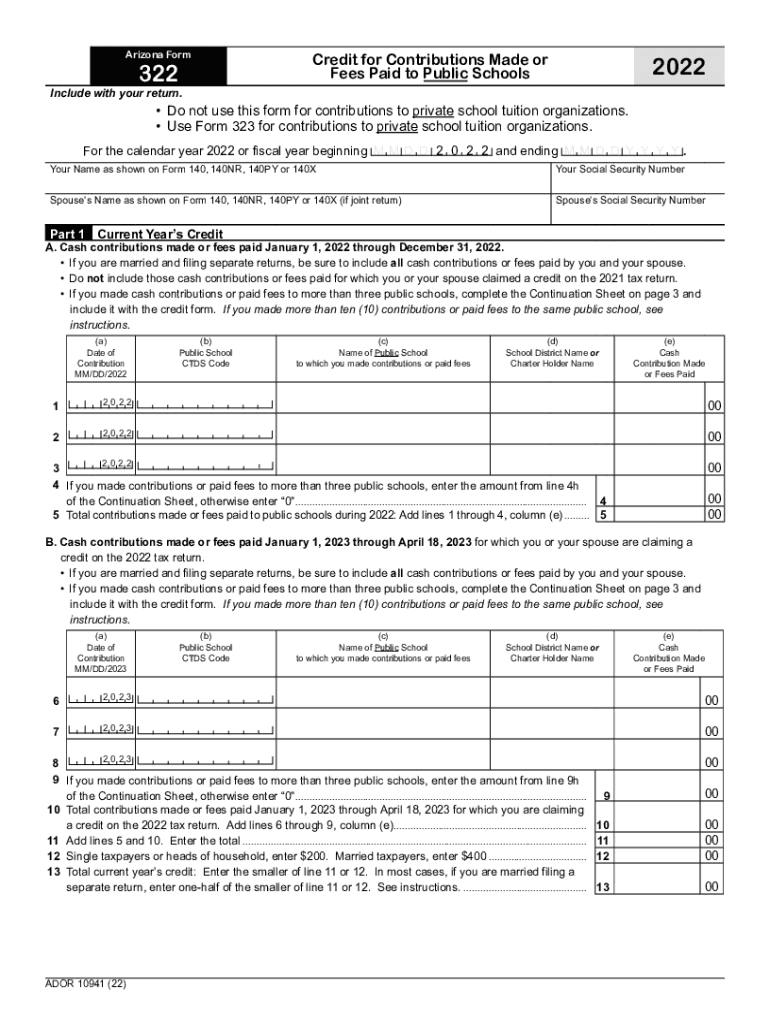

Do Not Use This Form for Contributions to Private School Tuition Organizations 2022

What is the Do Not Use This Form For Contributions To Private School Tuition Organizations

The form titled "Do Not Use This Form For Contributions To Private School Tuition Organizations" serves as a guideline for individuals and organizations regarding the proper channels for making contributions to private school tuition organizations. This form is crucial as it clarifies that certain forms should not be utilized for these contributions, ensuring compliance with specific regulations and avoiding potential legal issues.

How to Use the Do Not Use This Form For Contributions To Private School Tuition Organizations

To effectively use the "Do Not Use This Form For Contributions To Private School Tuition Organizations," individuals should first familiarize themselves with the specific requirements and guidelines outlined in the form. It is essential to understand the context in which this form applies, as using it incorrectly can lead to complications. Ensure that any contributions intended for private school tuition organizations are directed through the appropriate channels as specified by state or federal regulations.

Steps to Complete the Do Not Use This Form For Contributions To Private School Tuition Organizations

Completing the "Do Not Use This Form For Contributions To Private School Tuition Organizations" involves several key steps:

- Review the form thoroughly to understand its purpose and implications.

- Gather any necessary documentation or information required for your specific situation.

- Follow the instructions provided on the form to ensure accurate completion.

- Consult with a legal or financial advisor if you have questions about your contributions.

Legal Use of the Do Not Use This Form For Contributions To Private School Tuition Organizations

The legal use of the "Do Not Use This Form For Contributions To Private School Tuition Organizations" is paramount to ensure compliance with relevant laws. This form is designed to prevent misuse and to guide users in adhering to established legal frameworks. Understanding the legal implications of using this form can help individuals avoid penalties and ensure that their contributions are processed correctly.

Key Elements of the Do Not Use This Form For Contributions To Private School Tuition Organizations

Key elements of the "Do Not Use This Form For Contributions To Private School Tuition Organizations" include:

- Clear instructions on what forms should not be used for contributions.

- Legal disclaimers that outline the consequences of improper use.

- Guidance on alternative forms or processes for making contributions to private school tuition organizations.

IRS Guidelines

The IRS provides specific guidelines regarding contributions to private school tuition organizations. It is essential to consult these guidelines to ensure that any contributions made are compliant with tax regulations. Understanding these guidelines helps individuals navigate the complexities of tax deductions and credits associated with educational contributions.

Penalties for Non-Compliance

Non-compliance with the regulations surrounding the "Do Not Use This Form For Contributions To Private School Tuition Organizations" can result in various penalties. These may include fines, denial of tax deductions, or legal repercussions. Being aware of these penalties emphasizes the importance of following the correct procedures when making contributions to private school tuition organizations.

Quick guide on how to complete do not use this form for contributions to private school tuition organizations

Complete Do Not Use This Form For Contributions To Private School Tuition Organizations effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents promptly without any hold-ups. Manage Do Not Use This Form For Contributions To Private School Tuition Organizations on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to edit and electronically sign Do Not Use This Form For Contributions To Private School Tuition Organizations without hassle

- Find Do Not Use This Form For Contributions To Private School Tuition Organizations and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, requiring only seconds and holding the same legal validity as a conventional handwritten signature.

- Verify the details and then click on the Done button to save your changes.

- Select how you wish to submit your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Do Not Use This Form For Contributions To Private School Tuition Organizations while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct do not use this form for contributions to private school tuition organizations

Create this form in 5 minutes!

People also ask

-

What should I know about using forms for private school contributions?

It is crucial to remember that you should do not use this form for contributions to private school tuition organizations. This ensures compliance with IRS guidelines and prevents potential issues that could arise from misuse.

-

How does airSlate SignNow help with document management?

airSlate SignNow provides an easy-to-use platform for sending and eSigning documents. However, it's important to do not use this form for contributions to private school tuition organizations, as the platform is not intended for that purpose.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your workflow. However, be mindful that you do not use this form for contributions to private school tuition organizations, as it can lead to complications.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing tiers to accommodate different business needs. Regardless of your choice, remember that you do not use this form for contributions to private school tuition organizations.

-

What features does airSlate SignNow provide?

airSlate SignNow includes features such as document templates, collaboration tools, and in-depth analytics. Ensure that while using these features, you do not use this form for contributions to private school tuition organizations to avoid any legal issues.

-

Is airSlate SignNow user-friendly for new users?

Absolutely! airSlate SignNow is designed to be user-friendly, making it easy for new users to navigate the platform. Just keep in mind that you do not use this form for contributions to private school tuition organizations.

-

How can airSlate SignNow benefit my business?

By streamlining document workflows and reducing turnaround time, airSlate SignNow can signNowly benefit your business. Just be sure to remember that you do not use this form for contributions to private school tuition organizations.

Get more for Do Not Use This Form For Contributions To Private School Tuition Organizations

- Praecipe form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy montana form

- Warranty deed for parents to child with reservation of life estate montana form

- Warranty deed for separate or joint property to joint tenancy montana form

- Warranty deed to separate property of one spouse to both spouses as joint tenants montana form

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries montana form

- Warranty deed from limited partnership or llc is the grantor or grantee montana form

- Exhibit sheet montana form

Find out other Do Not Use This Form For Contributions To Private School Tuition Organizations

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template