Arizona Tax Credit Information 2023-2026

Understanding Arizona Tax Credit Information

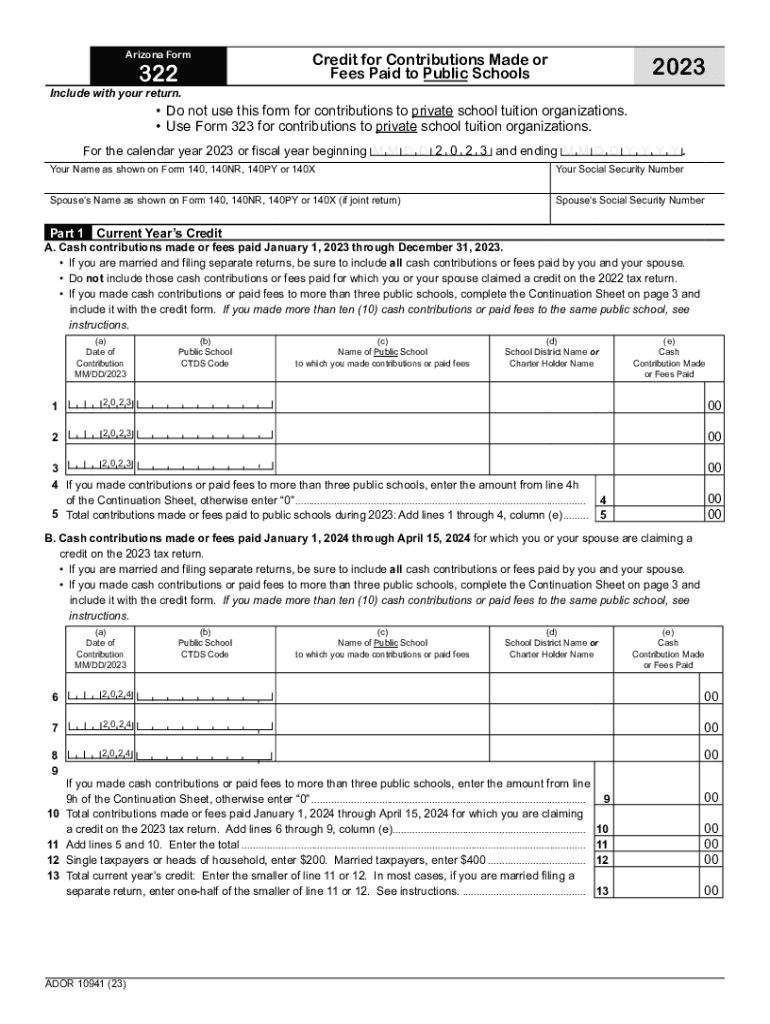

The Arizona Tax Credit Information provides essential details regarding tax credits available to residents and businesses in Arizona. These credits can significantly reduce tax liabilities and support various community initiatives. Tax credits may be available for contributions to schools, charitable organizations, and other qualifying entities. Understanding the specifics of these credits is crucial for maximizing tax benefits and ensuring compliance with state regulations.

Steps to Complete the Arizona Tax Credit Information

Completing the Arizona Tax Credit Information involves several key steps:

- Gather necessary documentation, including proof of contributions and personal identification.

- Review the eligibility criteria for the specific tax credits you wish to claim.

- Fill out the appropriate forms accurately, ensuring all information is complete and correct.

- Submit the forms through the designated method, whether online, by mail, or in person.

Following these steps carefully can help ensure that you receive the maximum tax benefits available.

Eligibility Criteria for Arizona Tax Credits

To qualify for Arizona tax credits, individuals and businesses must meet specific eligibility criteria. Generally, these criteria include:

- Residency in Arizona for individuals or business registration in the state.

- Making qualified contributions to approved organizations, such as schools or charities.

- Adhering to income limits or other specific requirements set by the state for certain credits.

Reviewing these criteria before applying can help determine your eligibility and streamline the application process.

Required Documents for Arizona Tax Credit Information

When applying for Arizona tax credits, certain documents are typically required. These may include:

- Proof of contribution, such as receipts or acknowledgment letters from the receiving organization.

- Personal identification, including Social Security numbers or taxpayer identification numbers.

- Previous year’s tax returns, if applicable, to verify income and filing status.

Having these documents prepared can facilitate a smoother application process and help avoid delays.

Filing Deadlines for Arizona Tax Credits

Filing deadlines for Arizona tax credits are crucial to ensure timely claims. Generally, the deadlines are aligned with state tax filing dates, which typically fall on April 15 each year. However, specific credits may have different deadlines, especially if they pertain to fiscal year contributions. It is essential to check the latest guidelines from the Arizona Department of Revenue for any updates or changes to these dates.

Form Submission Methods for Arizona Tax Credits

Arizona tax credit forms can be submitted through various methods, providing flexibility for taxpayers. The available submission methods include:

- Online submission through the Arizona Department of Revenue website.

- Mailing the completed forms to the appropriate state office.

- Delivering the forms in person to designated state offices.

Choosing the right submission method can depend on personal preference and the urgency of the filing.

Key Elements of Arizona Tax Credit Information

Understanding the key elements of Arizona Tax Credit Information can enhance awareness and compliance. Important components include:

- The types of tax credits available and their specific purposes.

- The maximum allowable credit amounts and any applicable limits.

- Guidelines for reporting credits on state tax returns.

Familiarizing yourself with these elements can help in making informed decisions regarding tax credit claims.

Quick guide on how to complete arizona tax credit information

Organize Arizona Tax Credit Information effortlessly on any gadget

Digital document management has become favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the needed template and securely save it online. airSlate SignNow provides you with all the features required to produce, modify, and electronically sign your documents swiftly without interruptions. Manage Arizona Tax Credit Information on any gadget with airSlate SignNow Android or iOS applications and streamline any document-centric process today.

How to modify and electronically sign Arizona Tax Credit Information with ease

- Obtain Arizona Tax Credit Information and click Get Form to begin.

- Make use of the resources we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to apply your modifications.

- Choose how you wish to distribute your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, painstaking form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Alter and electronically sign Arizona Tax Credit Information and ensure effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct arizona tax credit information

Create this form in 5 minutes!

How to create an eSignature for the arizona tax credit information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Arizona Tax Credit Information?

Arizona Tax Credit Information refers to the guidelines and details regarding the tax credits available for individuals and businesses in Arizona. This information helps taxpayers understand how they can leverage tax incentives to enhance their savings, particularly when contributing to qualifying charities or programs. Being informed about Arizona Tax Credit Information is crucial for maximizing tax benefits.

-

How can airSlate SignNow assist with Arizona Tax Credit Information?

airSlate SignNow streamlines the process of eSigning necessary documents related to Arizona Tax Credit Information. By using our platform, users can easily send, sign, and manage documents that may be required for claiming tax credits in Arizona. This simplifies compliance and ensures that all necessary paperwork is handled efficiently.

-

Are there any costs associated with using airSlate SignNow for Arizona Tax Credit Information?

airSlate SignNow offers a cost-effective solution for managing your documents related to Arizona Tax Credit Information. Our pricing plans are flexible and cater to different business needs, ensuring that every user can find a suitable option. This allows you to manage your documents and maintain compliance without incurring excessive costs.

-

What features does airSlate SignNow offer for handling Arizona Tax Credit Information?

airSlate SignNow provides a range of features that are beneficial for managing Arizona Tax Credit Information. These include customizable templates, secure eSignatures, real-time document tracking, and integration with various applications. These features make it easier to handle tax-related documents efficiently.

-

Can I integrate airSlate SignNow with other software for Arizona Tax Credit Information?

Yes, airSlate SignNow seamlessly integrates with a variety of software applications, enhancing your ability to manage Arizona Tax Credit Information. This allows users to connect with accounting software, CRM systems, and other tools that streamline tax-related processes. Such integrations minimize errors and save time during tax season.

-

What are the benefits of using airSlate SignNow for Arizona Tax Credit Information?

Utilizing airSlate SignNow for Arizona Tax Credit Information offers numerous benefits, including increased efficiency, enhanced security, and improved compliance. Our easy-to-use platform reduces the time taken to handle documents and ensures that all eSignatures are securely stored. This results in a smoother experience when dealing with tax credits.

-

Is airSlate SignNow user-friendly for managing Arizona Tax Credit Information?

Absolutely! airSlate SignNow is designed to be user-friendly, making it accessible for everyone managing Arizona Tax Credit Information. Our intuitive interface allows even those with minimal tech experience to navigate and complete document processes effortlessly. This enhances productivity as users can focus more on addressing their tax credit needs.

Get more for Arizona Tax Credit Information

Find out other Arizona Tax Credit Information

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later