Printable Arizona Form 322 Credit for Contributions Made or Fees Paid to Public Schools 2020

What is the Printable Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools

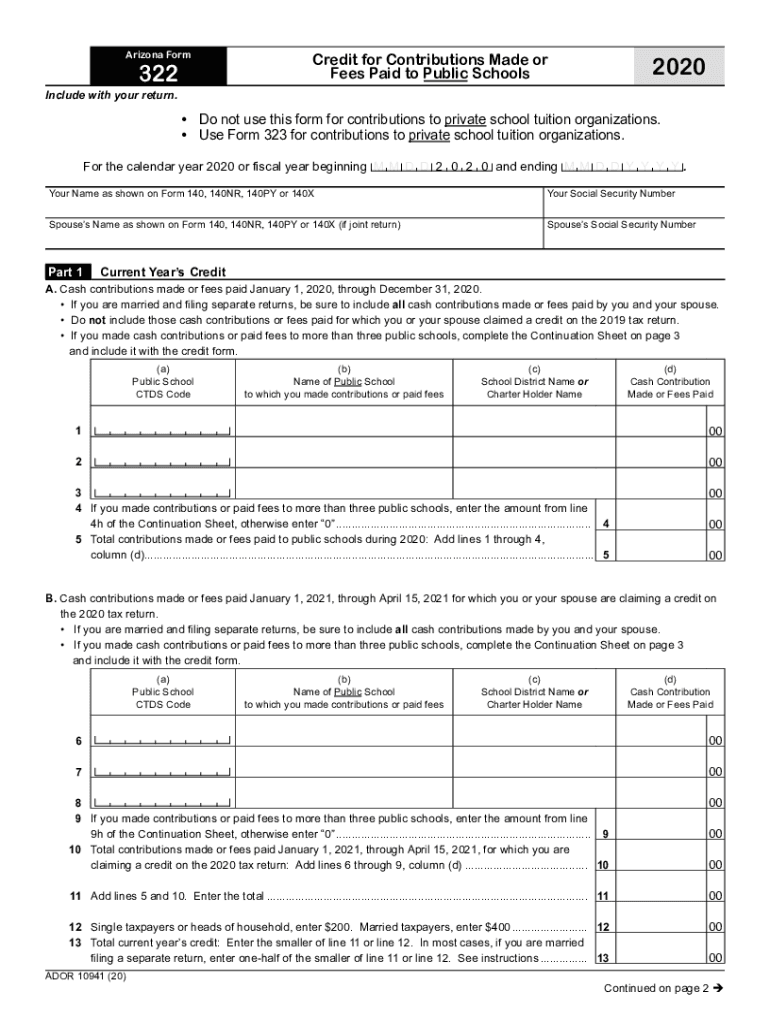

The Printable Arizona Form 322 is a tax form that allows taxpayers to claim a credit for contributions made to public schools or fees paid for educational purposes. This form is specifically designed for Arizona residents who wish to support their local educational institutions while benefiting from a tax credit. The credit can help reduce the amount of state tax owed, making it a valuable option for those who contribute to public schools. The form captures essential information about the taxpayer, the contributions made, and the eligible schools or programs supported.

How to use the Printable Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools

Using the Printable Arizona Form 322 involves several straightforward steps. First, gather all necessary documentation regarding contributions made to public schools. This may include receipts or proof of payment for fees. Next, download and print the form from a reliable source. Fill in the required fields, including personal information and details about the contributions. Ensure that all information is accurate to avoid delays in processing. Finally, submit the completed form with your state tax return to claim the credit.

Steps to complete the Printable Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools

Completing the Printable Arizona Form 322 involves a systematic approach:

- Gather documentation: Collect receipts or proof of contributions made to public schools.

- Download the form: Obtain the Printable Arizona Form 322 from a trusted source.

- Fill in personal information: Enter your name, address, and social security number as required.

- Detail contributions: Provide information about the contributions, including the amount and the school or program supported.

- Review your entries: Check for accuracy and completeness before submission.

- Submit the form: Include the completed form with your Arizona state tax return.

Legal use of the Printable Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools

The Printable Arizona Form 322 is legally recognized for claiming tax credits associated with contributions to public schools. To ensure compliance, taxpayers must adhere to Arizona state laws regarding eligibility and contribution limits. The form must be filled out accurately, and all contributions must meet the criteria set forth by the Arizona Department of Revenue. Using the form correctly helps ensure that taxpayers receive the intended benefits while supporting local educational initiatives.

Eligibility Criteria

To qualify for the credit claimed on the Printable Arizona Form 322, taxpayers must meet specific eligibility criteria. These include:

- Residency in Arizona.

- Making contributions to a qualifying public school or educational program.

- Adhering to the maximum contribution limits set by the state.

Taxpayers should verify their eligibility before submitting the form to ensure compliance and maximize their tax benefits.

Form Submission Methods

The Printable Arizona Form 322 can be submitted through various methods. Taxpayers may choose to file the form electronically as part of their state tax return or submit it by mail. When filing electronically, ensure that the form is properly integrated into the tax software being used. For mail submissions, it is advisable to send the form to the address specified by the Arizona Department of Revenue, ensuring it is postmarked by the appropriate deadline.

Quick guide on how to complete printable 2020 arizona form 322 credit for contributions made or fees paid to public schools

Complete Printable Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools effortlessly on any device

Digital document management has gained traction among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Printable Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Printable Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools without stress

- Obtain Printable Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form: via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign Printable Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 arizona form 322 credit for contributions made or fees paid to public schools

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 arizona form 322 credit for contributions made or fees paid to public schools

How to make an eSignature for a PDF online

How to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The best way to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

The best way to create an eSignature for a PDF document on Android

People also ask

-

What is the Printable Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools?

The Printable Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools allows taxpayers to claim a credit for contributions made to public schools or fees paid for extracurricular activities. This form is essential for Arizona residents looking to reduce their tax liability while supporting their local schools.

-

How can I obtain the Printable Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools?

You can easily obtain the Printable Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools from the Arizona Department of Revenue's website or through various tax preparation software. Additionally, airSlate SignNow provides secure options for eSigning and managing your documents online.

-

What are the benefits of using the Printable Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools?

Using the Printable Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools can signNowly reduce your tax liability while contributing to educational programs in your community. It provides financial support to schools and enhances the educational experience for students.

-

Are there any fees associated with using the Printable Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools?

There are no fees associated with filling out the Printable Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools itself. However, you should consider any potential fees from tax preparation services if you choose to use one, and ensure that contributions made qualify for the tax credit.

-

Can I eSign the Printable Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools?

Yes, you can eSign the Printable Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools using airSlate SignNow. Our platform offers a simple solution for electronically signing your documents and securely storing them for easy access.

-

Is there a limit on the contributions I can claim on the Printable Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools?

Yes, there is a limit on the contributions you can claim using the Printable Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools. For individual taxpayers, the credit limit is typically set annually by the state, so be sure to check the current guidelines for the exact amount.

-

What types of contributions qualify for the Printable Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools?

Qualifying contributions for the Printable Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools include donations to public schools for educational programs, materials, and extracurricular activities. Make sure your contributions meet the state requirements to be eligible for the tax credit.

Get more for Printable Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools

Find out other Printable Arizona Form 322 Credit For Contributions Made Or Fees Paid To Public Schools

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy