Tax Iowa GovsitesdefaultIA Nexus Questionnaire State of Iowa TaxesIowa 2021

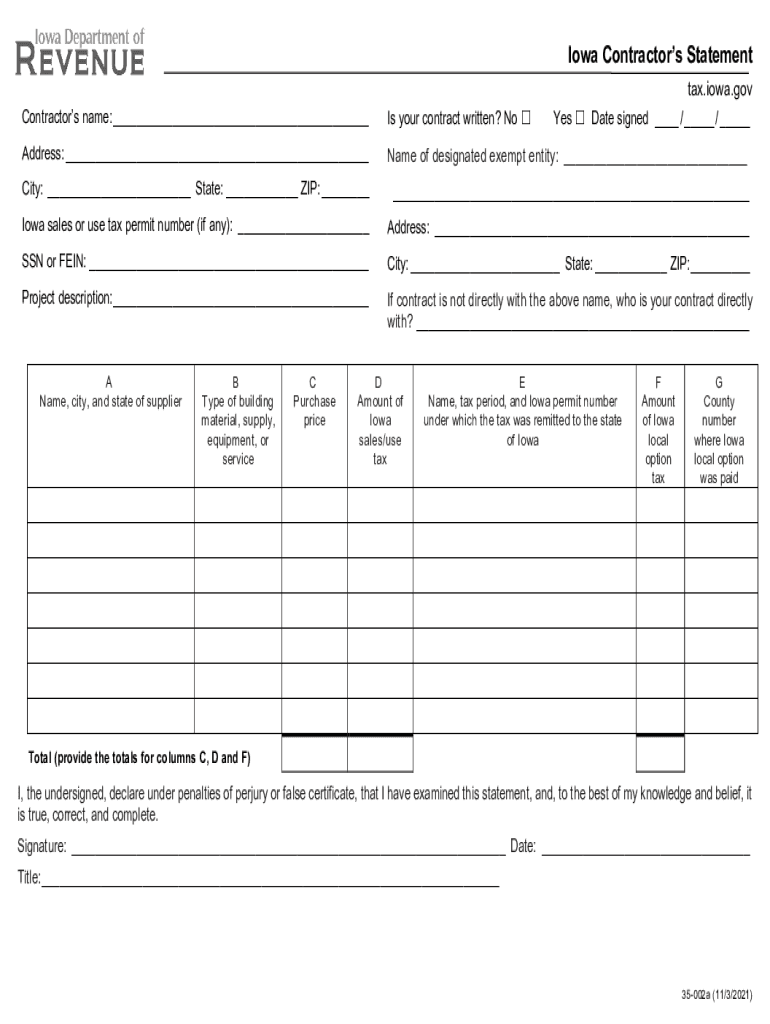

Understanding the Iowa Contractors Statement Form

The Iowa Contractors Statement form is essential for contractors operating within the state. This document serves as a declaration of a contractor's business activities and tax obligations. It is crucial for compliance with state regulations and ensures that contractors fulfill their tax responsibilities. Understanding the purpose and requirements of this form is vital for maintaining legal and financial integrity in business operations.

Steps to Complete the Iowa Contractors Statement Form

Filling out the Iowa Contractors Statement form involves several key steps:

- Gather necessary information, including your business name, address, and tax identification number.

- Detail your business activities, specifying the types of contracting work performed.

- Provide financial information, including gross receipts and any applicable deductions.

- Review the form for accuracy and completeness before submission.

Taking the time to ensure all information is correct can prevent delays in processing and potential compliance issues.

Legal Use of the Iowa Contractors Statement Form

The Iowa Contractors Statement form is legally binding when completed and submitted according to state regulations. It is important to ensure that all information provided is truthful and accurate, as any discrepancies could lead to penalties or legal action. Utilizing a reliable eSignature platform can enhance the legitimacy of the form by providing a digital certificate, ensuring compliance with eSignature laws such as ESIGN and UETA.

Required Documents for Submission

When completing the Iowa Contractors Statement form, certain documents may be required to support your submission. These can include:

- Proof of business registration.

- Financial statements or tax returns from the previous year.

- Any relevant licenses or permits required for your contracting work.

Having these documents ready can streamline the submission process and help ensure compliance with state regulations.

Form Submission Methods

The Iowa Contractors Statement form can be submitted through various methods, including:

- Online submission via the state’s official website.

- Mailing a printed copy to the appropriate state office.

- In-person submission at designated state offices.

Choosing the right submission method can depend on your preferences and the urgency of your filing.

Penalties for Non-Compliance

Failure to complete and submit the Iowa Contractors Statement form can result in significant penalties. These may include:

- Fines imposed by the state.

- Interest on unpaid taxes.

- Potential legal action against your business.

Understanding these consequences highlights the importance of timely and accurate form submission.

Quick guide on how to complete taxiowagovsitesdefaultia nexus questionnaire state of iowa taxesiowa

Complete Tax iowa govsitesdefaultIA Nexus Questionnaire State Of Iowa TaxesIowa effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents quickly without any delays. Manage Tax iowa govsitesdefaultIA Nexus Questionnaire State Of Iowa TaxesIowa on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to edit and electronically sign Tax iowa govsitesdefaultIA Nexus Questionnaire State Of Iowa TaxesIowa with ease

- Find Tax iowa govsitesdefaultIA Nexus Questionnaire State Of Iowa TaxesIowa and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or hide sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Tax iowa govsitesdefaultIA Nexus Questionnaire State Of Iowa TaxesIowa and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct taxiowagovsitesdefaultia nexus questionnaire state of iowa taxesiowa

Create this form in 5 minutes!

How to create an eSignature for the taxiowagovsitesdefaultia nexus questionnaire state of iowa taxesiowa

The way to create an e-signature for a PDF in the online mode

The way to create an e-signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

The best way to make an electronic signature from your smart phone

The best way to generate an e-signature for a PDF on iOS devices

The best way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is a taxable service in Iowa?

Here are some examples of taxable services in Iowa: Repair, cleaning, alteration, or improvement of tangible personal property. Rental or leasing of tangible personal property. Laundry, dry cleaning, and pressing services.

-

What is Nexus in Iowa state tax?

Economic Nexus Threshold for Small Businesses Iowa law includes an economic nexus threshold. Remote sellers must collect Iowa sales tax only if the remote seller has $100,000 or more in gross revenue from Iowa sales. Sellers that only sell products on a marketplace may not need to collect and remit Iowa sales tax.

-

Is rent taxable in Iowa?

On and after July 1, 1984, the lease or rental of all tangible personal property is subject to tax. See rule 701-2618.

-

Is internet service taxable in Iowa?

Internet access remains tax exempt Internet access and internet access service remains exempt from sales and use tax in Iowa. Iowa is prohibited by Federal law from imposing a sales or use tax on internet access service.

-

What are taxable services in Iowa?

Here are some examples of taxable services in Iowa: Repair, cleaning, alteration, or improvement of tangible personal property. Rental or leasing of tangible personal property. Laundry, dry cleaning, and pressing services.

-

Is software as a service taxable in Iowa?

Many states also implement sales and use tax on digital goods and SaaS (though keep in mind that Iowa has a unique SaaS sales tax exemption for commercial enterprises).

Get more for Tax iowa govsitesdefaultIA Nexus Questionnaire State Of Iowa TaxesIowa

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497303749 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement georgia form

- Letter about increase form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants georgia form

- Tenant landlord utility 497303753 form

- Letter from tenant to landlord about inadequacy of heating resources insufficient heat georgia form

- Rent lease terminates form

- 7 day notice to pay rent nonresidential georgia form

Find out other Tax iowa govsitesdefaultIA Nexus Questionnaire State Of Iowa TaxesIowa

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later