Request for a Copy of Exempt or Political Organization IRS Form 2021-2026

What is the Request For A Copy Of Exempt Or Political Organization IRS Form

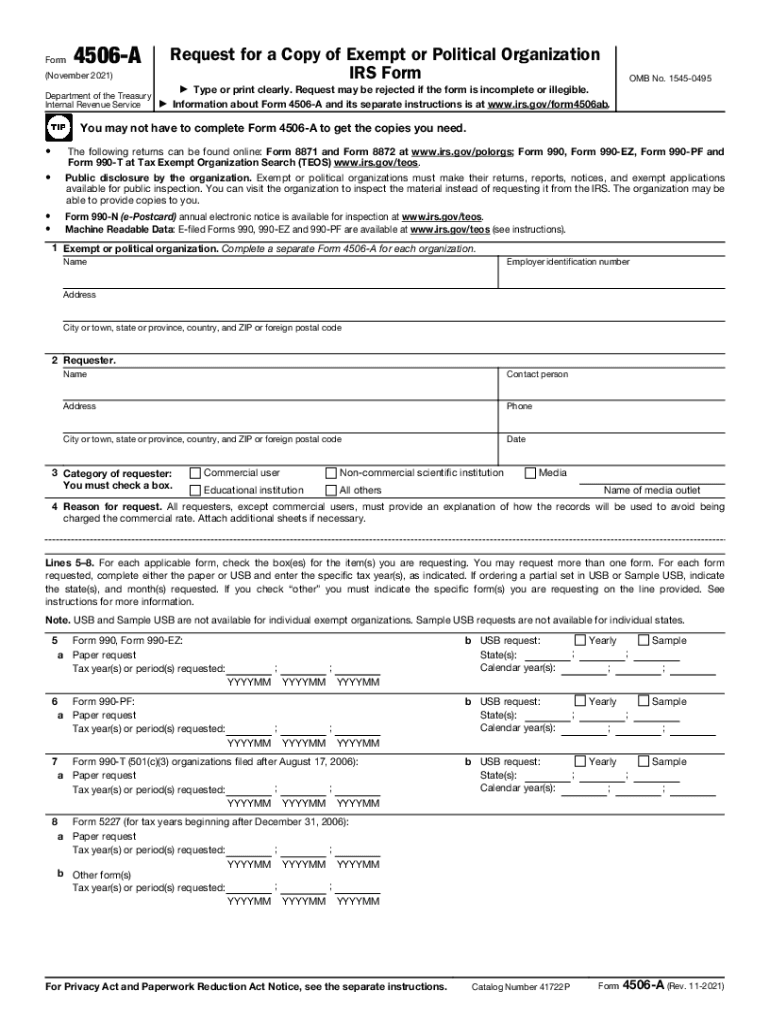

The Request For A Copy Of Exempt Or Political Organization IRS Form is a crucial document for organizations seeking to obtain copies of their tax exemption letters. This form allows non-profit organizations and political entities to request copies of their determination letters from the IRS, which affirm their tax-exempt status under Section 501(c)(3) or other relevant sections. The determination letter serves as proof of tax exemption and is often required for various administrative and operational purposes, including applying for grants, fundraising, and establishing credibility with donors.

How to obtain the Request For A Copy Of Exempt Or Political Organization IRS Form

Obtaining the Request For A Copy Of Exempt Or Political Organization IRS Form is a straightforward process. Organizations can download the form directly from the IRS website or request it by contacting the IRS directly. It is essential to ensure that the correct version of the form is used, as older versions may not be accepted. Once the form is obtained, organizations should carefully review the instructions provided to ensure all required information is accurately filled out.

Steps to complete the Request For A Copy Of Exempt Or Political Organization IRS Form

Completing the Request For A Copy Of Exempt Or Political Organization IRS Form involves several key steps:

- Gather necessary information, including the organization's name, address, and Employer Identification Number (EIN).

- Clearly specify the type of documents being requested, such as the 501(c)(3) determination letter.

- Provide a valid reason for the request, ensuring it aligns with IRS guidelines.

- Sign and date the form, certifying that the information provided is accurate.

- Submit the completed form to the appropriate IRS address, as indicated in the form instructions.

Legal use of the Request For A Copy Of Exempt Or Political Organization IRS Form

The legal use of the Request For A Copy Of Exempt Or Political Organization IRS Form is essential for maintaining compliance with IRS regulations. Organizations must ensure that their requests are legitimate and that they are authorized to obtain copies of the requested documents. Misuse of the form can lead to penalties or delays in receiving the necessary documentation. It is advisable for organizations to keep records of their requests and any correspondence with the IRS regarding their tax-exempt status.

Required Documents

When submitting the Request For A Copy Of Exempt Or Political Organization IRS Form, organizations may need to include additional documents to support their request. This may include:

- A copy of the organization's formation documents, such as articles of incorporation or bylaws.

- Proof of the organization's tax-exempt status, if available.

- Identification of the individual submitting the request, such as a driver's license or other government-issued ID.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Request For A Copy Of Exempt Or Political Organization IRS Form. These guidelines include:

- Ensuring that all information provided is accurate and complete.

- Submitting the form to the correct IRS office based on the organization's location.

- Adhering to any deadlines or timeframes specified by the IRS for processing requests.

Quick guide on how to complete request for a copy of exempt or political organization irs form

Complete Request For A Copy Of Exempt Or Political Organization IRS Form effortlessly on any device

Web-based document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Request For A Copy Of Exempt Or Political Organization IRS Form on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest method to modify and eSign Request For A Copy Of Exempt Or Political Organization IRS Form seamlessly

- Obtain Request For A Copy Of Exempt Or Political Organization IRS Form and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Request For A Copy Of Exempt Or Political Organization IRS Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct request for a copy of exempt or political organization irs form

Create this form in 5 minutes!

How to create an eSignature for the request for a copy of exempt or political organization irs form

The way to make an electronic signature for your PDF document in the online mode

The way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to make an e-signature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

The way to make an e-signature for a PDF file on Android devices

People also ask

-

What is a letter of determination 501 c 3 and why is it important?

A letter of determination 501 c 3 is an official document issued by the IRS that confirms your organization is recognized as a tax-exempt nonprofit. This document is crucial for nonprofits seeking tax-deductible donations and grants, as it assures donors and funding organizations of your tax-exempt status. Without it, you may struggle to raise funds and operate effectively.

-

How can airSlate SignNow help in obtaining a letter of determination 501 c 3?

airSlate SignNow streamlines the process of submitting documents required for obtaining a letter of determination 501 c 3. Our eSigning and document management features enable you to securely collect signatures from board members and stakeholders, reducing the time it takes to complete necessary paperwork. With our platform, you can ensure your application is complete and submitted efficiently.

-

What are the pricing options for using airSlate SignNow for nonprofit organizations?

airSlate SignNow offers competitive pricing tailored to nonprofit organizations, including features that simplify obtaining a letter of determination 501 c 3. We provide various subscription plans that cater to different levels of need and usage. Our cost-effective solution ensures that nonprofits can access essential tools without straining their budgets.

-

Does airSlate SignNow offer any templates for nonprofit forms?

Yes, airSlate SignNow provides a range of templates specifically designed for nonprofits, including those required to apply for a letter of determination 501 c 3. These templates can save you time in preparing documents and ensure compliance with IRS requirements. You can customize templates to fit your organization's specific needs.

-

What security features does airSlate SignNow provide for sensitive documents?

Security is a priority at airSlate SignNow, especially when handling documents such as the letter of determination 501 c 3. Our platform includes bank-level encryption, two-factor authentication, and secure cloud storage to protect your documents. You can be confident that your sensitive information is safe and compliant with legal standards.

-

Are there any integrations available with airSlate SignNow for other nonprofit tools?

Yes, airSlate SignNow integrates seamlessly with various nonprofit management tools and CRM systems to enhance your workflow. This allows you to manage your letter of determination 501 c 3 process alongside your other operations efficiently. Integration simplifies data management, making your activities smoother and more efficient.

-

How does airSlate SignNow enhance collaboration among nonprofit teams?

airSlate SignNow fosters collaboration among nonprofit teams by allowing multiple users to access and edit documents like the letter of determination 501 c 3 in real-time. Comments, annotations, and task assignments can keep your team aligned and ensure that every detail is addressed promptly. Collaboration tools help ensure that your nonprofit remains organized during important processes.

Get more for Request For A Copy Of Exempt Or Political Organization IRS Form

- Child care services package georgia form

- Special or limited power of attorney for real estate sales transaction by seller georgia form

- Special or limited power of attorney for real estate purchase transaction by purchaser georgia form

- Limited power of attorney where you specify powers with sample powers included georgia form

- Ga limited form

- Special durable power of attorney for bank account matters georgia form

- Ga small business form

- Georgia property form

Find out other Request For A Copy Of Exempt Or Political Organization IRS Form

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word