Form 4506a Online 2003

What is the Form 4506a Online

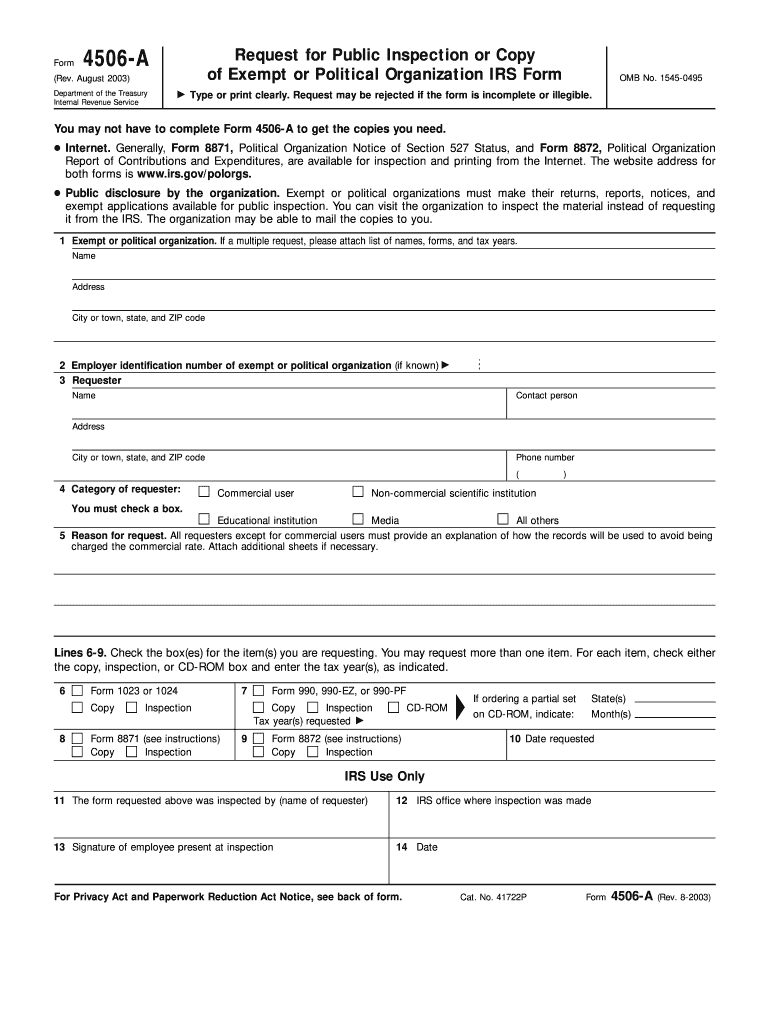

The Form 4506-A is a request for a transcript of tax return information that is specifically designed for use by third parties. This form allows individuals or businesses to authorize the IRS to release their tax information to a designated third party. The online version of Form 4506-A streamlines the process, making it easier for users to fill out and submit their requests digitally. This form is particularly useful for lenders, financial institutions, or other entities that require access to a taxpayer's information for verification purposes.

How to use the Form 4506a Online

Using the Form 4506-A online involves several straightforward steps. First, users need to access the digital form through a secure platform that supports e-signatures. Once the form is opened, users must fill in their personal details, including name, address, and Social Security number. Next, they will need to specify the type of tax information requested and the third party authorized to receive it. After completing the form, users can electronically sign it, ensuring the submission meets legal requirements. Finally, the form can be submitted directly to the IRS through the platform, eliminating the need for physical mailing.

Steps to complete the Form 4506a Online

Completing the Form 4506-A online involves a series of clear steps:

- Access the online form through a secure e-signature platform.

- Enter your personal information, including your name, address, and Social Security number.

- Indicate the specific tax information you are requesting.

- Provide the name and address of the third party to whom the information will be sent.

- Review the completed form for accuracy.

- Sign the form electronically to validate your request.

- Submit the form directly to the IRS through the platform.

Legal use of the Form 4506a Online

The legal use of the Form 4506-A online is governed by federal regulations that ensure the confidentiality and security of taxpayer information. When completed and submitted correctly, the form is considered legally binding. It is essential for users to understand that they are granting permission for the IRS to disclose their tax information to a specified third party. Compliance with e-signature laws, such as the ESIGN Act and UETA, ensures that the electronic signature holds the same legal weight as a handwritten signature. This legal framework protects both the requester and the third party receiving the information.

Required Documents

When filling out the Form 4506-A online, certain documents may be required to support the request. These typically include:

- A valid form of identification, such as a driver's license or passport.

- Any previous tax returns that may be relevant to the request.

- Documentation proving the relationship between the requester and the third party, if applicable.

Having these documents ready can facilitate a smoother completion process and ensure that the IRS has all necessary information to process the request efficiently.

Form Submission Methods

The Form 4506-A can be submitted through various methods, with the online submission being the most efficient. Users can choose to:

- Submit the form electronically through a secure e-signature platform.

- Mail a printed version of the completed form to the appropriate IRS address.

- Visit a local IRS office to submit the form in person, if necessary.

Each submission method has its own processing times, with online submissions typically resulting in faster responses from the IRS.

Quick guide on how to complete form 4506a online 2003

Complete Form 4506a Online effortlessly on any device

Digital document management has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage Form 4506a Online on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Form 4506a Online with ease

- Locate Form 4506a Online and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant parts of your documents or obscure sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Modify and eSign Form 4506a Online and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4506a online 2003

Create this form in 5 minutes!

How to create an eSignature for the form 4506a online 2003

The best way to create an eSignature for a PDF document online

The best way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

The way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is Form 4506a Online and how does it work?

Form 4506a Online is a streamlined digital solution for requesting tax return transcripts directly from the IRS. With airSlate SignNow, users can fill out, eSign, and submit the form effortlessly, ensuring a quicker turnaround time for their tax transcript needs.

-

How much does it cost to use airSlate SignNow for Form 4506a Online?

Using airSlate SignNow for Form 4506a Online is offered at competitive pricing, with different plans to fit various business needs. You can choose from a free trial or select a monthly subscription, which includes access to all features necessary for efficient document management.

-

What are the key features of airSlate SignNow for Form 4506a Online?

AirSlate SignNow offers essential features for managing Form 4506a Online, including eSignature capabilities, document templates, and secure cloud storage. Additionally, users benefit from real-time tracking and notifications, enhancing the overall document workflow.

-

Is airSlate SignNow secure for submitting Form 4506a Online?

Absolutely! airSlate SignNow employs advanced encryption and security protocols to ensure that all data submitted with Form 4506a Online is protected. This commitment to security helps safeguard sensitive information during transmission and storage.

-

Can I integrate airSlate SignNow with other applications while using Form 4506a Online?

Yes, airSlate SignNow supports a wide range of integrations, allowing users to connect with various popular applications while working with Form 4506a Online. This integration capability enhances workflows and allows for seamless data sharing across platforms.

-

What benefits does airSlate SignNow provide for businesses using Form 4506a Online?

Businesses using airSlate SignNow for Form 4506a Online enjoy improved efficiency, reduced paperwork, and quicker access to vital tax documents. The user-friendly interface and advanced features help teams streamline their operations and focus on their core activities.

-

Is there customer support available for airSlate SignNow users dealing with Form 4506a Online?

Yes, airSlate SignNow provides dedicated customer support for users navigating Form 4506a Online. Whether you have questions about the platform or need assistance with a specific issue, their support team is available via chat, email, or phone to help you.

Get more for Form 4506a Online

Find out other Form 4506a Online

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors