Forms & Instructions IRS Tax Formseitc Due Diligence and Self Employed TaxpayersEarned Eitc Due Diligence and Self Emplo 2021-2026

Understanding IRS Tax Forms and Instructions

The IRS provides various tax forms and instructions that are essential for individuals and businesses in the United States. These forms, such as Form 1040, are designed to help taxpayers report their income, claim deductions, and calculate their tax liabilities. Understanding these forms is crucial for compliance with federal tax laws and ensuring accurate reporting.

Steps to Complete IRS Tax Forms

Completing IRS tax forms involves several key steps. First, gather all necessary documentation, including W-2s, 1099s, and other income statements. Next, carefully read the instructions associated with the specific form you are using. Begin filling out the form by entering your personal information and income details. Ensure that you double-check your entries for accuracy before submitting the form. Finally, keep a copy of the completed form for your records.

Legal Use of IRS Tax Forms

IRS tax forms must be completed accurately and submitted on time to comply with federal laws. Failing to do so can result in penalties and interest on any unpaid taxes. It is important to ensure that all information provided is truthful and complete, as discrepancies can lead to audits or legal issues. Utilizing a reliable eSignature platform can enhance the security and legitimacy of your submissions.

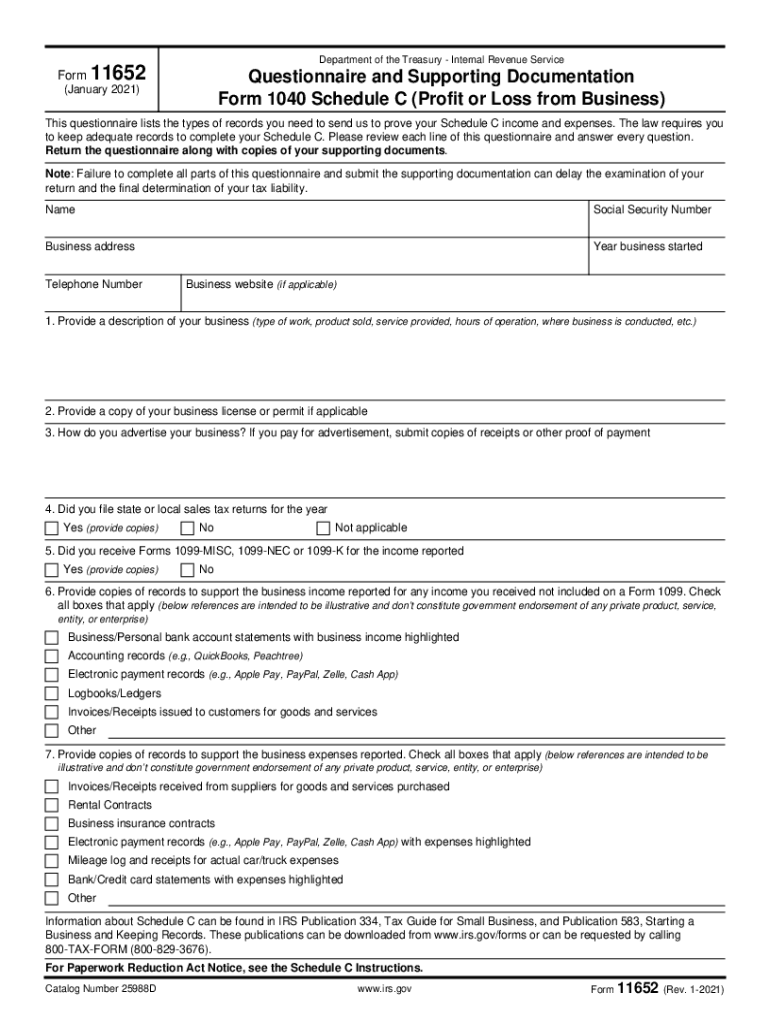

Required Documents for IRS Tax Forms

When preparing to file your taxes, certain documents are essential. These include proof of income, such as pay stubs or tax forms from employers, records of any deductions you plan to claim, and identification numbers such as your Social Security number. Having these documents organized will streamline the process and help ensure that your tax return is accurate.

Filing Deadlines and Important Dates

Tax filing deadlines are critical to avoid penalties. Typically, individual tax returns are due on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about these dates and plan accordingly to ensure timely submission of your tax forms.

Eligibility Criteria for IRS Tax Forms

Eligibility for certain IRS tax forms can vary based on factors such as income level, filing status, and specific tax credits or deductions. For example, self-employed individuals may need to fill out additional forms to report their business income. Understanding these criteria is essential for selecting the correct forms and ensuring compliance with tax regulations.

Quick guide on how to complete forms ampamp instructions irs tax formseitc due diligence and self employed taxpayersearned eitc due diligence and self

Effortlessly prepare Forms & Instructions IRS Tax Formseitc Due Diligence And Self Employed TaxpayersEarned eitc Due Diligence And Self Emplo on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to generate, modify, and electronically sign your documents swiftly without delays. Manage Forms & Instructions IRS Tax Formseitc Due Diligence And Self Employed TaxpayersEarned eitc Due Diligence And Self Emplo on any platform with the airSlate SignNow applications for Android or iOS and streamline any document-related task today.

How to modify and electronically sign Forms & Instructions IRS Tax Formseitc Due Diligence And Self Employed TaxpayersEarned eitc Due Diligence And Self Emplo effortlessly

- Locate Forms & Instructions IRS Tax Formseitc Due Diligence And Self Employed TaxpayersEarned eitc Due Diligence And Self Emplo and click Get Form to commence.

- Utilize the tools we offer to fill in your document.

- Emphasize relevant sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for this function.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and electronically sign Forms & Instructions IRS Tax Formseitc Due Diligence And Self Employed TaxpayersEarned eitc Due Diligence And Self Emplo and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct forms ampamp instructions irs tax formseitc due diligence and self employed taxpayersearned eitc due diligence and self

Create this form in 5 minutes!

How to create an eSignature for the forms ampamp instructions irs tax formseitc due diligence and self employed taxpayersearned eitc due diligence and self

The way to make an e-signature for your PDF file in the online mode

The way to make an e-signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

How can I profit from using airSlate SignNow?

By adopting airSlate SignNow, businesses can streamline their document signing processes which increases efficiency and saves time. This allows your team to focus on core tasks, thus enhancing productivity, ultimately leading to greater profit from improved operations.

-

What pricing plans does airSlate SignNow offer to help me profit from my investment?

airSlate SignNow provides flexible pricing plans tailored to various business sizes, allowing you to select the plan that best aligns with your budget and needs. Choosing the right plan can maximize your return on investment and help your organization profit from seamlessly integrated document management.

-

What features can I leverage to profit from airSlate SignNow?

airSlate SignNow offers features like customizable templates, secure electronic signatures, and automated workflows. Utilizing these tools can lead to signNow cost savings and efficiency gains, enabling your business to profit from enhanced document handling.

-

How does airSlate SignNow enhance collaboration and help teams profit from working together?

With airSlate SignNow, teams can collaborate in real-time on document signing and approvals. This level of collaboration reduces delays and fosters teamwork, allowing your organization to profit from better coordination and faster project completions.

-

Can airSlate SignNow integrate with existing tools I use to help me profit from my workflow?

Yes, airSlate SignNow integrates seamlessly with various software applications such as CRM and project management tools. These integrations ensure a smooth workflow, helping your business profit from a unified approach to document management.

-

What types of businesses can profit from using airSlate SignNow?

Businesses of all sizes, from startups to large enterprises, can profit from using airSlate SignNow. Its scalability and versatility make it an ideal solution for any organization looking to improve document efficiency and reduce operational costs.

-

Is the security offered by airSlate SignNow sufficient for my business to profit from its use?

Absolutely! airSlate SignNow adheres to the highest security standards to protect your sensitive data. The level of security provided ensures that your business can profit from using the platform without compromising data integrity.

Get more for Forms & Instructions IRS Tax Formseitc Due Diligence And Self Employed TaxpayersEarned eitc Due Diligence And Self Emplo

- Construction contract cost plus or fixed fee hawaii form

- Painting contract for contractor hawaii form

- Trim carpenter contract for contractor hawaii form

- Fencing contract for contractor hawaii form

- Hvac contract for contractor hawaii form

- Landscape contract for contractor hawaii form

- Commercial contract for contractor hawaii form

- Excavator contract for contractor hawaii form

Find out other Forms & Instructions IRS Tax Formseitc Due Diligence And Self Employed TaxpayersEarned eitc Due Diligence And Self Emplo

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF