PDF Form it 214 Claim for Real Property Tax Credit for Homeowners 2021

What is the PDF Form IT 214 Claim For Real Property Tax Credit For Homeowners

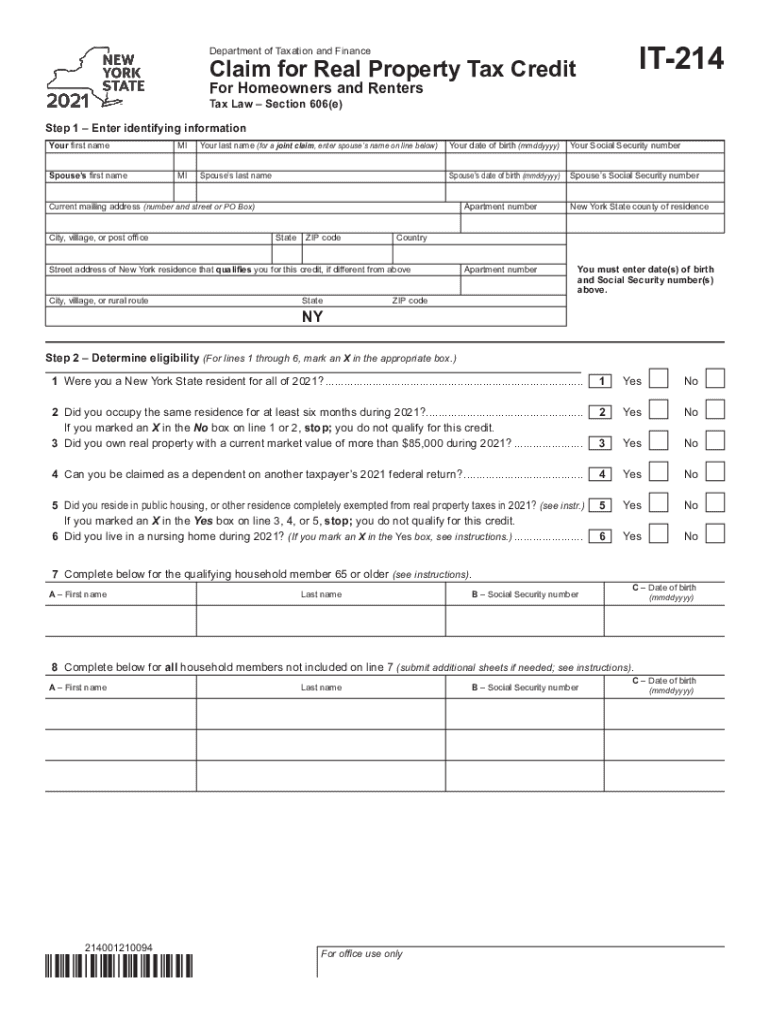

The IT 214 form is a tax document used by homeowners in New York State to claim a real property tax credit. This credit is designed to provide financial relief to eligible homeowners by reducing their property tax burden. The form is specifically targeted at those who meet certain income thresholds and property ownership criteria. Understanding the purpose of the IT 214 form is essential for homeowners looking to benefit from available tax credits.

Eligibility Criteria for the IT 214 Form

To qualify for the IT 214 Claim for Real Property Tax Credit, homeowners must meet specific eligibility requirements. These include:

- Ownership of the property for which the credit is claimed.

- Meeting the income limits set by the New York State Department of Taxation and Finance.

- Residency in the property as the primary residence.

- Filing the form within the designated tax year.

Homeowners should carefully review these criteria to ensure they qualify before submitting their claims.

Steps to Complete the PDF Form IT 214 Claim For Real Property Tax Credit For Homeowners

Completing the IT 214 form involves several key steps to ensure accuracy and compliance. Here is a straightforward process:

- Download the IT 214 form from the New York State Department of Taxation and Finance website.

- Gather necessary documentation, such as proof of property ownership and income statements.

- Fill out the form with accurate information regarding your property and income.

- Review the completed form for any errors or omissions.

- Submit the form by the specified deadline, either online, by mail, or in person.

Following these steps can help ensure that your claim is processed smoothly.

How to Obtain the PDF Form IT 214 Claim For Real Property Tax Credit For Homeowners

The IT 214 form can be obtained easily through various means. Homeowners can access the form by:

- Visiting the New York State Department of Taxation and Finance website to download the PDF version.

- Requesting a physical copy from local tax offices or government buildings.

- Checking with tax professionals who may provide the form as part of their services.

Having the correct form is essential for submitting a valid claim.

Form Submission Methods for the IT 214

Homeowners have several options for submitting the IT 214 form. These methods include:

- Online submission through the New York State Department of Taxation and Finance portal.

- Mailing the completed form to the designated tax office address.

- In-person submission at local tax offices for immediate processing.

Choosing the right submission method can affect the speed and efficiency of your claim processing.

Key Elements of the IT 214 Form

Understanding the key elements of the IT 214 form is crucial for successful completion. Important components include:

- Personal information, including the homeowner's name, address, and Social Security number.

- Property details, such as the address and assessment information.

- Income information to determine eligibility for the tax credit.

- Signature and date to validate the claim.

Ensuring all key elements are accurately filled out can help prevent delays in processing your claim.

Quick guide on how to complete pdf form it 214 claim for real property tax credit for homeowners

Manage PDF Form IT 214 Claim For Real Property Tax Credit For Homeowners effortlessly on any device

The management of online documents has gained traction among enterprises and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed documents, allowing you to obtain the right forms and securely keep them online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly without delays. Handle PDF Form IT 214 Claim For Real Property Tax Credit For Homeowners on any platform with airSlate SignNow applications for Android or iOS and streamline any document-related process today.

The easiest way to modify and electronically sign PDF Form IT 214 Claim For Real Property Tax Credit For Homeowners with ease

- Find PDF Form IT 214 Claim For Real Property Tax Credit For Homeowners and click Get Form to begin.

- Use the tools we provide to complete your document.

- Mark important sections of your documents or redact confidential information using tools specifically available from airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign PDF Form IT 214 Claim For Real Property Tax Credit For Homeowners to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf form it 214 claim for real property tax credit for homeowners

Create this form in 5 minutes!

How to create an eSignature for the pdf form it 214 claim for real property tax credit for homeowners

The best way to generate an electronic signature for your PDF file in the online mode

The best way to generate an electronic signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is the it 214 2021 form, and how can airSlate SignNow help?

The it 214 2021 form is a tax document used for specific reporting purposes. airSlate SignNow simplifies the process of signing and sending this form electronically, ensuring you stay compliant with the latest regulations. With our user-friendly interface, managing your it 214 2021 submissions has never been easier.

-

How does airSlate SignNow ensure the security of my it 214 2021 documents?

Security is a priority when handling sensitive documents like the it 214 2021. airSlate SignNow employs advanced encryption protocols and complies with industry standards to safeguard your data. You can trust us to maintain the confidentiality and integrity of your sensitive information throughout the signing process.

-

What are the pricing plans for using airSlate SignNow for it 214 2021 forms?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for handling it 214 2021 forms. Our competitive pricing ensures that you gain access to a powerful eSigning solution without breaking the bank. Visit our pricing page to find a plan that suits your requirements.

-

Can I integrate airSlate SignNow with my existing tools to manage it 214 2021 forms?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, including CRM and accounting software, to streamline your workflow when handling the it 214 2021. This integration enhances efficiency, allowing for quick access and management of your signing processes without switching between multiple platforms.

-

What features does airSlate SignNow offer for managing it 214 2021 documents?

airSlate SignNow includes features like customizable templates, automated reminders, and in-app document collaboration tailored for the it 214 2021. These tools help simplify the process of document management and improve team collaboration. With our easy-to-use features, you can handle your forms more efficiently and effectively.

-

Is airSlate SignNow suitable for both individuals and businesses handling the it 214 2021?

Yes, airSlate SignNow is designed for both individuals and businesses looking to manage the it 214 2021 efficiently. Whether you are a freelancer or part of a large organization, our solution scales to meet your needs while providing an intuitive signing experience. Everyone can benefit from our platform’s capabilities.

-

How does the electronic signing process work for the it 214 2021 with airSlate SignNow?

The electronic signing process for the it 214 2021 with airSlate SignNow is straightforward. Simply upload your document, add the necessary fields for signatures, and send it out to recipients. After signing, all parties receive a secure copy of the final document for their records, making compliance hassle-free.

Get more for PDF Form IT 214 Claim For Real Property Tax Credit For Homeowners

- Answer to original petition for divorce and amending petition louisiana form

- Reconventional demand 497308638 form

- Reconventional demand 497308639 form

- Answer to plaintiffs petition louisiana 497308640 form

- Louisiana answer petition 497308641 form

- Answer reconventional form

- Petition custody form

- Answer to petition louisiana form

Find out other PDF Form IT 214 Claim For Real Property Tax Credit For Homeowners

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement