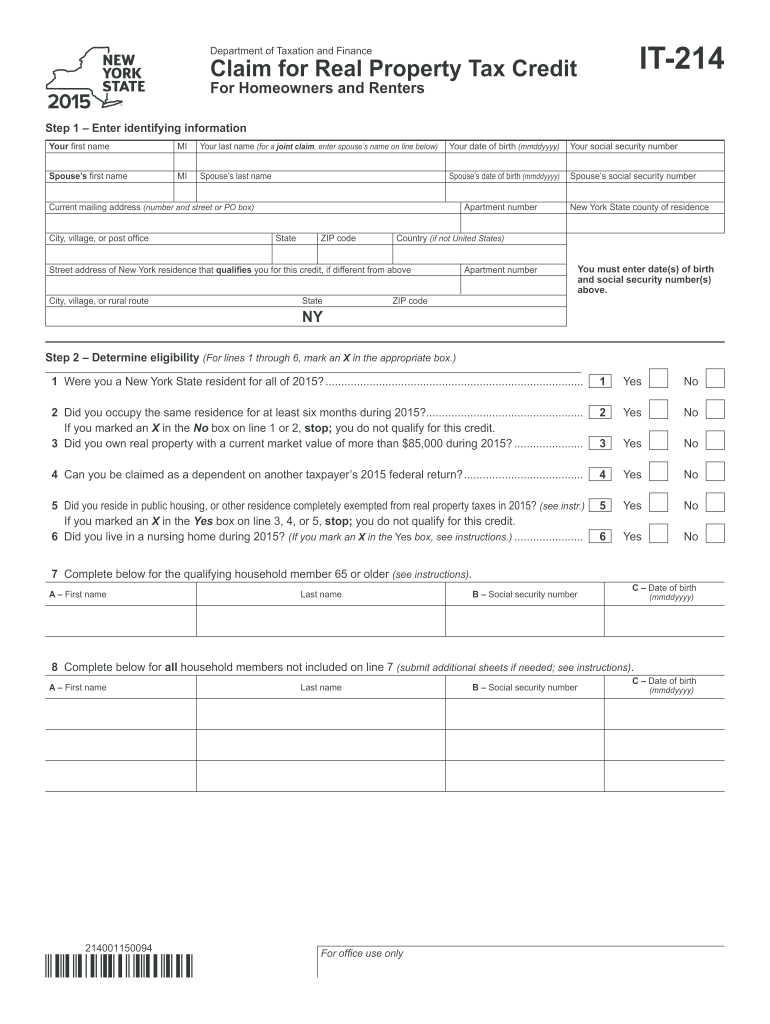

it 214 Form 2015

What is the It 214 Form

The It 214 Form is a tax document used primarily in the United States for claiming certain tax credits and deductions. It is often associated with specific tax situations, such as eligibility for various tax benefits. This form is crucial for taxpayers who need to report their financial information accurately to the Internal Revenue Service (IRS).

How to use the It 214 Form

To effectively use the It 214 Form, individuals must first ensure they meet the eligibility criteria for the credits or deductions they intend to claim. After confirming eligibility, taxpayers should accurately fill out the form with the required personal and financial information. It is essential to follow the instructions provided with the form to avoid errors that could lead to delays or complications in processing.

Steps to complete the It 214 Form

Completing the It 214 Form involves several key steps:

- Gather necessary documentation, such as income statements and previous tax returns.

- Carefully read the instructions accompanying the form to understand each section.

- Fill out personal information, including name, address, and Social Security number.

- Provide detailed financial information relevant to the tax credits or deductions.

- Review the completed form for accuracy before submission.

Legal use of the It 214 Form

The It 214 Form is legally binding when completed and submitted according to IRS regulations. Ensuring compliance with all applicable tax laws is essential for the form to be valid. Taxpayers must provide truthful and accurate information, as discrepancies can lead to penalties or audits.

Filing Deadlines / Important Dates

Timely submission of the It 214 Form is crucial to avoid penalties. The IRS typically sets specific deadlines for filing tax forms, which may vary each year. Taxpayers should be aware of these deadlines, usually coinciding with the annual tax filing season, to ensure they submit their forms on time.

Required Documents

When completing the It 214 Form, several documents may be required to support the information provided. Commonly needed documents include:

- W-2 forms from employers

- 1099 forms for additional income

- Receipts for deductible expenses

- Previous year’s tax return for reference

Form Submission Methods

The It 214 Form can be submitted through various methods, allowing flexibility for taxpayers. Common submission options include:

- Online filing through IRS-approved software

- Mailing a paper form to the appropriate IRS address

- In-person submission at designated IRS offices

Quick guide on how to complete it 214 2015 form

Complete It 214 Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage It 214 Form on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to amend and eSign It 214 Form with ease

- Locate It 214 Form and click Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select how you would like to share your form, by email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign It 214 Form to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it 214 2015 form

Create this form in 5 minutes!

How to create an eSignature for the it 214 2015 form

How to make an electronic signature for the It 214 2015 Form in the online mode

How to create an electronic signature for your It 214 2015 Form in Google Chrome

How to generate an eSignature for signing the It 214 2015 Form in Gmail

How to make an electronic signature for the It 214 2015 Form from your smart phone

How to make an electronic signature for the It 214 2015 Form on iOS

How to make an electronic signature for the It 214 2015 Form on Android devices

People also ask

-

What is the IT 214 Form and how can airSlate SignNow help?

The IT 214 Form is a tax form used to claim a credit for certain qualified expenses. With airSlate SignNow, you can easily fill out, send, and eSign the IT 214 Form, streamlining the process and ensuring accuracy in your submissions.

-

What features does airSlate SignNow offer for managing the IT 214 Form?

airSlate SignNow provides a variety of features to manage the IT 214 Form effectively, including customizable templates, secure eSignature options, and real-time collaboration tools. These features help simplify the completion and approval process of the IT 214 Form, making it easier for businesses to handle their tax filings.

-

Is there a cost associated with using airSlate SignNow for the IT 214 Form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan includes features that support the efficient management of documents like the IT 214 Form, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with other software for the IT 214 Form?

Absolutely! airSlate SignNow integrates seamlessly with many popular applications, allowing you to automate workflows related to the IT 214 Form. This integration ensures that your data flows smoothly between platforms, enhancing productivity and reducing manual entry errors.

-

How secure is airSlate SignNow when handling the IT 214 Form?

airSlate SignNow prioritizes security with advanced encryption protocols and strict compliance with industry standards. When you use airSlate SignNow for the IT 214 Form, you can trust that your sensitive tax information is protected against unauthorized access.

-

What are the benefits of using airSlate SignNow for the IT 214 Form?

Using airSlate SignNow for the IT 214 Form enables faster processing, reduces paperwork, and facilitates easy tracking of document status. This not only saves time but also enhances efficiency in managing tax-related documents.

-

Is it easy to eSign the IT 214 Form with airSlate SignNow?

Yes, eSigning the IT 214 Form with airSlate SignNow is incredibly straightforward. The platform allows users to sign documents electronically with just a few clicks, making it a hassle-free experience for both senders and recipients.

Get more for It 214 Form

Find out other It 214 Form

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now