it 214 Rental Rebate Forms 2018

What is the IT-214 Rental Rebate Form?

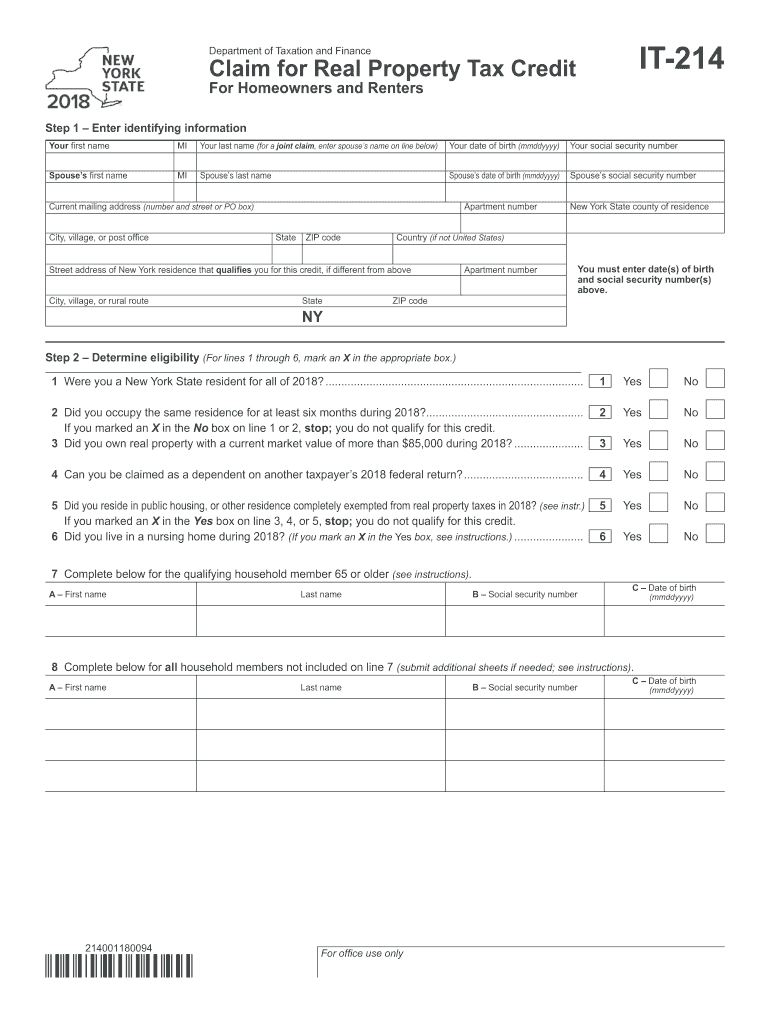

The IT-214 form is a New York State tax document used to claim a real property tax credit for eligible renters. This form allows individuals to receive a rebate based on the amount of rent paid and the property taxes levied on the rental property. The rebate is designed to assist low- and moderate-income residents who may struggle with housing costs. The IT-214 form is specifically aimed at those who qualify under New York State guidelines, ensuring that financial relief is directed to those in need.

Eligibility Criteria for the IT-214 Rental Rebate Form

To qualify for the IT-214 form, applicants must meet specific eligibility criteria set by New York State. Key requirements include:

- Residency in New York State for the entire tax year.

- Meeting income limits, which vary based on filing status and household size.

- Renting a residence that is subject to property taxes.

- Providing proof of rent payments and the property owner's information.

It is essential for applicants to review the current year’s guidelines to ensure they meet all necessary conditions before filing.

Steps to Complete the IT-214 Rental Rebate Form

Completing the IT-214 form involves several steps to ensure accuracy and compliance with New York State tax regulations:

- Gather all necessary documentation, including proof of rent payments and income statements.

- Obtain the IT-214 form from the New York State Department of Taxation and Finance website or through authorized channels.

- Fill out the form, providing all required personal information, rental details, and income information.

- Review the completed form for accuracy and completeness.

- Submit the form by the specified deadline, either online or via mail, ensuring to keep copies for your records.

How to Obtain the IT-214 Rental Rebate Form

The IT-214 form can be obtained through multiple channels, making it accessible for all eligible applicants. Options include:

- Downloading the form directly from the New York State Department of Taxation and Finance website.

- Requesting a paper copy from local tax offices or community organizations that assist with tax filings.

- Accessing the form through tax preparation software that supports New York State tax filings.

Ensuring you have the correct and most current version of the IT-214 form is crucial for a successful filing.

Legal Use of the IT-214 Rental Rebate Form

The IT-214 form is legally recognized as a valid means to claim a rental rebate in New York State. To ensure its legal use, applicants must:

- Complete the form accurately and truthfully, providing all required information.

- Submit the form within the designated filing period to avoid penalties.

- Maintain documentation supporting the claim, such as rent receipts and income statements, in case of an audit.

Understanding the legal implications of the IT-214 form helps applicants navigate the filing process with confidence.

Form Submission Methods for the IT-214

Applicants can submit the IT-214 form using various methods, ensuring flexibility and convenience. The available submission methods include:

- Online submission through the New York State Department of Taxation and Finance e-filing system.

- Mailing the completed form to the appropriate tax office address as specified in the form instructions.

- In-person submission at designated tax offices, where assistance may also be available.

Choosing the right submission method can help streamline the process and ensure timely receipt of any potential rebates.

Quick guide on how to complete it 214 2018 2019 form

Easily Prepare It 214 Rental Rebate Forms on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and electronically sign your documents promptly without delays. Manage It 214 Rental Rebate Forms on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related tasks today.

How to Modify and Electronically Sign It 214 Rental Rebate Forms with Ease

- Find It 214 Rental Rebate Forms and click Get Form to begin.

- Utilize the features we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using airSlate SignNow's designated tools for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to distribute your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign It 214 Rental Rebate Forms to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it 214 2018 2019 form

Create this form in 5 minutes!

How to create an eSignature for the it 214 2018 2019 form

How to make an eSignature for the It 214 2018 2019 Form in the online mode

How to create an electronic signature for the It 214 2018 2019 Form in Google Chrome

How to make an electronic signature for putting it on the It 214 2018 2019 Form in Gmail

How to make an electronic signature for the It 214 2018 2019 Form from your mobile device

How to make an electronic signature for the It 214 2018 2019 Form on iOS devices

How to create an electronic signature for the It 214 2018 2019 Form on Android

People also ask

-

What are IT 214 Rental Rebate Forms?

IT 214 Rental Rebate Forms are tax documents used in Texas for claiming property tax rent rebates. These forms allow renters to receive a tax refund based on their rental payments, providing signNow savings. Understanding how to fill out and submit IT 214 Rental Rebate Forms is crucial for maximizing your potential rebates.

-

How can airSlate SignNow help with IT 214 Rental Rebate Forms?

AirSlate SignNow simplifies the process of handling IT 214 Rental Rebate Forms by allowing you to easily send, receive, and eSign these documents online. With its user-friendly interface, you can ensure that all necessary information is accurately filled out and submitted on time. This streamlines your tax rebate application process signNowly.

-

Are there any costs associated with using airSlate SignNow for IT 214 Rental Rebate Forms?

AirSlate SignNow offers a variety of pricing plans tailored to meet different needs, including a cost-effective solution for managing IT 214 Rental Rebate Forms. You can choose from monthly or annual subscriptions based on your usage requirements. Additionally, there are often trials available, allowing you to evaluate the service before committing.

-

What features does airSlate SignNow offer for managing IT 214 Rental Rebate Forms?

AirSlate SignNow provides several features specifically for IT 214 Rental Rebate Forms, including customizable templates, secure eSigning, and document tracking. These tools help ensure that your forms are completed correctly and monitored throughout the submission process. The platform also supports easy collaboration with multiple signers.

-

Can I integrate airSlate SignNow with other software for handling IT 214 Rental Rebate Forms?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your experience with IT 214 Rental Rebate Forms. You can connect it with tools like Google Drive, Dropbox, and other document management systems to streamline your workflow. This integration allows for easy access to your documents from any platform.

-

How secure is airSlate SignNow when handling IT 214 Rental Rebate Forms?

AirSlate SignNow employs advanced security protocols to protect your IT 214 Rental Rebate Forms and personal data. With encryption, secure servers, and compliance with industry standards, your information remains confidential and safe from unauthorized access. You can trust that your tax documents are in secure hands.

-

What are the benefits of using airSlate SignNow for IT 214 Rental Rebate Forms?

Using airSlate SignNow for IT 214 Rental Rebate Forms offers numerous benefits, including increased efficiency and reduced paperwork. The digital format allows you to quickly fill out, eSign, and submit forms without the hassle of printing and mailing. This not only saves time but also helps ensure that your applications are processed faster.

Get more for It 214 Rental Rebate Forms

Find out other It 214 Rental Rebate Forms

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors