Department of Taxation and Finance Claim for Real Property 2020

What is the Department of Taxation and Finance Claim for Real Property

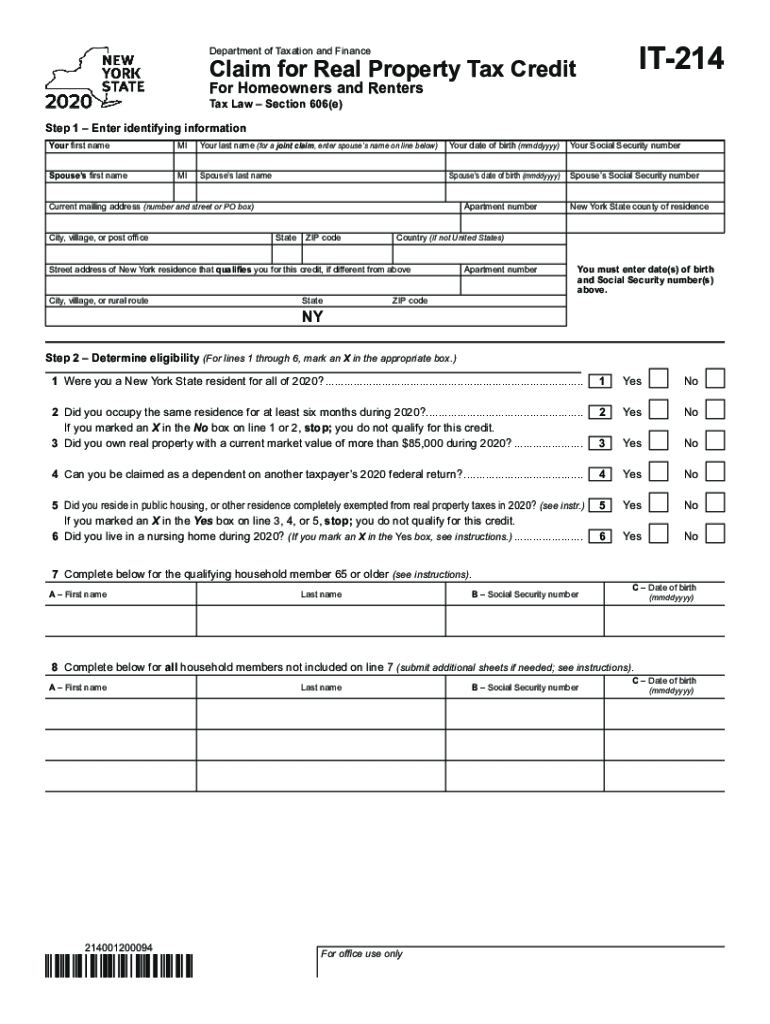

The Department of Taxation and Finance Claim for Real Property is a form used in New York State to apply for a real property tax credit. This credit is available to eligible homeowners and renters who meet specific income and residency requirements. The form allows individuals to claim a reduction in their property taxes, which can significantly ease the financial burden of homeownership or renting. Understanding the purpose and function of this form is crucial for those seeking to take advantage of available tax relief.

Steps to Complete the Department of Taxation and Finance Claim for Real Property

Completing the Claim for Real Property involves several important steps:

- Gather Required Information: Collect all necessary documentation, including proof of income, residency, and property ownership or rental agreements.

- Fill Out the Form: Carefully complete the form, ensuring all sections are filled out accurately. Pay special attention to income thresholds and eligibility criteria.

- Review Your Submission: Double-check all entries for accuracy and completeness to avoid delays in processing.

- Submit the Form: Choose your preferred method of submission, whether online, by mail, or in person, and ensure it is sent before the deadline.

Eligibility Criteria

To qualify for the Claim for Real Property, applicants must meet specific eligibility criteria, including:

- Residency in New York State for at least six months prior to the application.

- Income limits that vary based on household size and property type.

- Ownership of the property or a valid rental agreement.

Reviewing these criteria carefully will help determine if you can successfully file for the tax credit.

Form Submission Methods

The Claim for Real Property can be submitted through various methods, allowing flexibility for applicants:

- Online: Many applicants prefer to complete and submit the form electronically through the New York State Department of Taxation and Finance website.

- By Mail: Completed forms can also be printed and mailed to the appropriate tax office.

- In-Person: For those who prefer face-to-face assistance, submitting the form in person at a local tax office is an option.

Filing Deadlines / Important Dates

Understanding the filing deadlines is critical for ensuring that your application is processed in a timely manner. The deadlines for submitting the Claim for Real Property typically align with the annual tax filing season. It is essential to check the specific dates each year, as they can vary. Missing the deadline may result in the loss of potential tax credits.

Key Elements of the Department of Taxation and Finance Claim for Real Property

The Claim for Real Property consists of several key elements that applicants must be aware of:

- Personal Information: This includes the applicant's name, address, and contact details.

- Income Information: Applicants must provide details about their income sources and amounts.

- Property Information: Information about the property, including its location and ownership status, is required.

Each of these elements plays a crucial role in determining eligibility and the amount of credit that may be awarded.

Quick guide on how to complete department of taxation and finance claim for real property

Effortlessly Prepare Department Of Taxation And Finance Claim For Real Property on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-conscious substitute to traditional printed and signed forms, as you can easily access the necessary template and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without delays. Handle Department Of Taxation And Finance Claim For Real Property on any device using airSlate SignNow’s Android or iOS applications and simplify your document-related tasks today.

The easiest way to modify and eSign Department Of Taxation And Finance Claim For Real Property with minimal effort

- Find Department Of Taxation And Finance Claim For Real Property and click on Get Form to begin.

- Utilize the tools we've made available to complete your document.

- Mark important parts of the documents or hide sensitive information using the tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature with the Sign tool, which only takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and then hit the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or disorganized documents, monotonous form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Revise and eSign Department Of Taxation And Finance Claim For Real Property and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct department of taxation and finance claim for real property

Create this form in 5 minutes!

How to create an eSignature for the department of taxation and finance claim for real property

The best way to generate an eSignature for a PDF file in the online mode

The best way to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to create an eSignature from your smartphone

How to create an eSignature for a PDF file on iOS devices

How to create an eSignature for a PDF file on Android

People also ask

-

What is 214 form in New York State tax filing?

The 214 form is a document required for certain tax filings in New York State. It serves to provide essential information to the state tax authorities regarding tax credits and deductions a taxpayer may qualify for. Understanding what is 214 form in New York State tax filing is crucial for accurate reporting and maximizing potential savings.

-

How can airSlate SignNow help with New York State tax filing?

airSlate SignNow streamlines the process of preparing and submitting your tax documents, including the 214 form. Our platform allows you to easily send, eSign, and manage forms securely online, saving you time and reducing the risk of errors. Utilizing airSlate SignNow enhances your overall efficiency when handling what is 214 form in New York State tax filing.

-

Are there any costs associated with using airSlate SignNow for tax forms?

Yes, airSlate SignNow offers affordable pricing plans that cater to businesses of all sizes. Our flexible subscriptions ensure you only pay for the features you need, making it a cost-effective choice for managing what is 214 form in New York State tax filing. Check our website for detailed pricing information and choose a plan that fits your budget.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides a range of features tailored for tax document management, including customizable templates, eSignature capabilities, and secure cloud storage. These tools are specifically designed to help you navigate what is 214 form in New York State tax filing efficiently. Our platform enhances collaboration and ensures your documents are always accessible.

-

Can airSlate SignNow integrate with other accounting software?

Yes, airSlate SignNow seamlessly integrates with various accounting software platforms to streamline your tax filing process. This includes popular programs that will help you manage and prepare documents like the 214 form. Integration enables you to utilize your existing tools while ensuring compliance with what is 214 form in New York State tax filing.

-

What are the benefits of using eSignatures for tax filings?

Using eSignatures for tax filings offers numerous benefits, including increased security, legal compliance, and the ability to complete forms faster. With airSlate SignNow, you can ensure that documents like the 214 form are signed and submitted promptly, reducing delays in tax processing. This efficiency is vital when dealing with what is 214 form in New York State tax filing.

-

Is airSlate SignNow user-friendly for first-time users?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for first-time users to navigate the platform. You can quickly learn how to manage and sign documents, including what is 214 form in New York State tax filing, without any technical expertise. Our customer support is also available to assist you as needed.

Get more for Department Of Taxation And Finance Claim For Real Property

- Malawi adventist university application forms pdf

- Self declaration form for education loan

- Child immunisation card in uganda form

- Script continuity sheet form

- Quest international university admission forms

- Klb biology form 1 pdf download 311777808

- Sis security application form pdf

- Richland county board of zoning appeals application checklist form

Find out other Department Of Taxation And Finance Claim For Real Property

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors