it 214Claim for Real Property Tax Credit Tax NY Gov 2023-2026

What is the IT-214 Claim for Real Property Tax Credit?

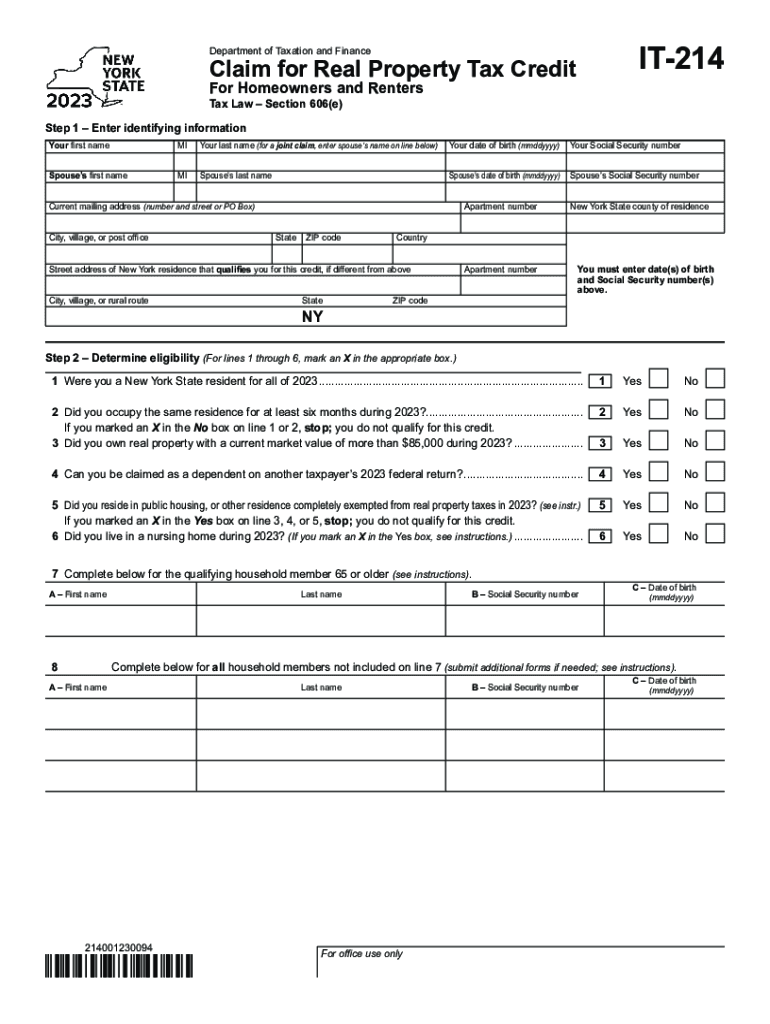

The IT-214 is a tax form used in New York State for claiming a credit on real property taxes. This form is specifically designed for homeowners who meet certain eligibility criteria, allowing them to receive a tax credit based on their property taxes paid. The credit aims to provide financial relief to qualifying homeowners, making it an important aspect of tax planning for many residents. Understanding the purpose and benefits of the IT-214 can help homeowners maximize their tax savings.

Eligibility Criteria for the IT-214

To qualify for the IT-214, homeowners must meet specific eligibility requirements. These include:

- Ownership of the property for which the credit is being claimed.

- Residency in the property as a primary residence.

- Income limits that may affect eligibility, typically based on the homeowner's total income.

- Payment of real property taxes on the property for which the credit is claimed.

It is essential for applicants to review these criteria carefully to ensure they qualify before submitting the form.

Steps to Complete the IT-214 Form

Completing the IT-214 form involves several key steps to ensure accurate submission:

- Gather necessary documentation, including proof of property ownership and tax payment receipts.

- Fill out the form with accurate personal and property information, including income details.

- Calculate the credit amount based on the guidelines provided in the form instructions.

- Review the completed form for accuracy and completeness before submission.

Following these steps will help streamline the process and reduce the likelihood of errors that could delay the credit issuance.

Required Documents for the IT-214

When filing the IT-214, homeowners must provide specific documents to support their claim. These documents typically include:

- Proof of property ownership, such as a deed or mortgage statement.

- Real property tax bills or receipts showing payment of taxes.

- Documentation of income, such as tax returns or W-2 forms, to verify eligibility.

Having these documents ready can facilitate a smoother filing process and ensure compliance with the requirements of the New York State tax authorities.

Form Submission Methods for the IT-214

The IT-214 can be submitted through various methods, providing flexibility for homeowners. The submission options include:

- Online submission through the New York State Department of Taxation and Finance website.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if preferred.

Choosing the right submission method can depend on individual preferences and circumstances, including the urgency of the claim.

Important Filing Deadlines for the IT-214

Homeowners must be aware of the filing deadlines associated with the IT-214 to ensure timely submission. Generally, the form must be filed by:

- The due date for the New York State personal income tax return, typically April 15.

- Any extensions granted for filing income tax returns, if applicable.

Staying informed about these deadlines helps prevent penalties and ensures that homeowners receive their credits promptly.

Quick guide on how to complete it 214claim for real property tax credit tax ny gov

Effortlessly Prepare IT 214Claim For Real Property Tax Credit Tax NY gov on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage IT 214Claim For Real Property Tax Credit Tax NY gov on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The Easiest Way to Modify and eSign IT 214Claim For Real Property Tax Credit Tax NY gov with Ease

- Find IT 214Claim For Real Property Tax Credit Tax NY gov and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools designed specifically for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes just seconds and holds the same legal significance as an ink signature.

- Verify all the details and then click the Done button to save your changes.

- Select how you’d like to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign IT 214Claim For Real Property Tax Credit Tax NY gov and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it 214claim for real property tax credit tax ny gov

Create this form in 5 minutes!

How to create an eSignature for the it 214claim for real property tax credit tax ny gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2019 IT 214 property and how does it relate to eSigning?

The 2019 IT 214 property is a document category specifically designed for property-related transactions. It allows businesses and individuals to electronically sign essential documents securely. Utilizing airSlate SignNow, you can easily manage and eSign your 2019 IT 214 property to streamline your workflow.

-

How does airSlate SignNow support the 2019 IT 214 property?

airSlate SignNow provides a user-friendly platform for managing the 2019 IT 214 property documentation. Our solution ensures that you can easily upload, edit, and eSign your property documents without hassle. This saves time and helps keep your records organized.

-

What are the pricing options for using airSlate SignNow with the 2019 IT 214 property?

AirSlate SignNow offers competitive pricing plans that cater to various business needs. You can choose from monthly or annual subscriptions to access features specifically beneficial for managing your 2019 IT 214 property. Each plan provides value with unlimited document signing and storage.

-

Are there any integrations available for managing the 2019 IT 214 property?

Yes, airSlate SignNow offers integrations with various platforms like Google Drive, Dropbox, and CRM systems. This allows you to streamline your processes while managing the 2019 IT 214 property. You can easily import and export documents across your favorite apps.

-

What features make airSlate SignNow ideal for handling the 2019 IT 214 property?

AirSlate SignNow includes key features such as customizable templates, secure cloud storage, and real-time collaboration. These functionalities enhance your experience when managing your 2019 IT 214 property. Additionally, our mobile app ensures you can access documents anytime, anywhere.

-

How can eSigning improve workflow efficiency for the 2019 IT 214 property?

By using airSlate SignNow to eSign the 2019 IT 214 property, you eliminate the need for physical signatures, thereby speeding up the process. This results in quicker approvals and finalizations, which is crucial in property transactions. The seamless digital experience signNowly enhances overall workflow efficiency.

-

Is airSlate SignNow secure for handling sensitive 2019 IT 214 property information?

Absolutely, airSlate SignNow prioritizes security with features like encryption and compliance with industry standards. Your sensitive information related to the 2019 IT 214 property is protected at all stages. We ensure that all your documents are safe from unauthorized access.

Get more for IT 214Claim For Real Property Tax Credit Tax NY gov

Find out other IT 214Claim For Real Property Tax Credit Tax NY gov

- Sign New York Codicil to Will Now

- Sign Oregon Codicil to Will Later

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien