Www Ctreg14 OrguploadedHumanResourcesDepartment of Revenue Services State of Connecticut Form CT 2021

Understanding the CT W-4 Form

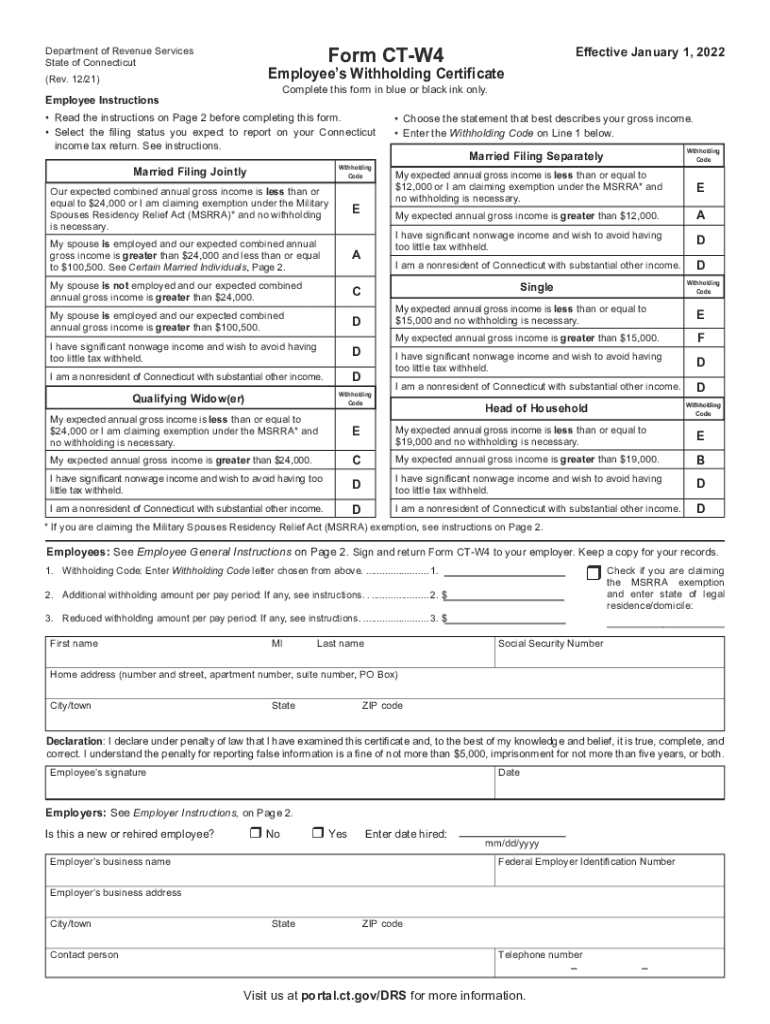

The CT W-4 form is a state-specific tax withholding form used by employees in Connecticut to inform their employers about the amount of state income tax to withhold from their paychecks. This form is essential for ensuring that the correct amount of tax is deducted, helping to avoid underpayment or overpayment of state taxes. The information provided on the CT W-4 directly impacts the employee's take-home pay and tax obligations.

Steps to Complete the CT W-4 Form

Completing the CT W-4 form involves several key steps:

- Personal Information: Fill in your name, address, and Social Security number. This information is critical for accurate identification and processing.

- Filing Status: Indicate your filing status, such as single, married, or head of household. This affects your tax rate.

- Allowances: Calculate the number of allowances you are claiming based on your personal circumstances. More allowances typically result in less tax withheld.

- Additional Withholding: If you want to withhold additional amounts, specify this in the designated section.

- Signature: Sign and date the form to validate it. An unsigned form is not considered valid.

Legal Use of the CT W-4 Form

The CT W-4 form is legally binding once completed and signed. It is important to ensure that the information provided is accurate and up-to-date, as it directly affects tax withholding. Employers are required to comply with the information provided on the form, making it essential for employees to review their withholding status periodically, especially after major life changes such as marriage or the birth of a child.

Filing Deadlines for the CT W-4 Form

While the CT W-4 does not have a specific filing deadline like annual tax returns, it should be submitted to your employer as soon as you start a new job or when you wish to update your withholding information. Keeping your CT W-4 current is crucial to ensure that the correct amount of state income tax is withheld from your paycheck throughout the year.

Who Issues the CT W-4 Form

The CT W-4 form is issued by the Connecticut Department of Revenue Services. This state agency is responsible for administering tax laws and ensuring compliance with state tax regulations. Employees can obtain the form directly from their employer or download it from the official state website.

Examples of Using the CT W-4 Form

There are various scenarios where the CT W-4 form is applicable:

- New Employment: When starting a new job, employees must complete the CT W-4 to establish their tax withholding preferences.

- Life Changes: Significant events such as marriage, divorce, or having a child may warrant a review and update of the CT W-4 to reflect changes in tax status.

- Adjusting Withholding: If an employee finds that they are receiving a large tax refund or owe taxes at the end of the year, they may choose to adjust their withholding by submitting a new CT W-4.

Quick guide on how to complete wwwctreg14orguploadedhumanresourcesdepartment of revenue services state of connecticut form ct

Complete Www ctreg14 orguploadedHumanResourcesDepartment Of Revenue Services State Of Connecticut Form CT effortlessly on any device

Web-based document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without any delays. Handle Www ctreg14 orguploadedHumanResourcesDepartment Of Revenue Services State Of Connecticut Form CT on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to alter and eSign Www ctreg14 orguploadedHumanResourcesDepartment Of Revenue Services State Of Connecticut Form CT with ease

- Find Www ctreg14 orguploadedHumanResourcesDepartment Of Revenue Services State Of Connecticut Form CT and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or corrections that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and eSign Www ctreg14 orguploadedHumanResourcesDepartment Of Revenue Services State Of Connecticut Form CT and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwctreg14orguploadedhumanresourcesdepartment of revenue services state of connecticut form ct

Create this form in 5 minutes!

How to create an eSignature for the wwwctreg14orguploadedhumanresourcesdepartment of revenue services state of connecticut form ct

The way to create an e-signature for a PDF in the online mode

The way to create an e-signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

The best way to make an electronic signature from your smart phone

The best way to generate an e-signature for a PDF on iOS devices

The best way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the ct w4 form and why is it important?

The ct w4 form is a crucial document for Connecticut employees, as it allows you to declare your withholding allowances for state income tax. Completing this form accurately ensures the correct amount of tax is withheld from your paycheck, potentially affecting your overall tax return at the end of the year.

-

How can airSlate SignNow help with filling out the ct w4?

airSlate SignNow provides an intuitive platform to complete your ct w4 form digitally. With our eSignature features, you can seamlessly fill out, sign, and send your ct w4 form, ensuring you meet deadlines without any hassle.

-

Is there a cost associated with using airSlate SignNow for my ct w4 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our affordable subscriptions provide access to a suite of features designed to streamline the process of completing essential forms like the ct w4.

-

What features does airSlate SignNow offer for managing the ct w4?

With airSlate SignNow, users can easily create, fill out, and electronically sign their ct w4 forms. Additional features include document template storage, automated reminders, and secure sharing options to simplify your paperwork further.

-

Can I integrate airSlate SignNow with other tools for processing the ct w4?

Absolutely! airSlate SignNow seamlessly integrates with various applications like Google Drive, Dropbox, and more. This integration allows for easy access to your ct w4 forms alongside other important documents, enhancing your workflow.

-

What benefits will I get from using airSlate SignNow for the ct w4?

By using airSlate SignNow for your ct w4 form, you gain efficiency, security, and ease of use. The digital signing process saves time, minimizes errors, and ensures that your documents are securely stored and easily retrievable.

-

Is airSlate SignNow compliant with state regulations for the ct w4?

Yes, airSlate SignNow is designed to adhere to state regulations, including those related to the ct w4 form. Our platform ensures that all signatures and documents are legally binding, maintaining compliance with Connecticut laws.

Get more for Www ctreg14 orguploadedHumanResourcesDepartment Of Revenue Services State Of Connecticut Form CT

- Motion for speedy trial form

- Motion for speedy trial louisiana form

- Request for statutory notice of trial louisiana form

- Written stipulation form

- Court subpoena form

- Louisiana subpoena form

- Act subordination form

- Petition for probate and possession heirship or descent affidavit sworn descriptive list judgment and order louisiana form

Find out other Www ctreg14 orguploadedHumanResourcesDepartment Of Revenue Services State Of Connecticut Form CT

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe