Ct W4 2019

What is the Ct W4

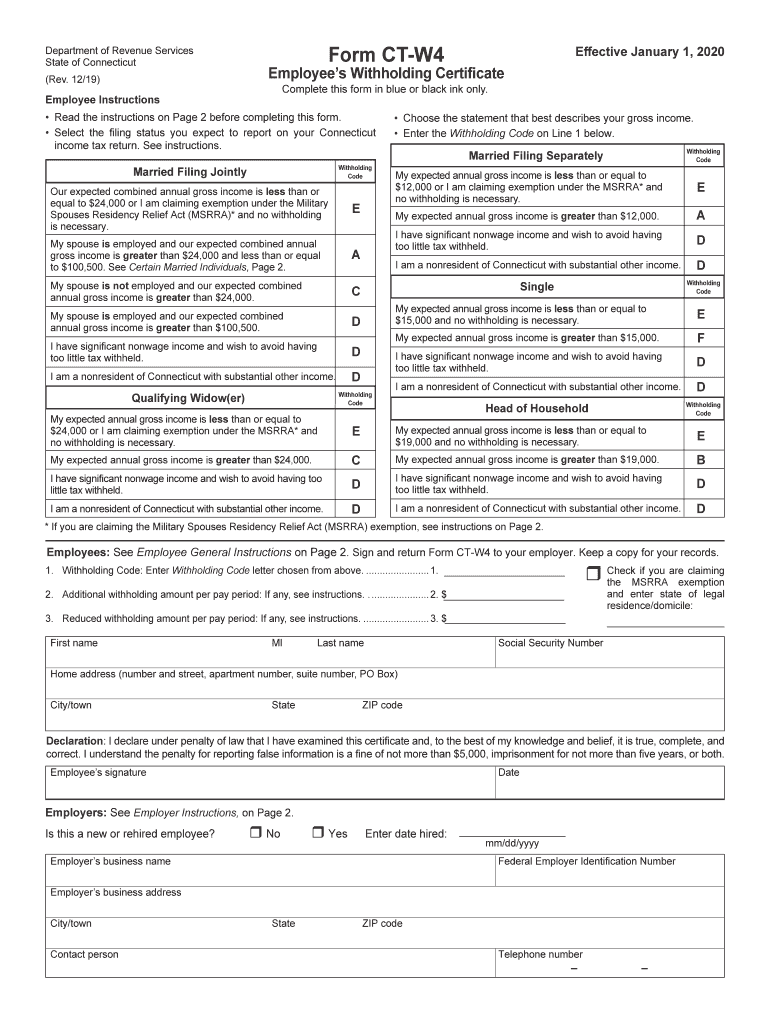

The Ct W4 form is a state-specific tax document used in Connecticut for withholding tax purposes. This form allows employees to inform their employers about their tax withholding preferences, which directly affects the amount of state income tax withheld from their paychecks. By accurately completing the Ct W4, employees can ensure that the correct amount of tax is withheld, helping to avoid underpayment or overpayment of taxes throughout the year. The Ct W4 is particularly important for new hires or those who have experienced changes in their personal or financial circumstances.

How to use the Ct W4

Using the Ct W4 form involves several straightforward steps. First, employees must gather necessary personal information, including their Social Security number and filing status. Next, they will need to specify the number of allowances they are claiming, which will determine the withholding amount. Additionally, employees can choose to have extra amounts withheld if desired. Once completed, the form should be submitted to the employer’s payroll department. It is essential to keep a copy for personal records and to review the form periodically, especially after significant life changes.

Steps to complete the Ct W4

Completing the Ct W4 requires careful attention to detail. Here are the steps to follow:

- Obtain a copy of the Ct W4 form from your employer or the Connecticut Department of Revenue Services website.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate your filing status, which can be single, married, or head of household.

- Claim the number of allowances based on your personal situation, referring to the instructions provided on the form.

- If necessary, specify any additional amount you wish to withhold.

- Sign and date the form before submitting it to your employer.

Legal use of the Ct W4

The Ct W4 is legally binding once it is signed and submitted to the employer. It must comply with state regulations regarding tax withholding. Employers are required to keep the completed forms on file for their employees. The information provided on the Ct W4 is used to calculate the amount of state income tax to withhold from employee paychecks. Failure to submit a properly completed Ct W4 can result in employers defaulting to a higher withholding rate, which may not reflect the employee's actual tax liability.

Filing Deadlines / Important Dates

While the Ct W4 itself does not have a specific filing deadline, it is crucial for employees to submit the form to their employer as soon as they begin employment or experience a significant life change. Employers typically require the Ct W4 to be completed before the first paycheck is issued. Additionally, employees should review their withholding status annually or when personal circumstances change, such as marriage, divorce, or the birth of a child.

Form Submission Methods (Online / Mail / In-Person)

The Ct W4 form can be submitted in various ways, depending on the employer's policies. Generally, employees can:

- Submit the completed form in person to the payroll department.

- Email a scanned copy of the signed form if the employer allows electronic submissions.

- Mail the form to the employer’s payroll office, ensuring it is sent well before the first paycheck date.

It is advisable to confirm with the employer regarding the preferred submission method to ensure timely processing.

Quick guide on how to complete read the instructions on page2 before completing this form

Complete Ct W4 effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Ct W4 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The most effective way to edit and electronically sign Ct W4 with ease

- Locate Ct W4 and click Get Form to begin.

- Utilize the tools we offer to finish your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Ct W4 while ensuring exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct read the instructions on page2 before completing this form

Create this form in 5 minutes!

How to create an eSignature for the read the instructions on page2 before completing this form

How to create an eSignature for the Read The Instructions On Page2 Before Completing This Form online

How to generate an eSignature for your Read The Instructions On Page2 Before Completing This Form in Chrome

How to create an eSignature for putting it on the Read The Instructions On Page2 Before Completing This Form in Gmail

How to create an eSignature for the Read The Instructions On Page2 Before Completing This Form straight from your smart phone

How to make an electronic signature for the Read The Instructions On Page2 Before Completing This Form on iOS devices

How to make an electronic signature for the Read The Instructions On Page2 Before Completing This Form on Android OS

People also ask

-

What is a Ct W4 form and how is it used?

The Ct W4 form is a tax withholding certificate used by employees in Connecticut to determine the amount of state tax withheld from their paychecks. By filling out the Ct W4 accurately, employees can ensure that their tax withholdings align with their financial situation, avoiding overpayment or underpayment during tax season.

-

How can airSlate SignNow help with the Ct W4 form?

airSlate SignNow simplifies the process of completing and signing the Ct W4 form electronically. With our platform, you can easily fill out the form, sign it, and send it to your employer, all while ensuring secure document handling and storage.

-

Is there a cost associated with using airSlate SignNow for the Ct W4 form?

Yes, airSlate SignNow offers various pricing plans to accommodate businesses of all sizes. Our plans are designed to be cost-effective, allowing you to manage multiple documents, including the Ct W4, without breaking the bank.

-

What features does airSlate SignNow offer for managing the Ct W4 form?

AirSlate SignNow provides a user-friendly interface for filling out the Ct W4 form, along with features like document templates, eSignature capabilities, and real-time tracking. These tools make it easy to manage your tax documents efficiently.

-

Can I integrate airSlate SignNow with other software to handle my Ct W4 forms?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, allowing you to manage your Ct W4 forms alongside your other business applications. This integration helps streamline workflows and improves overall efficiency.

-

What are the benefits of using airSlate SignNow for the Ct W4 over traditional paper methods?

Using airSlate SignNow for your Ct W4 form offers numerous benefits, including faster processing, reduced paper usage, and enhanced security. This electronic process minimizes the risk of errors and ensures that your documents are always accessible.

-

How secure is my information when using airSlate SignNow for the Ct W4?

Security is a top priority at airSlate SignNow. When you use our platform for the Ct W4 form, your information is protected with advanced encryption and secure data storage, ensuring that your sensitive information remains confidential.

Get more for Ct W4

- Cin legal data servicesamp39 consumer authorization and release form

- Parental written statement form amp instructions tfc 61104 request for taxpayer identification number and certification

- Screening form

- Videofluroscopic report template form

- City of chandler backflow prevention assembly test report chandleraz form

- Allianz general liability application form js davidson insurance jsdavidson

- Tribal sales tax report form for prime contracting tohono o tonation nsn

- Form w 8 attachment x

Find out other Ct W4

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe