Income Tax Withholding Guide for Employers Tax Virginia Gov 2022-2026

Key elements of the CT W-4 form

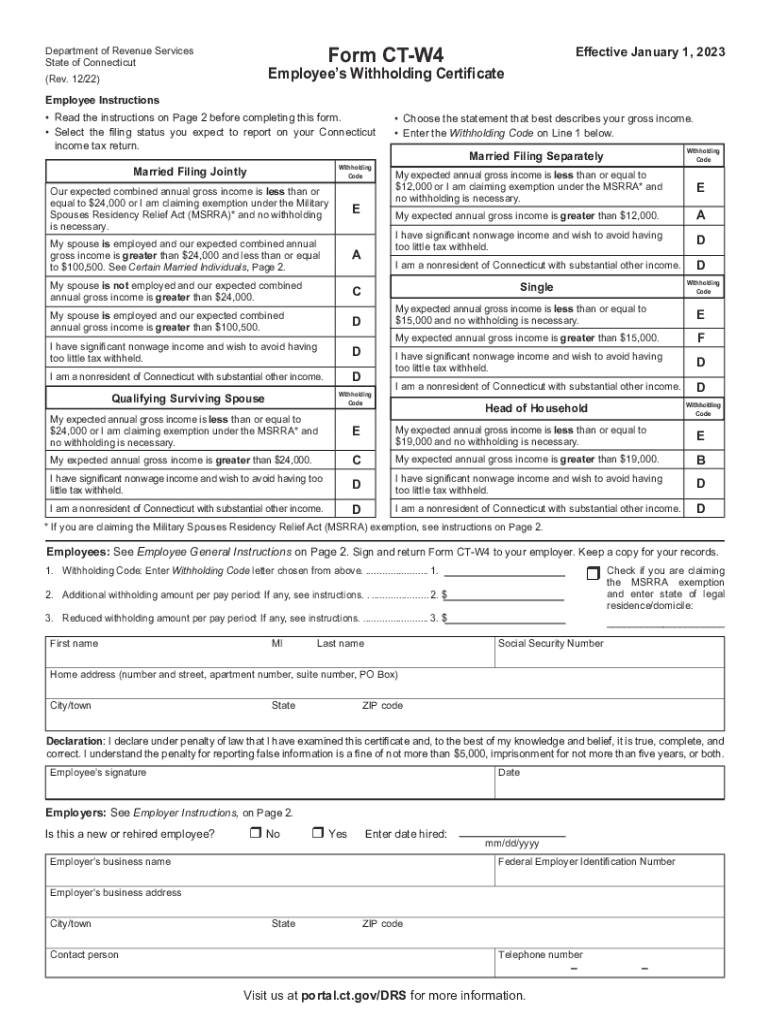

The CT W-4, or Connecticut Employee's Withholding Certificate, is crucial for determining the amount of state income tax withheld from an employee's paycheck. Key elements of this form include:

- Personal Information: Employees must provide their name, address, and Social Security number.

- Filing Status: The form requires the employee to indicate their filing status, which can affect withholding rates.

- Allowances: Employees can claim allowances based on their personal and financial situation, which directly impacts the withholding amount.

- Additional Withholding: Employees may choose to have additional amounts withheld from their paychecks for various reasons.

Steps to complete the CT W-4 form

Filling out the CT W-4 form involves several straightforward steps:

- Gather Personal Information: Collect necessary details such as your name, address, and Social Security number.

- Determine Your Filing Status: Choose the appropriate filing status that reflects your situation.

- Calculate Allowances: Assess your eligibility for allowances based on dependents and other factors.

- Complete the Form: Fill in the required sections accurately, ensuring all information is correct.

- Submit the Form: Provide the completed form to your employer for processing.

Filing Deadlines / Important Dates

Understanding the deadlines for submitting the CT W-4 form is essential for compliance. Generally, employees should submit their W-4 by the following dates:

- Upon Employment: New employees should submit the form on or before their first paycheck.

- Changes in Circumstances: If personal or financial situations change, employees should update their W-4 promptly.

Penalties for Non-Compliance

Failure to comply with the requirements of the CT W-4 can lead to significant penalties. These may include:

- Underwithholding: If too little tax is withheld, individuals may face unexpected tax bills and potential penalties at tax time.

- Fines: The state may impose fines for not submitting the W-4 form or for inaccuracies in the information provided.

Legal use of the CT W-4 form

The CT W-4 form serves a legal purpose in ensuring proper income tax withholding. It is essential for:

- Compliance with State Laws: The form helps employers meet state tax withholding requirements.

- Employee Rights: Employees have the right to accurate withholding based on their financial situation.

- Record Keeping: Proper completion of the form aids in maintaining accurate payroll records.

Examples of using the CT W-4 form

Here are some common scenarios illustrating how the CT W-4 form is used:

- New Employee: A new hire fills out the CT W-4 to establish their withholding preferences.

- Change in Marital Status: An employee who recently got married updates their W-4 to reflect their new filing status.

- Additional Income: An employee with a side business may choose to have extra tax withheld to cover their additional income.

Quick guide on how to complete income tax withholding guide for employers taxvirginiagov

Effortlessly Prepare Income Tax Withholding Guide For Employers Tax virginia gov on Any Device

Managing documents online has become increasingly favored by businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools needed to create, edit, and electronically sign your documents promptly without any delays. Handle Income Tax Withholding Guide For Employers Tax virginia gov on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign Income Tax Withholding Guide For Employers Tax virginia gov with Ease

- Obtain Income Tax Withholding Guide For Employers Tax virginia gov and click Get Form to begin.

- Employ the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just a few seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form hunting, or errors that require new document copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Income Tax Withholding Guide For Employers Tax virginia gov and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct income tax withholding guide for employers taxvirginiagov

Create this form in 5 minutes!

How to create an eSignature for the income tax withholding guide for employers taxvirginiagov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What pricing plans are available for airSlate SignNow in Connecticut from?

airSlate SignNow offers several pricing plans tailored to meet the needs of businesses in Connecticut from. These plans range from basic to advanced, ensuring that every user finds a solution that fits their budget. Additionally, there are no hidden fees, allowing for transparent budgeting.

-

What features does airSlate SignNow provide for users in Connecticut from?

Based in Connecticut from, airSlate SignNow includes a wide range of features that enhance document management, such as eSignatures, document templates, and real-time tracking. These tools help streamline workflows and save valuable time for businesses. Moreover, users can customize the solution to meet specific industry needs.

-

How does airSlate SignNow benefit businesses operating in Connecticut from?

Businesses in Connecticut from can benefit signNowly from airSlate SignNow through increased efficiency and reduced operational costs. By digitizing the signature process, companies can save on paper, ink, and storage costs. Furthermore, it accelerates transaction times, leading to faster business processes.

-

Is there a free trial available for airSlate SignNow in Connecticut from?

Yes, airSlate SignNow offers a free trial for potential users in Connecticut from. This allows businesses to explore the features and functionalities without any financial commitment. The trial helps users assess how the solution can fit into their operations before making a purchase decision.

-

What kind of integrations does airSlate SignNow offer for Connecticut from users?

airSlate SignNow provides numerous integrations with popular applications and services that businesses in Connecticut from commonly use. This includes CRM systems, cloud storage solutions, and project management tools. Such integrations ensure a seamless workflow, allowing users to manage documents from their preferred platforms.

-

How secure is airSlate SignNow for users in Connecticut from?

Security is a top priority for airSlate SignNow, particularly for businesses in Connecticut from. The platform utilizes advanced encryption and complies with major security standards to protect sensitive documents. Users can trust that their information is secure while benefiting from an efficient document management solution.

-

Can airSlate SignNow be used for legal documents in Connecticut from?

Absolutely! airSlate SignNow is fully compliant with legal standards, making it an excellent choice for managing legal documents in Connecticut from. The use of electronic signatures is recognized by various legal jurisdictions, ensuring that your documents hold up in court as needed.

Get more for Income Tax Withholding Guide For Employers Tax virginia gov

- Notice nonpayment form

- Landlord tenant notice 497326731 form

- Landlord tenant remove form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497326733 form

- Letter from tenant to landlord containing notice that premises leaks during rain and demand for repair tennessee form

- Letter from tenant to landlord containing notice that doors are broken and demand repair tennessee form

- Tn broken form

- Tennessee letter demand form

Find out other Income Tax Withholding Guide For Employers Tax virginia gov

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe