CT W4, Employee's Withholding Certificate Employee's Withholding Certificate 2016

What is the CT W4, Employee's Withholding Certificate

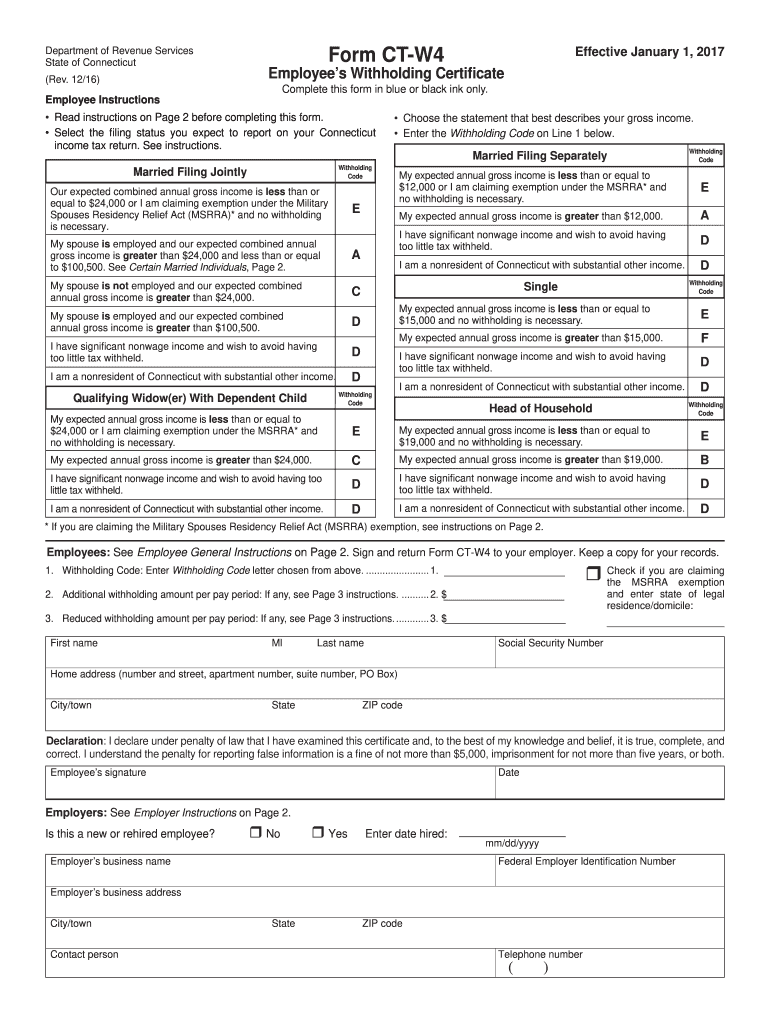

The CT W4, Employee's Withholding Certificate, is a crucial form used by employees in Connecticut to determine the amount of state income tax withheld from their paychecks. This form allows employees to provide their employers with information about their tax situation, including filing status and any additional withholding allowances. By accurately completing the CT W4, employees can ensure that the correct amount of taxes is withheld, helping to avoid underpayment or overpayment of state taxes throughout the year.

Steps to complete the CT W4, Employee's Withholding Certificate

Completing the CT W4 involves several straightforward steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate your filing status, such as single, married, or head of household.

- Determine the number of allowances you are claiming. This can affect the amount withheld from your paycheck.

- If applicable, specify any additional amount you wish to withhold from your pay.

- Review your information for accuracy and sign the form to validate it.

Once completed, submit the form to your employer to ensure proper withholding.

How to obtain the CT W4, Employee's Withholding Certificate

Employees can obtain the CT W4 form from various sources. It is available on the Connecticut Department of Revenue Services website, where you can download a printable version. Additionally, employers may provide the form directly to new hires or existing employees during tax season. It is important to ensure you are using the most current version of the form to comply with state regulations.

Legal use of the CT W4, Employee's Withholding Certificate

The CT W4 is legally binding when completed and submitted to an employer. It must be filled out accurately to reflect an employee's tax situation. Employers are required to withhold the appropriate amount of state income tax based on the information provided in the CT W4. Misrepresentation or failure to submit the form can lead to penalties, including under-withholding, which may result in tax liabilities for the employee.

Key elements of the CT W4, Employee's Withholding Certificate

Several key elements are essential for the CT W4:

- Personal Information: This includes the employee's name, address, and Social Security number.

- Filing Status: Employees must indicate their filing status, which can affect withholding amounts.

- Allowances: The number of allowances claimed influences the amount of tax withheld.

- Additional Withholding: Employees can request additional amounts to be withheld if desired.

Understanding these elements is vital for ensuring accurate tax withholding.

Form Submission Methods

The CT W4 can be submitted to an employer through various methods. The most common method is by handing in a printed copy of the completed form directly to the employer's human resources or payroll department. Some employers may also accept electronic submissions, allowing employees to fill out the form digitally and send it via email or through an employee portal. It is important to check with your employer regarding their preferred submission method.

Quick guide on how to complete ct w42017 employees withholding certificate 2017 employees withholding certificate

Complete CT W4, Employee's Withholding Certificate Employee's Withholding Certificate effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It serves as an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage CT W4, Employee's Withholding Certificate Employee's Withholding Certificate on any device using airSlate SignNow's Android or iOS applications, and enhance any document-focused workflow today.

The easiest way to alter and eSign CT W4, Employee's Withholding Certificate Employee's Withholding Certificate seamlessly

- Locate CT W4, Employee's Withholding Certificate Employee's Withholding Certificate and click Get Form to initiate.

- Utilize the tools we offer to finish your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for these tasks.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional ink signature.

- Review all the details and click the Done button to secure your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worrying over lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and eSign CT W4, Employee's Withholding Certificate Employee's Withholding Certificate and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct w42017 employees withholding certificate 2017 employees withholding certificate

Create this form in 5 minutes!

How to create an eSignature for the ct w42017 employees withholding certificate 2017 employees withholding certificate

How to generate an eSignature for your Ct W42017 Employees Withholding Certificate 2017 Employees Withholding Certificate online

How to make an eSignature for the Ct W42017 Employees Withholding Certificate 2017 Employees Withholding Certificate in Chrome

How to create an electronic signature for signing the Ct W42017 Employees Withholding Certificate 2017 Employees Withholding Certificate in Gmail

How to create an electronic signature for the Ct W42017 Employees Withholding Certificate 2017 Employees Withholding Certificate from your smartphone

How to create an electronic signature for the Ct W42017 Employees Withholding Certificate 2017 Employees Withholding Certificate on iOS devices

How to make an electronic signature for the Ct W42017 Employees Withholding Certificate 2017 Employees Withholding Certificate on Android devices

People also ask

-

What is the CT W4, Employee's Withholding Certificate?

The CT W4, Employee's Withholding Certificate is a form used by employees in Connecticut to instruct their employers on how much state income tax to withhold from their paychecks. Properly filling out this certificate is crucial for ensuring accurate tax withholding throughout the year.

-

How does airSlate SignNow streamline the process of completing the CT W4, Employee's Withholding Certificate?

airSlate SignNow provides a user-friendly platform for employees to easily fill out and eSign the CT W4, Employee's Withholding Certificate. This reduces paper handling and minimizes errors, ensuring that your tax withholding preferences are accurately communicated to your employer.

-

Is there a cost associated with using airSlate SignNow for the CT W4, Employee's Withholding Certificate?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business needs, making it a cost-effective solution for managing the CT W4, Employee's Withholding Certificate. You can choose from various subscription options that fit your budget and usage requirements.

-

What features does airSlate SignNow offer for managing the CT W4, Employee's Withholding Certificate?

airSlate SignNow boasts features like customizable templates, real-time tracking, and secure cloud storage for the CT W4, Employee's Withholding Certificate. These tools enhance efficiency and organization, allowing you to manage your employee's tax information effectively.

-

Can I integrate airSlate SignNow with other HR tools when using the CT W4, Employee's Withholding Certificate?

Absolutely! airSlate SignNow allows seamless integrations with various HR and payroll systems. This capability ensures that your management of the CT W4, Employee's Withholding Certificate is harmonized with other workforce solutions, easing the administrative burden.

-

What are the benefits of using airSlate SignNow for the CT W4, Employee's Withholding Certificate?

Using airSlate SignNow for the CT W4, Employee's Withholding Certificate offers benefits such as time savings, increased accuracy, and a fully digital process. This means less time spent on paperwork and more focus on your core business activities, all while ensuring compliance with state regulations.

-

Is it safe to eSign the CT W4, Employee's Withholding Certificate using airSlate SignNow?

Yes, airSlate SignNow prioritizes security and data protection. Your eSignature on the CT W4, Employee's Withholding Certificate is entirely safe, as the platform uses advanced encryption methods to protect your sensitive information.

Get more for CT W4, Employee's Withholding Certificate Employee's Withholding Certificate

- Jwu physical examination form

- Drexel immunization records form

- Savoy fire department firefighter application form

- Bsbsil form

- Instate and out of state group providers tn gov tn form

- Stanford referral form

- Oxford claim form

- Halogen atoms in the modern medicinal chemistry hints for the drug design form

Find out other CT W4, Employee's Withholding Certificate Employee's Withholding Certificate

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF