Form CT W4NA Effective January 1, 2021 Employees Withholding 2020

Understanding the Form CT W4NA Effective January 1, 2021

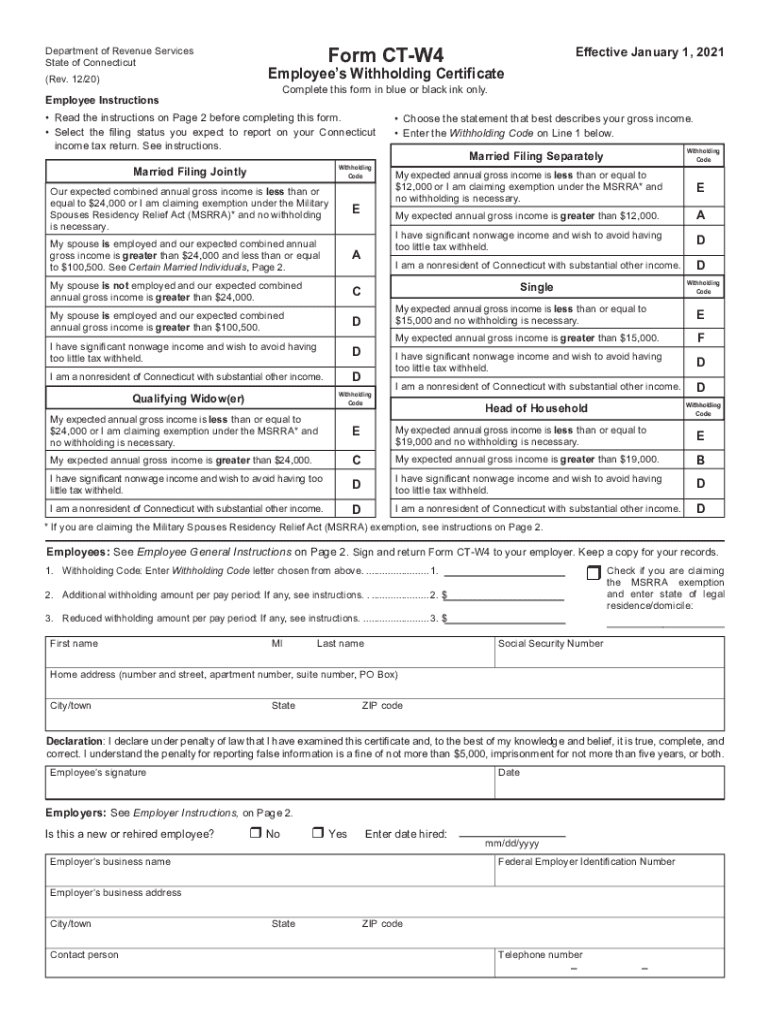

The Form CT W4NA is essential for employees in Connecticut to determine their state tax withholding. This form is specifically designed for employees who wish to adjust their withholding amounts based on personal circumstances, such as changes in marital status or dependents. Effective January 1, 2021, the form has been updated to reflect changes in tax laws and regulations. Understanding this form is crucial for ensuring that employees do not overpay or underpay their state taxes throughout the year.

Steps to Complete the Form CT W4NA

Completing the Form CT W4NA involves several straightforward steps. First, employees should gather necessary personal information, including their Social Security number and details about their filing status. Next, they need to accurately fill out the sections regarding personal allowances and any additional withholding amounts. It's important to review the completed form for accuracy before submission. Finally, employees should submit the form to their employer, ensuring that it is processed in a timely manner to reflect any changes in withholding in upcoming paychecks.

Legal Use of the Form CT W4NA

The legal use of the Form CT W4NA is governed by state tax laws, which require employees to provide accurate information regarding their tax withholding preferences. Misrepresentation or failure to submit the form can lead to penalties, including under-withholding or over-withholding of state taxes. It is essential for employees to understand that this form is legally binding, and any changes made should be communicated promptly to avoid compliance issues.

Filing Deadlines for the Form CT W4NA

Employees should be aware of important filing deadlines associated with the Form CT W4NA. Typically, it should be submitted to the employer as soon as there are changes in personal circumstances that affect withholding. Additionally, employers are required to process the form promptly to ensure that the correct withholding amounts are applied in the next payroll cycle. Staying informed about these deadlines helps employees manage their tax obligations effectively.

Obtaining the Form CT W4NA

The Form CT W4NA can be obtained through various channels. Employees can download the form directly from the Connecticut Department of Revenue Services website or request a physical copy from their employer. It is advisable to ensure that the most current version of the form is used, as outdated forms may not be accepted for processing. Accessing the form online provides the added benefit of being able to fill it out digitally, streamlining the submission process.

Key Elements of the Form CT W4NA

Key elements of the Form CT W4NA include sections for personal information, filing status, and the number of allowances claimed. Additionally, there is a section for specifying any additional withholding amounts. Employees should pay close attention to these elements, as they directly impact the amount of state tax withheld from their paychecks. Understanding these components helps ensure accurate tax withholding and compliance with state regulations.

Quick guide on how to complete form ct w4na effective january 1 2021 employees withholding

Finish Form CT W4NA Effective January 1, 2021 Employees Withholding smoothly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the correct format and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents swiftly and without complications. Handle Form CT W4NA Effective January 1, 2021 Employees Withholding on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest method to modify and electronically sign Form CT W4NA Effective January 1, 2021 Employees Withholding with ease

- Find Form CT W4NA Effective January 1, 2021 Employees Withholding and click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Mark essential parts of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to confirm your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document versions. airSlate SignNow addresses your document management needs in just a few clicks from any device. Alter and electronically sign Form CT W4NA Effective January 1, 2021 Employees Withholding to guarantee exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct w4na effective january 1 2021 employees withholding

Create this form in 5 minutes!

How to create an eSignature for the form ct w4na effective january 1 2021 employees withholding

The way to generate an eSignature for a PDF file in the online mode

The way to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

The way to generate an eSignature for a PDF file on Android

People also ask

-

What are CT tax forms and why are they important?

CT tax forms are specific documents required for filing taxes in Connecticut. They include income tax returns, business tax forms, and other financial declarations. Correctly completing these forms is crucial to ensure compliance with state tax regulations and avoid penalties.

-

How can airSlate SignNow help with CT tax forms?

airSlate SignNow offers a streamlined process for managing CT tax forms by allowing users to electronically sign and send documents quickly. Our solution simplifies the filing of these forms, improving efficiency and reducing the risk of errors. With user-friendly interfaces, you can complete your CT tax forms with confidence.

-

Are there any costs associated with using airSlate SignNow for CT tax forms?

Yes, there are various pricing plans available for using airSlate SignNow, which cater to different business needs. Each plan includes features that enhance the handling of CT tax forms, ensuring your investment supports efficient document management. Trials and free versions are also available to help you find the perfect fit.

-

What features does airSlate SignNow offer for managing CT tax forms?

airSlate SignNow comes with a host of features designed to facilitate the management of CT tax forms. These include template creation, document tracking, secure eSigning, and integration with popular apps. With robust features, you can effortlessly manage your tax documentation.

-

Is airSlate SignNow secure for sending CT tax forms?

Absolutely! airSlate SignNow takes security seriously, employing advanced encryption methods to protect your CT tax forms. This ensures that all documents are transmitted securely, maintaining your privacy and compliance with regulations. You can trust that your sensitive information is safe.

-

Can airSlate SignNow integrate with other accounting software for CT tax forms?

Yes, airSlate SignNow integrates seamlessly with a variety of accounting software platforms. This allows for easier management of CT tax forms and ensures that all your financial data is connected and up-to-date. Integrating our solution with your existing tools can enhance your workflow signNowly.

-

What are the benefits of using airSlate SignNow for CT tax forms over traditional methods?

Using airSlate SignNow for CT tax forms offers numerous advantages over traditional methods, such as faster turnaround times, reduced paperwork, and improved accuracy. Our platform helps eliminate the hassle of printing, signing, and faxing documents, making your tax filing process more efficient. This ultimately saves your business time and resources.

Get more for Form CT W4NA Effective January 1, 2021 Employees Withholding

- Assumption agreement of deed of trust and release of original mortgagors utah form

- Foreign judgment uniform enforcement act

- Utah small form

- Affidavit for transfer of title to motor vehicles in a small estate proceeding utah form

- Utah landlord notices for eviction unlawful detainer forms package utah

- Utah criminal form

- Checklist for victims statement in petition to expunge records utah form

- Utah expungement application form

Find out other Form CT W4NA Effective January 1, 2021 Employees Withholding

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License