RETURN for NONRESIDENT EMPLOYEES of the CITY of NEW YORK 2020

What is the RETURN FOR NONRESIDENT EMPLOYEES OF THE CITY OF NEW YORK

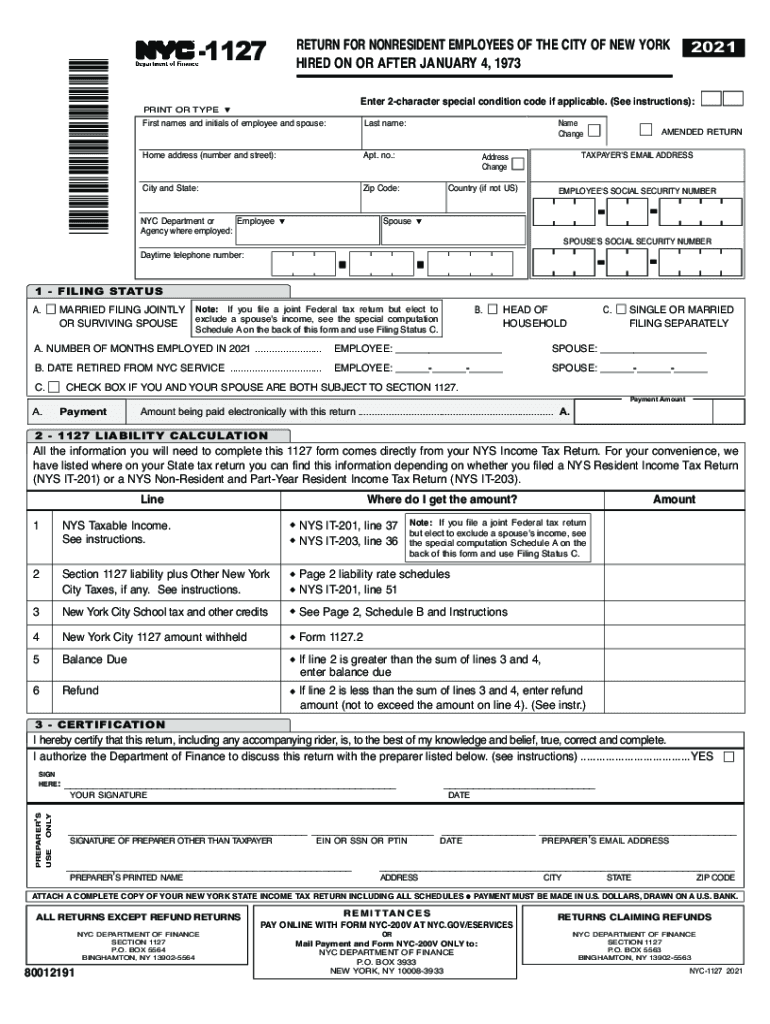

The RETURN FOR NONRESIDENT EMPLOYEES OF THE CITY OF NEW YORK, commonly referred to as the 2021 NYC 1127, is a tax form designed for individuals who work in New York City but do not reside there. This form is essential for reporting income earned within the city, ensuring that nonresident employees fulfill their tax obligations. It is specifically tailored for those who are employed in New York City but maintain their primary residence outside the city limits.

Steps to complete the RETURN FOR NONRESIDENT EMPLOYEES OF THE CITY OF NEW YORK

Completing the 2021 NYC 1127 involves several key steps to ensure accurate reporting of income. First, gather all relevant income information, including W-2 forms and any other documentation that reflects earnings from New York City employers. Next, fill out the form by entering personal details, including your name, address, and Social Security number. Be sure to report your total income earned in New York City accurately. After completing the form, review it for any errors before submitting it to the appropriate tax authority.

Legal use of the RETURN FOR NONRESIDENT EMPLOYEES OF THE CITY OF NEW YORK

Using the 2021 NYC 1127 is legally mandated for nonresident employees earning income in New York City. This form complies with local tax regulations, ensuring that individuals meet their tax responsibilities. It is crucial to understand that failure to file this form can result in penalties and interest on unpaid taxes. Therefore, it is important to complete and submit the form accurately and on time to avoid any legal repercussions.

Filing Deadlines / Important Dates

For the 2021 tax year, the deadline for submitting the NYC 1127 is typically aligned with the federal tax filing deadline, which is usually April 15. However, it is advisable to check for any specific changes or extensions that may apply for that tax year. Filing on time is essential to avoid penalties and ensure compliance with tax regulations.

Required Documents

To complete the 2021 NYC 1127, several documents are necessary. Primarily, you will need your W-2 forms from employers that report income earned in New York City. Additionally, any other income documentation, such as 1099 forms or records of self-employment income, should also be collected. Having these documents ready will facilitate a smoother filing process.

Form Submission Methods (Online / Mail / In-Person)

The 2021 NYC 1127 can be submitted through various methods. Nonresident employees have the option to file the form online through the New York City Department of Finance website, which provides a convenient and efficient way to submit tax documents. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. It is important to choose a submission method that best suits your needs and ensures timely processing.

Quick guide on how to complete return for nonresident employees of the city of new york

Complete RETURN FOR NONRESIDENT EMPLOYEES OF THE CITY OF NEW YORK effortlessly on any device

Online document management has gained popularity among organizations and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage RETURN FOR NONRESIDENT EMPLOYEES OF THE CITY OF NEW YORK on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to alter and eSign RETURN FOR NONRESIDENT EMPLOYEES OF THE CITY OF NEW YORK without effort

- Locate RETURN FOR NONRESIDENT EMPLOYEES OF THE CITY OF NEW YORK and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Modify and eSign RETURN FOR NONRESIDENT EMPLOYEES OF THE CITY OF NEW YORK and guarantee excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct return for nonresident employees of the city of new york

Create this form in 5 minutes!

How to create an eSignature for the return for nonresident employees of the city of new york

The way to make an electronic signature for your PDF file in the online mode

The way to make an electronic signature for your PDF file in Chrome

The best way to make an e-signature for putting it on PDFs in Gmail

The way to make an e-signature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

The way to make an e-signature for a PDF file on Android

People also ask

-

What is the 2021 NYC 1127 document, and how does airSlate SignNow assist with it?

The 2021 NYC 1127 document refers to a specific form required for compliance in New York City. airSlate SignNow simplifies the eSigning process for this document by providing an intuitive platform to securely send, sign, and manage it, ensuring a seamless experience for users.

-

What are the pricing options available for using airSlate SignNow with the 2021 NYC 1127?

airSlate SignNow offers various pricing plans tailored to different business needs. Users can select a plan that fits their budget while ensuring they can easily manage the 2021 NYC 1127 document and other related forms efficiently.

-

What features does airSlate SignNow provide for managing the 2021 NYC 1127?

With airSlate SignNow, users can take advantage of features like customizable templates, automated workflows, and secure cloud storage. These capabilities make it easy to manage the 2021 NYC 1127 and streamline document processing.

-

How does airSlate SignNow enhance the signing experience for the 2021 NYC 1127?

airSlate SignNow enhances the signing experience for the 2021 NYC 1127 by offering a user-friendly interface that allows signers to complete and return documents quickly. The platform ensures that signing is secure and compliant, providing peace of mind for both senders and recipients.

-

Can airSlate SignNow integrate with other applications to help with the 2021 NYC 1127?

Yes, airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRM systems. This integration capability allows businesses to easily access and manage the 2021 NYC 1127 and other documents directly from their preferred platforms.

-

What are the benefits of using airSlate SignNow for the 2021 NYC 1127?

Using airSlate SignNow for the 2021 NYC 1127 provides numerous benefits, including increased efficiency, cost savings, and improved organization of documents. The platform's electronic signature functionalities further streamline the signing process, saving businesses valuable time.

-

Is airSlate SignNow secure for handling sensitive information related to the 2021 NYC 1127?

Absolutely, airSlate SignNow employs advanced security features like encryption and multi-factor authentication to protect sensitive information. This ensures that documents, including the 2021 NYC 1127, are safely handled and reduces risks of data bsignNowes.

Get more for RETURN FOR NONRESIDENT EMPLOYEES OF THE CITY OF NEW YORK

- Limited power of attorney for stock transactions and corporate powers louisiana form

- Special durable power of attorney for bank account matters louisiana form

- Louisiana business order form

- Louisiana property management package louisiana form

- Louisiana ad hoc form

- Recommendation of under turtix louisiana form

- Judgment louisiana form

- Petition settlement form

Find out other RETURN FOR NONRESIDENT EMPLOYEES OF THE CITY OF NEW YORK

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template