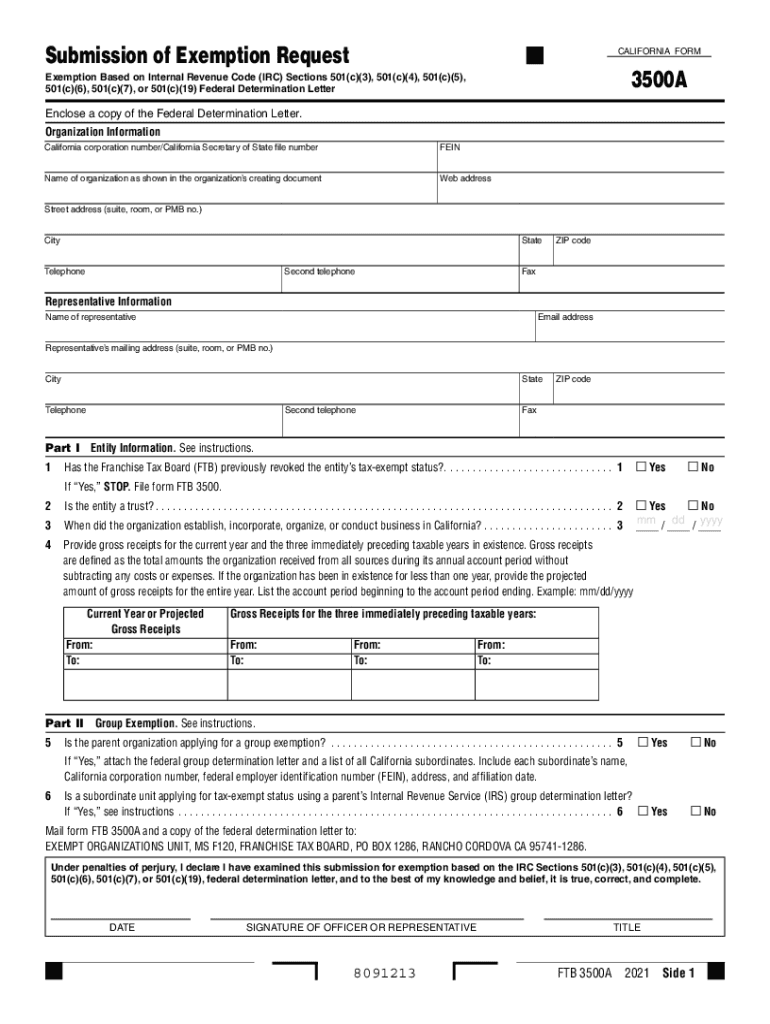

California Form 3500 A, Submission of Exemption Request 2021

What is the California Form 3500A?

The California Form 3500A is an official document used to request an exemption from certain tax obligations in the state of California. This form is primarily utilized by organizations seeking to establish their tax-exempt status under California law. Completing this form correctly is essential for entities such as nonprofits, charities, and other qualifying organizations to ensure compliance with state regulations and to avoid unnecessary tax liabilities.

Steps to Complete the California Form 3500A

Filling out the California Form 3500A involves several important steps to ensure accuracy and compliance. Begin by gathering all necessary information about your organization, including its legal name, address, and federal employer identification number (EIN). Next, provide detailed descriptions of the organization's activities and its purpose. Be sure to include any supporting documents that demonstrate eligibility for tax exemption, such as bylaws and financial statements. Once completed, review the form for accuracy before submission.

Eligibility Criteria for the California Form 3500A

To qualify for tax exemption using the California Form 3500A, organizations must meet specific eligibility criteria. Typically, this includes being a nonprofit organization that operates exclusively for charitable, educational, or religious purposes. Additionally, the organization must not engage in activities that benefit private interests or individuals. Understanding these criteria is crucial for organizations to ensure they meet the necessary requirements before submitting their exemption request.

Required Documents for Submission

When submitting the California Form 3500A, several supporting documents are required to validate the exemption request. These documents often include the organization’s articles of incorporation, bylaws, a statement of activities, and financial statements. It is important to compile these documents carefully, as they provide evidence of the organization's eligibility for tax-exempt status. Ensure that all documents are current and accurately reflect the organization's operations.

Form Submission Methods

The California Form 3500A can be submitted through various methods, providing flexibility for organizations. The form can be filed online through the California Franchise Tax Board's website, which is the fastest method for processing. Alternatively, organizations may opt to submit the form via mail or in-person at designated tax offices. Each submission method has its own processing times, so organizations should choose the one that best suits their needs.

Legal Use of the California Form 3500A

The California Form 3500A serves a vital legal function by formalizing an organization’s request for tax-exempt status. When submitted correctly, the form establishes the legal basis for the organization to operate without certain tax obligations. Compliance with state laws and regulations is essential, as failure to properly submit the form or to adhere to tax-exempt requirements can result in penalties or loss of status. Understanding the legal implications of the form is crucial for organizations seeking exemption.

Quick guide on how to complete california form 3500 a submission of exemption request

Effortlessly Prepare California Form 3500 A, Submission Of Exemption Request on Any Device

Electronic document management has become increasingly favored by enterprises and individuals. It serves as a superb eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the appropriate format and securely store it online. airSlate SignNow provides all the tools necessary to craft, modify, and eSign your documents swiftly without delays. Manage California Form 3500 A, Submission Of Exemption Request on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

How to Alter and eSign California Form 3500 A, Submission Of Exemption Request with Ease

- Locate California Form 3500 A, Submission Of Exemption Request and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate reprinting documents. airSlate SignNow addresses your document management needs within a few clicks from any device you choose. Modify and eSign California Form 3500 A, Submission Of Exemption Request to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california form 3500 a submission of exemption request

Create this form in 5 minutes!

How to create an eSignature for the california form 3500 a submission of exemption request

How to generate an electronic signature for your PDF file online

How to generate an electronic signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

How to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

How to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is a form California exemption?

A form California exemption is a specific document that allows businesses to request an exemption from certain taxes and regulations. This form enables organizations to better manage their financial obligations while ensuring compliance with state laws.

-

How can airSlate SignNow help with filling out a form California exemption?

airSlate SignNow simplifies the process of filling out a form California exemption by providing user-friendly templates that streamline document creation. Our platform allows you to easily input required information and ensure your forms are completed accurately.

-

Is there a cost associated with using airSlate SignNow for a form California exemption?

Yes, airSlate SignNow offers several pricing plans to accommodate different business needs, including those looking to submit a form California exemption. We offer competitive pricing with various features tailored to help businesses efficiently manage their documents.

-

What features does airSlate SignNow offer for managing forms like the California exemption?

AirSlate SignNow provides features such as customizable templates, electronic signatures, and secure storage to enhance your document management process. Specifically for a form California exemption, these features ensure that your submissions are efficient and legally compliant.

-

Can I integrate airSlate SignNow with other applications for managing a form California exemption?

Absolutely! airSlate SignNow supports integrations with popular business tools, making it easy to manage your form California exemption alongside other processes. Whether you use CRM systems, cloud storage, or project management tools, airSlate SignNow can enhance your workflow.

-

What benefits does airSlate SignNow offer for submitting forms like the California exemption?

Using airSlate SignNow for submitting forms such as the California exemption provides numerous benefits, including increased efficiency and time savings. With our platform, you can quickly fill, sign, and send documents, helping you focus on your core business activities.

-

Is airSlate SignNow compliant with regulations needed for a form California exemption?

Yes, airSlate SignNow is designed to meet compliance standards essential for electronic documents, including the requirements surrounding a form California exemption. Our security features ensure that your sensitive information is handled safely and securely.

Get more for California Form 3500 A, Submission Of Exemption Request

- Bill of sale without warranty by individual seller massachusetts form

- Bill of sale without warranty by corporate seller massachusetts form

- 13 plan form

- Massachusetts reaffirmation agreement form

- Verification of creditors matrix massachusetts form

- Acknowledgment of authority of officer massachusetts form

- Massachusetts joint petition divorce form

- Massachusetts divorce order form

Find out other California Form 3500 A, Submission Of Exemption Request

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors