Form California Exemption 2017

What is the Form California Exemption

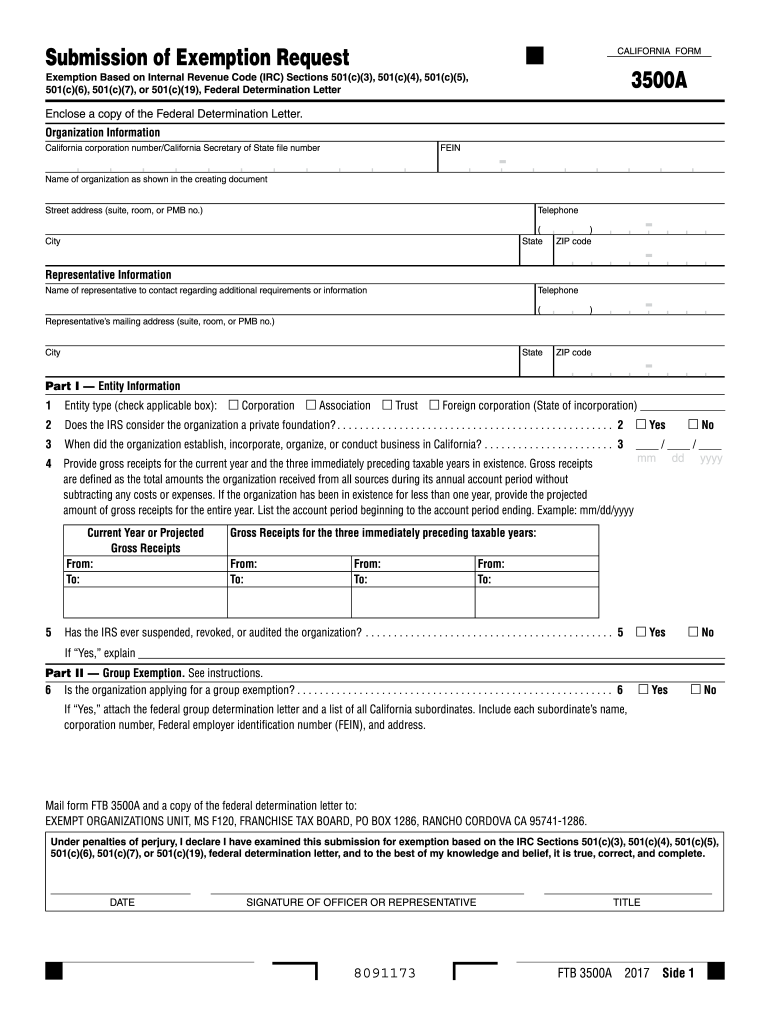

The Form California Exemption is a crucial document used by taxpayers in California to claim specific exemptions that may reduce their taxable income. This form is particularly relevant for individuals and businesses seeking to navigate the complexities of state tax regulations. Understanding the purpose and implications of this form is essential for ensuring compliance with California tax laws.

Steps to complete the Form California Exemption

Completing the Form California Exemption involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including personal identification details and any relevant financial data. Next, carefully fill out each section of the form, ensuring that all fields are completed as required. After completing the form, review it for any errors or omissions before signing it. Finally, submit the form through the appropriate channels, whether electronically or via mail, to ensure it is processed in a timely manner.

Legal use of the Form California Exemption

The legal use of the Form California Exemption is governed by state tax laws, which outline the specific circumstances under which exemptions can be claimed. Taxpayers must ensure that they meet the eligibility criteria set forth by the California Franchise Tax Board. Misuse of the form or claiming exemptions without proper justification can result in penalties or audits, making it imperative to understand the legal ramifications of its use.

Eligibility Criteria

Eligibility for using the Form California Exemption varies based on several factors, including income level, filing status, and specific exemptions being claimed. Individuals and businesses must assess their situation against the criteria established by the California tax authorities. Familiarity with these eligibility requirements helps taxpayers avoid common pitfalls and ensures that they accurately complete the form.

Form Submission Methods

Taxpayers have multiple options for submitting the Form California Exemption, including online, by mail, or in person. Online submission is often the most efficient method, allowing for quicker processing and confirmation of receipt. Alternatively, submitting the form by mail requires careful attention to deadlines and proper addressing to ensure it reaches the appropriate tax authority. In-person submissions may be suitable for those needing assistance or clarification regarding the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form California Exemption are critical for taxpayers to observe. Typically, the form must be submitted by the state tax filing deadline, which aligns with federal tax deadlines. It is essential for taxpayers to stay informed about any changes to these dates, as missing a deadline can result in penalties or loss of exemptions. Keeping a calendar of important dates helps ensure compliance and timely submissions.

Key elements of the Form California Exemption

The Form California Exemption includes several key elements that taxpayers must understand to complete it correctly. These elements typically encompass personal information, the specific exemptions being claimed, and any required signatures. Each section of the form serves a distinct purpose, and accurately providing the requested information is vital for the form's acceptance by tax authorities.

Quick guide on how to complete form california exemption 2017

Your assistance manual on how to prepare your Form California Exemption

If you're wondering how to complete and submit your Form California Exemption, here are some straightforward directions on how to simplify tax processing.

To begin, you simply need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to edit, draft, and finalize your income tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and go back to modify details when necessary. Optimize your tax administration with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Form California Exemption in just a few minutes:

- Establish your account and start working on PDFs in no time.

- Utilize our directory to obtain any IRS tax form; explore various versions and schedules.

- Click Get form to access your Form California Exemption in our editor.

- Populate the necessary fillable fields with your details (text, numbers, checkmarks).

- Utilize the Sign Tool to add your legally-binding eSignature (if needed).

- Examine your document and correct any discrepancies.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Make use of this manual to file your taxes electronically with airSlate SignNow. Please remember that submitting in print may result in increased errors and delays in refunds. Certainly, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form california exemption 2017

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

-

How do I fill out the JEE Advanced 2017 application form?

JEE Advanced Application Form 2017 is now available for all eligible candidates from April 28 to May 2, 2017 (5 PM). Registrations with late fee will be open from May 3 to May 4, 2017. The application form of JEE Advanced 2017 has been released only in online mode. visit - http://www.entrancezone.com/engi...

-

How can I fill out an improvement form of the CBSE 2017?

IN the month of August the application form will be available on cbse official website which you have to fill online then it will ask in which you subject you want to apply for improvement…you can select all subjects and additional subjects also then you have to pay the amount for improvement exam which you have to pay at bank. take the print out of the acknowledgement and the e-challan and deposit the fees at bank… you also have to change your region when you type the pin code then according to that you will get your centre as well as new region means you region will change. it don't effect anything. after all these thing you have to send a xerox copy of your marksheet e-challan acknowledgement to the regional office which you get. the address will be returned on the acknowledgement after that you have to wait to get your admit card which you will get online on month of February…and improvement marksheet will be send to you address which you fill at time of applications form filling time. if you get less marks in improvement then old marksheet will be valid soAll The Best

Create this form in 5 minutes!

How to create an eSignature for the form california exemption 2017

How to make an eSignature for your Form California Exemption 2017 in the online mode

How to generate an eSignature for your Form California Exemption 2017 in Google Chrome

How to generate an electronic signature for putting it on the Form California Exemption 2017 in Gmail

How to generate an eSignature for the Form California Exemption 2017 right from your smartphone

How to make an eSignature for the Form California Exemption 2017 on iOS

How to make an eSignature for the Form California Exemption 2017 on Android OS

People also ask

-

What is the Form California Exemption?

The Form California Exemption is a document designed to help businesses in California claim certain tax exemptions. By utilizing this form, users can efficiently outline their eligibility for specific exemptions, ensuring compliance with state regulations.

-

How can airSlate SignNow assist with the Form California Exemption?

airSlate SignNow simplifies the process of completing and submitting the Form California Exemption. With our intuitive platform, users can easily fill out the form electronically, obtain necessary signatures, and ensure that their documents are securely stored and accessible.

-

Is there a cost associated with using airSlate SignNow for the Form California Exemption?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. While accessing features related to the Form California Exemption may incur costs, our plans are designed to provide you with a cost-effective solution for eSigning and document management.

-

Can I integrate airSlate SignNow with other applications while managing the Form California Exemption?

Absolutely! airSlate SignNow supports integration with numerous third-party applications, enhancing your workflow. Whether you are using CRM systems or document management tools, these integrations allow you to seamlessly manage the Form California Exemption and other documents.

-

What features does airSlate SignNow provide for managing the Form California Exemption?

airSlate SignNow offers features such as document templates, eSignature capabilities, and real-time tracking for managing the Form California Exemption. These tools aim to streamline your document processes, ensuring faster approvals and enhanced compliance.

-

How does airSlate SignNow improve the signing experience for the Form California Exemption?

With airSlate SignNow, the signing experience for the Form California Exemption is smooth and user-friendly. Our platform offers mobile compatibility and easy navigation, allowing parties to sign documents quickly, thereby expediting the overall process.

-

Are there any customer support options available for issues related to the Form California Exemption?

Yes, airSlate SignNow provides robust customer support to assist users with any issues regarding the Form California Exemption. Our team is available to guide you through any challenges, ensuring you can efficiently manage your documents.

Get more for Form California Exemption

- Spartanburg housing authority application form

- Travel orders permanent change of station pcs and temporary form

- South dakota department of transportation dot application for utility permit state sd form

- End of course evaluation form pdf institute for mathematics

- Jordan normal forms for a skew adjoint operator in the lorentzian math csusb

- Nonprofit shareholder agreement template form

- Nonprofit sponsorship agreement template form

- Nonprofit volunteer agreement template form

Find out other Form California Exemption

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast