501c6, 501c7, or 501c19 Federal Determination Letter 2023-2026

Understanding the CA FTB 3500A Form

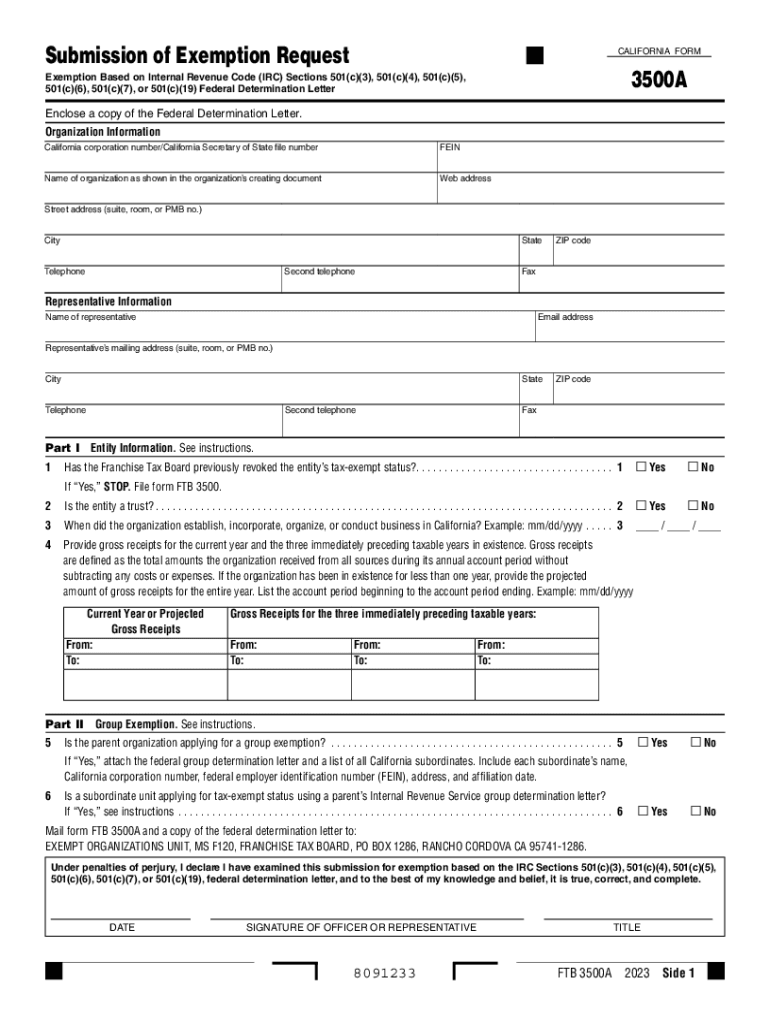

The CA FTB 3500A form is a crucial document used by organizations seeking tax-exempt status in California. Specifically, it is designed for nonprofit organizations that are applying for exemption from the California Franchise Tax Board. This form is essential for entities classified under certain sections of the Internal Revenue Code, such as 501(c)(6), 501(c)(7), and 501(c)(19). Understanding the purpose and requirements of this form is vital for organizations aiming to operate without the burden of state taxation.

Steps to Complete the CA FTB 3500A Form

Completing the CA FTB 3500A form involves several important steps:

- Gather necessary documentation, including your organization’s bylaws and articles of incorporation.

- Fill out the form accurately, ensuring all sections are complete to avoid delays.

- Provide detailed information regarding your organization’s activities and purpose.

- Review the form for accuracy and completeness before submission.

- Submit the completed form to the California Franchise Tax Board, either online or via mail.

Eligibility Criteria for the CA FTB 3500A Form

To qualify for submitting the CA FTB 3500A form, organizations must meet specific eligibility criteria. These typically include:

- Being organized and operated exclusively for charitable, educational, or similar purposes.

- Meeting the requirements set forth by the IRS for tax-exempt status under the relevant sections.

- Providing services that serve the public interest and do not benefit private interests.

Required Documents for Submission

When submitting the CA FTB 3500A form, organizations must include several key documents to support their application. These documents typically include:

- Articles of incorporation or organization.

- Bylaws that govern the organization.

- A detailed statement of the organization’s purpose and activities.

- Financial statements or budgets, if applicable.

Form Submission Methods

The CA FTB 3500A form can be submitted using various methods, providing flexibility for organizations. The available submission methods include:

- Online submission through the California Franchise Tax Board's website.

- Mailing a paper copy of the completed form to the appropriate address.

- In-person submission at designated Franchise Tax Board offices, if necessary.

Important Filing Deadlines

Organizations must be aware of important deadlines associated with the CA FTB 3500A form to ensure timely submission. Key deadlines include:

- The deadline for submitting the form typically coincides with the organization's fiscal year-end.

- Extensions may be available, but must be requested in advance.

Quick guide on how to complete 501c6 501c7 or 501c19 federal determination letter

Prepare 501c6, 501c7, Or 501c19 Federal Determination Letter seamlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly without interruptions. Handle 501c6, 501c7, Or 501c19 Federal Determination Letter on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and eSign 501c6, 501c7, Or 501c19 Federal Determination Letter without hassle

- Locate 501c6, 501c7, Or 501c19 Federal Determination Letter and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form navigation, or errors that necessitate printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from a device of your choice. Modify and eSign 501c6, 501c7, Or 501c19 Federal Determination Letter and ensure outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 501c6 501c7 or 501c19 federal determination letter

Create this form in 5 minutes!

How to create an eSignature for the 501c6 501c7 or 501c19 federal determination letter

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form ca exemption pdf?

The form ca exemption pdf is a document used by businesses and individuals in California to claim exemptions for certain tax-related purposes. This form helps ensure compliance with state regulations while streamlining the process of documenting exemptions. It is critical to complete this form accurately to avoid potential issues with the IRS.

-

How can I create a form ca exemption pdf using airSlate SignNow?

With airSlate SignNow, you can easily create a form ca exemption pdf by uploading your form and using our intuitive editing tools. Add fields, signatures, and customize the document before sending it for eSignature. The platform simplifies the process, ensuring that you can manage your forms efficiently.

-

Is airSlate SignNow cost-effective for managing form ca exemption pdf?

Yes, airSlate SignNow offers a cost-effective solution for managing your form ca exemption pdf and other document needs. With flexible pricing models tailored to your requirements, it provides high value for businesses of all sizes. You can benefit from unlimited access to features without breaking the bank.

-

What features does airSlate SignNow offer for form ca exemption pdf?

airSlate SignNow offers a variety of features for the form ca exemption pdf, including eSignature functionality, document templates, and real-time tracking of document status. You can also integrate with various applications to streamline your workflow. This comprehensive tool makes document management seamless and efficient.

-

Can I integrate airSlate SignNow with other software for my form ca exemption pdf?

Absolutely! airSlate SignNow allows integration with popular software tools like Google Drive, Salesforce, and Microsoft Office. This means you can import, manage, and share your form ca exemption pdf effortlessly across different platforms. Enhancing efficiency while maintaining document integrity is easy with these integrations.

-

How secure is my data when using airSlate SignNow for form ca exemption pdf?

Your data security is our top priority at airSlate SignNow. We implement advanced security protocols such as encryption and secure servers to protect your form ca exemption pdf and other sensitive documents. Rest assured, your information remains confidential and secure while using our platform.

-

How do I send a form ca exemption pdf for signature?

Sending a form ca exemption pdf for signature is simple with airSlate SignNow. After creating your document, just enter the recipient's email, and our platform will handle the rest. You'll receive notifications when the document has been signed, allowing you to keep track of all your transactions easily.

Get more for 501c6, 501c7, Or 501c19 Federal Determination Letter

- Form 10 85 volunteer

- Employee transfer questionnaire form

- 2930 001 special recreation permit application special recreation permit application form

- Aacrn application form national park service

- Di 1868 us department of the interior doi form

- Special scouting achievement award us fish and wildlife service fws form

- 2 national software application permission request form blm

- Cultural resources compliance request letter form

Find out other 501c6, 501c7, Or 501c19 Federal Determination Letter

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist