Exempt Purposes Internal Revenue Code Section 501c3 2022

What is the Exempt Purposes Internal Revenue Code Section 501(c)(3)

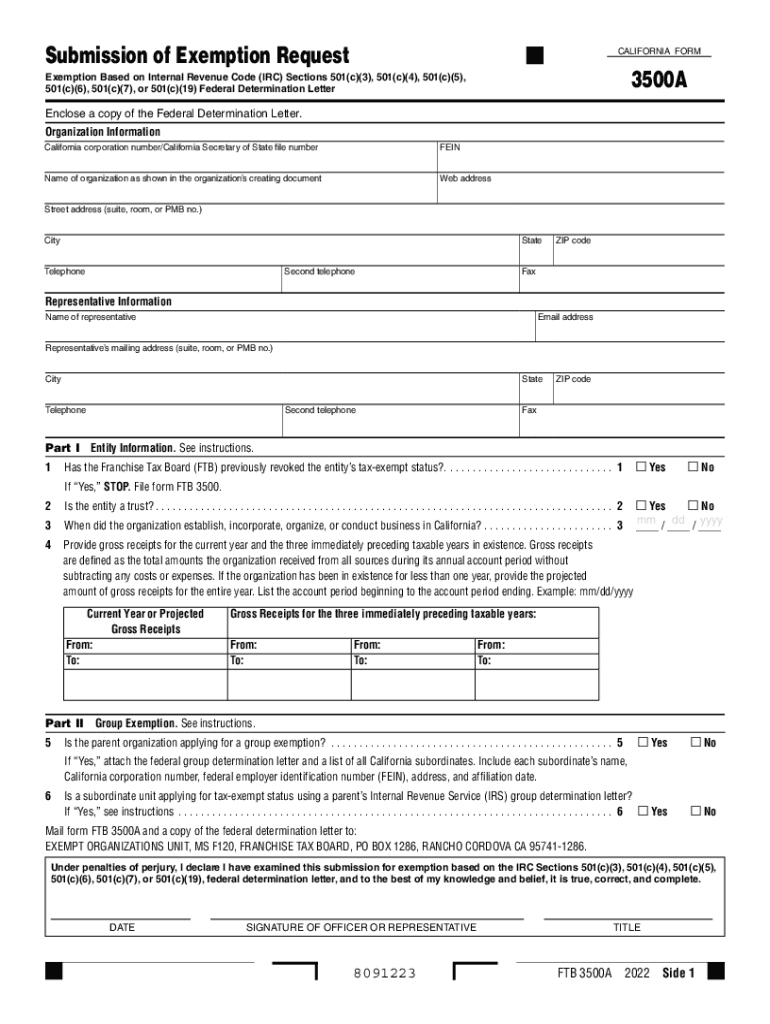

The Exempt Purposes Internal Revenue Code Section 501(c)(3) defines the criteria for organizations that qualify for tax-exempt status in the United States. This section primarily applies to charitable organizations, which must operate exclusively for religious, charitable, scientific, literary, or educational purposes. To qualify, an organization must not be driven by profit motives and must ensure that its activities benefit the public rather than private interests.

Eligibility Criteria for 501(c)(3) Status

To qualify for 501(c)(3) status, an organization must meet specific eligibility criteria. These include:

- The organization must be organized as a corporation, trust, or unincorporated association.

- Its purposes must align with those outlined in Section 501(c)(3).

- The organization must not engage in substantial lobbying or political activities.

- Any net earnings must not benefit private shareholders or individuals.

Steps to Complete the Application for 501(c)(3) Status

Applying for 501(c)(3) status involves several key steps:

- Determine eligibility based on the criteria outlined in Section 501(c)(3).

- Prepare the necessary documentation, including articles of incorporation and bylaws.

- Complete IRS Form 1023 or Form 1023-EZ, depending on the size and complexity of the organization.

- Submit the application along with the required fee to the IRS.

IRS Guidelines for Maintaining 501(c)(3) Status

Organizations must adhere to IRS guidelines to maintain their 501(c)(3) status. Key requirements include:

- Regularly filing Form 990, 990-EZ, or 990-N, depending on the organization's revenue.

- Ensuring that activities remain consistent with the exempt purposes defined in the application.

- Maintaining accurate records of income and expenditures.

Filing Deadlines and Important Dates

Organizations must be aware of critical filing deadlines to ensure compliance. The application for 501(c)(3) status should be submitted within 27 months of the organization’s formation to receive retroactive tax-exempt status. Annual filings, such as Form 990, typically have deadlines based on the organization's fiscal year end.

Penalties for Non-Compliance with 501(c)(3) Regulations

Failure to comply with the regulations governing 501(c)(3) organizations can result in severe penalties. These may include:

- Loss of tax-exempt status.

- Financial penalties for failure to file required forms.

- Potential legal action for engaging in prohibited activities.

Quick guide on how to complete exempt purposes internal revenue code section 501c3

Prepare Exempt Purposes Internal Revenue Code Section 501c3 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed documents, allowing you to find the appropriate format and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Exempt Purposes Internal Revenue Code Section 501c3 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered procedure today.

How to modify and electronically sign Exempt Purposes Internal Revenue Code Section 501c3 with ease

- Obtain Exempt Purposes Internal Revenue Code Section 501c3 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, laborious form searches, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Exempt Purposes Internal Revenue Code Section 501c3 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct exempt purposes internal revenue code section 501c3

Create this form in 5 minutes!

How to create an eSignature for the exempt purposes internal revenue code section 501c3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is FTB in the context of airSlate SignNow?

FTB stands for 'File Transfer and Backup' in airSlate SignNow, referring to the secure handling and storage of your documents. This feature ensures that your important files are backed up and can be easily transferred whenever needed, making document management more efficient.

-

How does airSlate SignNow's pricing structure work for FTB?

airSlate SignNow offers flexible pricing plans that are designed to accommodate different business needs while ensuring FTB services are included. The plans range from basic to premium, allowing businesses to choose the level of features and storage they require for their document management.

-

What features does airSlate SignNow offer for FTB?

Key features of airSlate SignNow’s FTB include automated document routing, notification alerts, and robust security protocols. These features enhance the reliability and effectiveness of your document handling, ensuring you can track and manage your items seamlessly.

-

How can airSlate SignNow benefit my business with FTB?

Using airSlate SignNow’s FTB can greatly benefit your business by streamlining your document processes, reducing errors, and enhancing collaboration. These benefits result in increased efficiency, as your team can focus on higher-value tasks rather than manual document management.

-

Does airSlate SignNow integrate with other tools for FTB?

Yes, airSlate SignNow integrates with various third-party applications, allowing for seamless FTB capabilities. This integration enables users to enhance workflows by combining signature, document management, and filing solutions effectively.

-

Is there a mobile app for managing FTB in airSlate SignNow?

Absolutely! airSlate SignNow offers a mobile app that allows you to manage FTB functionality on-the-go. With the app, you can easily send, eSign, and store documents securely, ensuring that you have access to critical files anytime, anywhere.

-

What security measures does airSlate SignNow apply for FTB?

airSlate SignNow implements advanced security measures for FTB, such as end-to-end encryption, secure cloud storage, and user authentication protocols. These security features help protect your sensitive documents from unauthorized access and data bsignNowes.

Get more for Exempt Purposes Internal Revenue Code Section 501c3

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles south carolina form

- Letter from tenant to landlord about landlords failure to make repairs south carolina form

- Letter notice rent template form

- Letter from tenant to landlord about landlord using unlawful self help to gain possession south carolina form

- Letter from tenant to landlord about illegal entry by landlord south carolina form

- Letter from landlord to tenant about time of intent to enter premises south carolina form

- Tenant notice rent 497325652 form

- Letter from tenant to landlord about sexual harassment south carolina form

Find out other Exempt Purposes Internal Revenue Code Section 501c3

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy