Form 5805 Underpayment of Estimated Tax by Individuals and Fiduciaries Form 5805 Underpayment of Estimated Tax by Individuals an 2021

Understanding the Form 5805 for Estimated Tax Underpayment

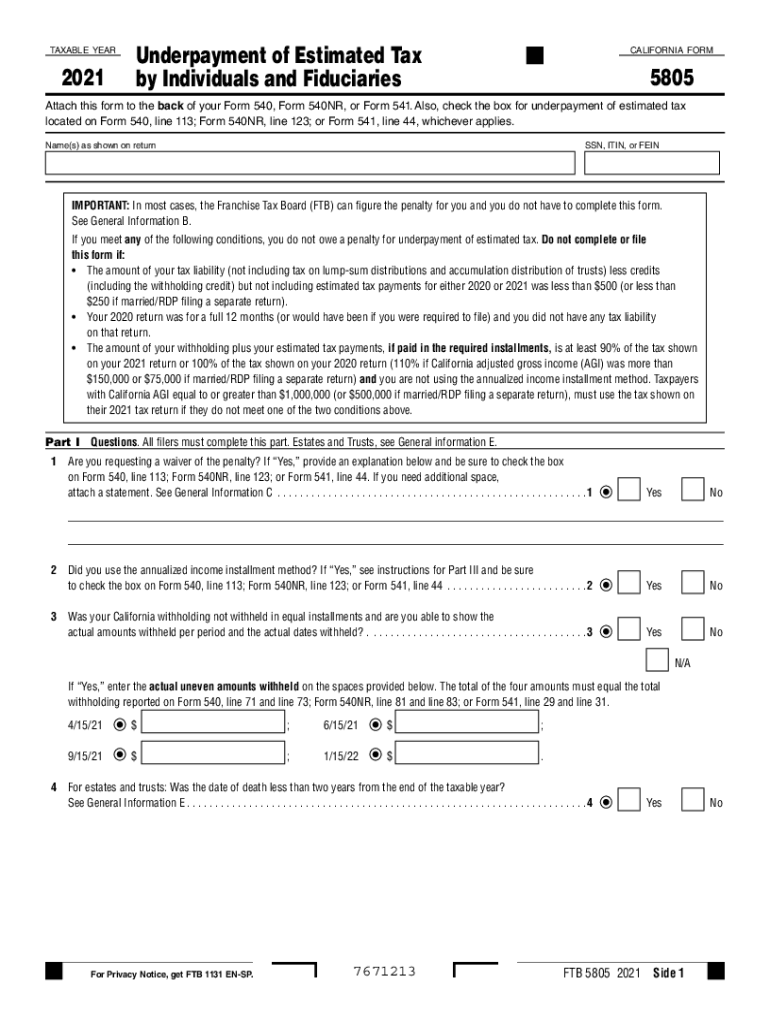

The Form 5805, known as the Underpayment of Estimated Tax by Individuals and Fiduciaries, is designed for California taxpayers who may not have paid enough tax throughout the year. This form helps determine if you owe a penalty for underpayment of estimated taxes. It is essential for individuals and fiduciaries to accurately assess their tax obligations to avoid penalties and ensure compliance with state tax laws.

Steps to Complete the Form 5805

Completing the Form 5805 involves several key steps to ensure accuracy and compliance. Begin by gathering your financial information, including your total income, deductions, and credits for the tax year. Follow these steps:

- Calculate your total tax liability for the year.

- Determine the amount of tax you have already paid through withholding and estimated payments.

- Use the form to calculate any underpayment by comparing your total tax liability with the amount paid.

- Complete the form by providing all required information, including your name, Social Security number, and details of your tax payments.

- Review the form for accuracy before submission.

Legal Use of the Form 5805

The Form 5805 serves a critical legal function in California tax compliance. It is used to report underpayment of estimated taxes, which can lead to penalties if not addressed. By filing this form, taxpayers can formally acknowledge any underpayment and take steps to rectify the situation. It is important to understand that failing to file this form when required may result in additional penalties and interest on the unpaid tax amount.

Filing Deadlines and Important Dates

Timely filing of the Form 5805 is crucial to avoid penalties. The form must typically be submitted by the due date of your California income tax return. For most individuals, this date falls on April 15 of the following year. However, if you file for an extension, ensure that you also adhere to any extended deadlines for submitting the 5805 form to remain compliant with state regulations.

Examples of Using the Form 5805

There are various scenarios where the Form 5805 may be applicable. For instance, self-employed individuals who do not have sufficient tax withheld from their income may need to file this form to report their underpayment. Additionally, fiduciaries managing estates or trusts may also find themselves in a position where they need to use the 5805 to report underpayment of estimated taxes on behalf of the entity they manage. Understanding these examples can help taxpayers identify when to utilize this form effectively.

Penalties for Non-Compliance

Failing to file the Form 5805 or underreporting estimated tax payments can lead to significant penalties. California imposes a penalty based on the amount of underpayment and the duration of the underpayment period. This penalty can accumulate quickly, making it essential for taxpayers to stay informed about their tax obligations and file the necessary forms promptly to avoid financial repercussions.

Quick guide on how to complete 2021 form 5805 underpayment of estimated tax by individuals and fiduciaries 2021 form 5805 underpayment of estimated tax by

Effortlessly Prepare Form 5805 Underpayment Of Estimated Tax By Individuals And Fiduciaries Form 5805 Underpayment Of Estimated Tax By Individuals An on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can easily locate the right form and securely store it online. airSlate SignNow offers all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage Form 5805 Underpayment Of Estimated Tax By Individuals And Fiduciaries Form 5805 Underpayment Of Estimated Tax By Individuals An across any platform with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The Easiest Way to Edit and eSign Form 5805 Underpayment Of Estimated Tax By Individuals And Fiduciaries Form 5805 Underpayment Of Estimated Tax By Individuals An with Ease

- Locate Form 5805 Underpayment Of Estimated Tax By Individuals And Fiduciaries Form 5805 Underpayment Of Estimated Tax By Individuals An and select Get Form to begin.

- Utilize the tools provided to complete your document.

- Highlight important sections or redact sensitive information with the tools specifically designed for this purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere moments and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to store your changes.

- Select your preferred method to send the document: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, and mistakes that require printing new document versions. airSlate SignNow expertly manages your document needs in just a few clicks from any device you prefer. Edit and eSign Form 5805 Underpayment Of Estimated Tax By Individuals And Fiduciaries Form 5805 Underpayment Of Estimated Tax By Individuals An while ensuring outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form 5805 underpayment of estimated tax by individuals and fiduciaries 2021 form 5805 underpayment of estimated tax by

Create this form in 5 minutes!

How to create an eSignature for the 2021 form 5805 underpayment of estimated tax by individuals and fiduciaries 2021 form 5805 underpayment of estimated tax by

How to generate an e-signature for your PDF document online

How to generate an e-signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is the FTB 5805 form used for?

The FTB 5805 form is a California tax form used for reporting individual income tax information. It is primarily utilized by taxpayers who need to report changes in their financial situation. By understanding the FTB 5805, users can ensure accurate and timely submissions for their tax obligations.

-

How can airSlate SignNow assist with the FTB 5805 form?

AirSlate SignNow simplifies the process of completing and eSigning the FTB 5805 form. With our intuitive platform, users can easily upload, edit, and sign documents securely. This ensures that your tax submissions are handled efficiently, helping you avoid delays or errors.

-

What are the pricing plans for using airSlate SignNow?

AirSlate SignNow offers competitive pricing plans tailored for both individuals and businesses. Each plan includes features that enhance productivity, such as unlimited eSigning and secure storage, making it an excellent choice for handling important forms like the FTB 5805.

-

Is airSlate SignNow compatible with other software for FTB 5805 integration?

Yes, airSlate SignNow integrates seamlessly with various software applications, including popular accounting and document management tools. This compatibility allows users to link their FTB 5805 form processing with other platforms, streamlining workflow and improving efficiency.

-

What are the benefits of eSigning the FTB 5805 with airSlate SignNow?

eSigning the FTB 5805 with airSlate SignNow offers numerous benefits, including enhanced security, reduced processing time, and ease of access. Our platform ensures that your eSignatures are legally binding and stored securely, providing peace of mind during tax season.

-

Can I track the status of my FTB 5805 submissions with airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily track the status of your FTB 5805 submissions in real-time. This feature helps you stay informed about the progress of your documents and ensures timely follow-ups as needed.

-

Is there customer support available for FTB 5805 inquiries on airSlate SignNow?

Yes, airSlate SignNow offers robust customer support to assist with any questions or concerns regarding the FTB 5805 form. Our dedicated support team is available through multiple channels to provide quick assistance and ensure a smooth experience.

Get more for Form 5805 Underpayment Of Estimated Tax By Individuals And Fiduciaries Form 5805 Underpayment Of Estimated Tax By Individuals An

- Premarital agreements package massachusetts form

- Painting contractor package massachusetts form

- Framing contractor package massachusetts form

- Foundation contractor package massachusetts form

- Plumbing contractor package massachusetts form

- Brick mason contractor package massachusetts form

- Roofing contractor package massachusetts form

- Electrical contractor package massachusetts form

Find out other Form 5805 Underpayment Of Estimated Tax By Individuals And Fiduciaries Form 5805 Underpayment Of Estimated Tax By Individuals An

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online