PDF Form 540NR Franchise Tax Board CA Gov 2020

Understanding the 2 Form

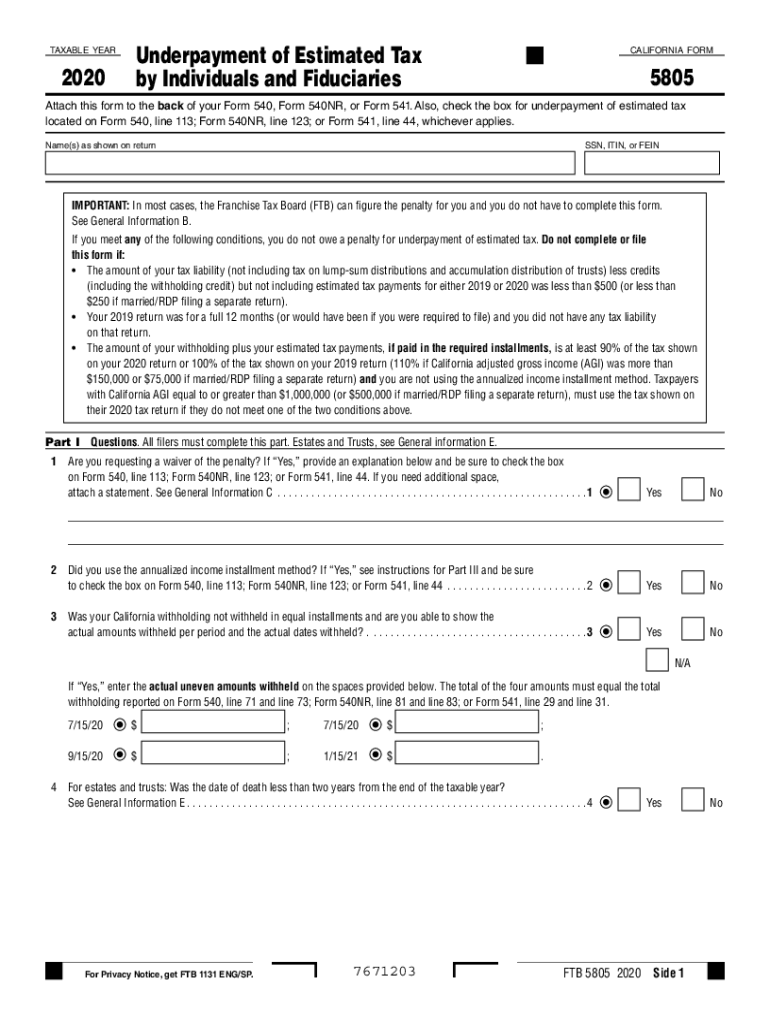

The 2 form, also known as the California Underpayment Penalty Worksheet, is utilized by taxpayers in California to determine if they have underpaid their estimated taxes for the year. This form is essential for those who may face penalties due to insufficient tax payments throughout the year. It helps in calculating the amount of underpayment and any potential penalties that may apply, ensuring compliance with California tax regulations.

Steps to Complete the 2 Form

Completing the 2 form involves several key steps:

- Gather your financial records, including your total income and tax payments made throughout the year.

- Calculate your total tax liability for the year using your income and applicable tax rates.

- Determine the amount of estimated tax payments you have made to date.

- Compare your total tax liability with your estimated payments to identify any underpayment.

- Fill out the 2 form by following the instructions provided, ensuring all calculations are accurate.

- Review the completed form for any errors before submission.

Legal Use of the 2 Form

The 2 form is legally recognized for calculating underpayment penalties in California. It is crucial to complete this form accurately to avoid penalties imposed by the California Franchise Tax Board. The form adheres to the guidelines set forth by the state tax authority, ensuring that taxpayers can fulfill their obligations while minimizing potential penalties.

Filing Deadlines for the 2 Form

Timely filing of the 2 form is essential to avoid additional penalties. The form should be submitted along with your tax return by the standard filing deadline, which is typically April 15 of the following year. If you have filed for an extension, ensure that you also account for the submission of this form within the extended timeframe to maintain compliance.

Required Documents for the 2 Form

To complete the 2 form, you will need several documents:

- Your completed tax return for the year.

- Records of estimated tax payments made.

- Any relevant documentation regarding income sources and deductions.

- Prior year tax returns, if applicable, for comparison purposes.

Penalties for Non-Compliance with the 2 Form

Failure to accurately complete and submit the 2 form can result in significant penalties. The California Franchise Tax Board may impose fines based on the amount of underpayment, which can accumulate over time. It is important to address any underpayment issues promptly to avoid escalating penalties and interest charges.

Quick guide on how to complete pdf form 540nr franchise tax board cagov

Finalize PDF Form 540NR Franchise Tax Board CA gov effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents quickly and efficiently. Handle PDF Form 540NR Franchise Tax Board CA gov on any device using the airSlate SignNow Android or iOS applications and enhance your document-oriented processes today.

How to adjust and electronically sign PDF Form 540NR Franchise Tax Board CA gov with ease

- Locate PDF Form 540NR Franchise Tax Board CA gov and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all details and then click the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Adjust and electronically sign PDF Form 540NR Franchise Tax Board CA gov to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf form 540nr franchise tax board cagov

Create this form in 5 minutes!

How to create an eSignature for the pdf form 540nr franchise tax board cagov

How to make an eSignature for your PDF online

How to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The best way to create an electronic signature for a PDF file on Android

People also ask

-

What is the 2020 5805 feature in airSlate SignNow?

The 2020 5805 feature in airSlate SignNow refers to the innovative tools that streamline the eSigning process. This functionality allows users to easily send, sign, and manage documents digitally, ensuring compliance and security. By leveraging the 2020 5805 feature, businesses can enhance their workflow efficiency.

-

How much does the 2020 5805 solution cost?

The pricing for the 2020 5805 solution varies based on specific business needs and chosen plans. airSlate SignNow offers competitive pricing tailored to accommodate different organizations, making it a cost-effective solution. To find out the exact pricing, we recommend visiting the airSlate SignNow website.

-

What are the key benefits of using the 2020 5805?

The main benefits of the 2020 5805 include improved document turnaround times, enhanced team collaboration, and higher security for sensitive materials. With the airSlate SignNow platform, users can quickly eSign documents from anywhere, which boosts overall productivity. These advantages make the 2020 5805 a valuable asset for businesses.

-

Can the 2020 5805 integrate with other software?

Yes, the 2020 5805 integrates smoothly with various popular software solutions, including CRMs and productivity tools. This feature enables businesses to create a seamless workflow and enhance their existing processes. By using the airSlate SignNow, teams can maintain their favorite tools while still benefiting from the 2020 5805's capabilities.

-

Is the 2020 5805 easy to use?

Absolutely! The 2020 5805 is designed with user-friendliness in mind, allowing anyone to navigate the interface without extensive training. The simplicity of airSlate SignNow minimizes the learning curve, enabling new users to get started with eSigning quickly and efficiently. Experience effortless document management with the 2020 5805.

-

What types of documents can be signed using the 2020 5805?

The 2020 5805 solution supports a wide range of document types, including contracts, agreements, and forms. Users can upload various file formats, making it versatile for any business needs. This flexibility ensures that all documentation can be eSigned and processed easily within the airSlate SignNow platform.

-

Is the 2020 5805 secure for my documents?

Yes, the 2020 5805 prioritizes document security with advanced encryption and compliance features. airSlate SignNow adheres to industry standards to ensure that all eSigned documents are safe from unauthorized access. You can trust that your sensitive information remains protected while using the 2020 5805.

Get more for PDF Form 540NR Franchise Tax Board CA gov

Find out other PDF Form 540NR Franchise Tax Board CA gov

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later