Form 5805 Underpayment of Estimated Tax by Individuals and Fiduciaries Form 5805 Underpayment of Estimated Tax by Individuals an 2023

Understanding the FTB 5805 Form

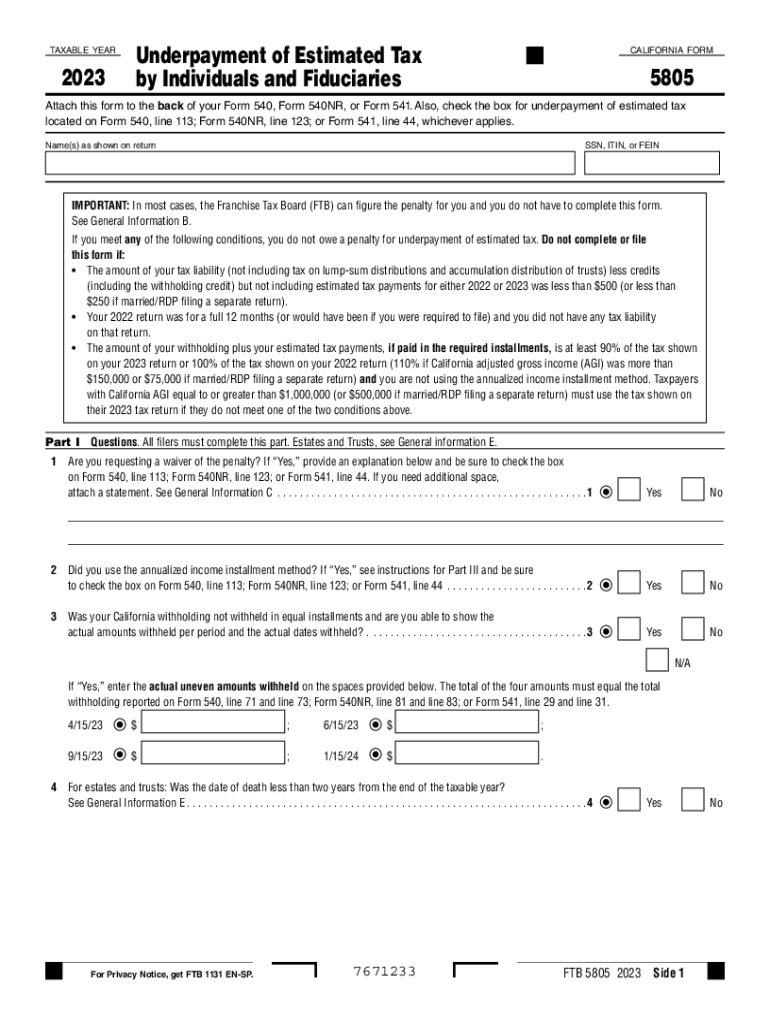

The FTB 5805 form, officially known as the Underpayment of Estimated Tax by Individuals and Fiduciaries, is a crucial document for California taxpayers. This form is designed for individuals and fiduciaries who may not have paid enough in estimated taxes throughout the year. If your tax liability exceeds a certain threshold, you may be subject to penalties for underpayment, making this form essential for compliance with California tax regulations.

How to Complete the FTB 5805 Form

Completing the FTB 5805 form involves several steps to ensure accuracy and compliance. First, gather your financial documents, including your income statements and previous tax returns. Next, calculate your total tax liability for the year and determine the amount of estimated tax payments you have made. The form will guide you through calculating any underpayment and the associated penalties. Be sure to review each section carefully to avoid errors that could lead to further complications.

Obtaining the FTB 5805 Form

The FTB 5805 form can be easily obtained from the California Franchise Tax Board's official website. It is available in a downloadable PDF format, allowing you to print and fill it out manually. Additionally, you may find the form at various tax preparation offices or through tax software that supports California tax filings. Ensure you are using the most current version of the form to comply with the latest tax regulations.

Key Elements of the FTB 5805 Form

The FTB 5805 form includes several key elements that taxpayers must understand. These elements encompass your personal information, the calculation of your estimated tax payments, and any penalties for underpayment. The form also requires you to provide details about your income sources and any credits that may apply. Understanding these components is vital for accurately reporting your tax situation and avoiding penalties.

Filing Deadlines for the FTB 5805 Form

Filing deadlines for the FTB 5805 form align with the general tax filing deadlines in California. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 of the following year. If you are unable to meet this deadline, consider filing for an extension to avoid penalties. It is important to stay informed about any changes to these deadlines, especially in light of adjustments that may occur due to special circumstances.

Penalties for Non-Compliance with the FTB 5805 Form

Failing to file the FTB 5805 form or underreporting your estimated tax payments can result in significant penalties. The California Franchise Tax Board imposes penalties based on the amount of underpayment and the duration of the underpayment period. These penalties can accumulate quickly, making it essential to complete and submit the form accurately and on time. Understanding the potential consequences can motivate timely compliance and help maintain your financial health.

Create this form in 5 minutes or less

Find and fill out the correct form 5805 underpayment of estimated tax by individuals and fiduciaries form 5805 underpayment of estimated tax by individuals

Create this form in 5 minutes!

How to create an eSignature for the form 5805 underpayment of estimated tax by individuals and fiduciaries form 5805 underpayment of estimated tax by individuals

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ftb 5805 form and why is it important?

The ftb 5805 form is a California tax form used for reporting various tax credits and adjustments. Understanding this form is crucial for ensuring compliance with state tax regulations and maximizing potential refunds. Using airSlate SignNow can simplify the process of completing and submitting the ftb 5805 form electronically.

-

How can airSlate SignNow help with the ftb 5805 form?

airSlate SignNow provides an intuitive platform for electronically signing and sending the ftb 5805 form. With its user-friendly interface, you can easily fill out the form, add signatures, and share it securely with relevant parties. This streamlines the process and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for the ftb 5805?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting with a free trial. Each plan includes features that facilitate the completion and signing of documents like the ftb 5805 form. You can choose a plan that best fits your budget and requirements.

-

Are there any integrations available for airSlate SignNow when handling the ftb 5805?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your workflow when dealing with the ftb 5805 form. You can connect it with popular tools like Google Drive, Dropbox, and CRM systems to streamline document management. This integration helps in organizing and accessing your forms efficiently.

-

What features does airSlate SignNow offer for managing the ftb 5805?

airSlate SignNow offers features such as customizable templates, automated reminders, and secure cloud storage for managing the ftb 5805 form. These tools help ensure that your documents are completed accurately and on time. Additionally, the platform provides tracking capabilities to monitor the status of your submissions.

-

Can I use airSlate SignNow on mobile devices for the ftb 5805?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to manage the ftb 5805 form on the go. Whether you’re using a smartphone or tablet, you can easily fill out, sign, and send documents from anywhere. This flexibility is ideal for busy professionals.

-

What are the benefits of using airSlate SignNow for the ftb 5805?

Using airSlate SignNow for the ftb 5805 form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform simplifies the signing process, making it faster and more reliable. Additionally, it helps you stay organized and compliant with tax regulations.

Get more for Form 5805 Underpayment Of Estimated Tax By Individuals And Fiduciaries Form 5805 Underpayment Of Estimated Tax By Individuals An

Find out other Form 5805 Underpayment Of Estimated Tax By Individuals And Fiduciaries Form 5805 Underpayment Of Estimated Tax By Individuals An

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple