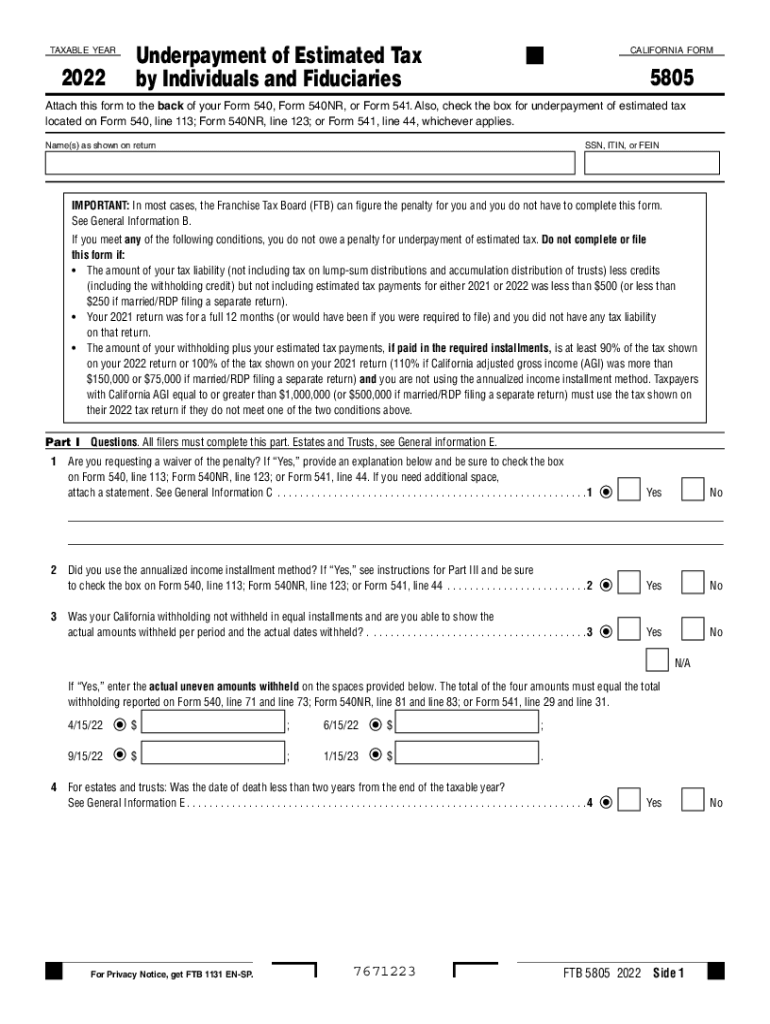

Form 5805 Underpayment of Estimated Tax by Individuals and Fiduciaries Form 5805 Underpayment of Estimated Tax by Individuals an 2022

Understanding the Form 5805: Underpayment of Estimated Tax

The Form 5805 is a critical document used for reporting the underpayment of estimated tax by individuals and fiduciaries in California. This form is essential for taxpayers who have not paid enough tax throughout the year, either through withholding or estimated payments. It helps calculate any penalties that may apply due to underpayment. Understanding this form is vital for compliance with California tax laws and for avoiding potential financial penalties.

Steps to Complete the Form 5805

Completing the Form 5805 involves several key steps to ensure accuracy and compliance. Begin by gathering your financial information, including total income, deductions, and any tax credits. Next, follow these steps:

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income for the year, including wages, dividends, and any other sources of income.

- Calculate your total tax liability based on your income and applicable tax rates.

- Determine the amount of tax you have already paid through withholding and estimated payments.

- Calculate the difference between your total tax liability and the amount already paid to find any underpayment.

- Complete the form by signing and dating it, ensuring all information is accurate.

Legal Use of the Form 5805

The Form 5805 serves a legal purpose in the context of California tax law. It is used to report underpayment of estimated taxes, which is a requirement for compliance with state tax regulations. Filing this form accurately can help avoid penalties and interest charges that may arise from underpayment. It is crucial to adhere to the guidelines set forth by the California Franchise Tax Board (FTB) to ensure that the form is legally valid.

Filing Deadlines for the Form 5805

Timely filing of the Form 5805 is essential to avoid penalties. Generally, the form should be filed by the tax deadline, which is typically April 15 for individual taxpayers. If you are unable to file by this date, it is advisable to check for any extensions or specific deadlines that may apply to your situation. Staying informed about filing deadlines ensures compliance and helps manage your tax obligations effectively.

Penalties for Non-Compliance

Failure to file the Form 5805 or to pay the required estimated taxes can result in significant penalties. The California FTB may impose a penalty based on the amount of underpayment, which can accumulate over time. Additionally, interest may accrue on any unpaid taxes. Understanding these potential consequences emphasizes the importance of timely and accurate filing of the Form 5805 to avoid unnecessary financial burdens.

Obtaining the Form 5805

The Form 5805 can be obtained directly from the California Franchise Tax Board’s website or through authorized tax professionals. It is available in a downloadable PDF format, making it easy to access and complete. Ensure you have the most current version of the form, as updates may occur annually. Having the correct form is essential for accurate reporting and compliance with state tax laws.

Quick guide on how to complete 2022 form 5805 underpayment of estimated tax by individuals and fiduciaries 2022 form 5805 underpayment of estimated tax by

Easily Create Form 5805 Underpayment Of Estimated Tax By Individuals And Fiduciaries Form 5805 Underpayment Of Estimated Tax By Individuals An on Any Device

Managing documents online has gained popularity among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork since you can obtain the correct document and securely preserve it online. airSlate SignNow provides all the tools necessary to generate, modify, and electronically sign your documents swiftly without interruptions. Manage Form 5805 Underpayment Of Estimated Tax By Individuals And Fiduciaries Form 5805 Underpayment Of Estimated Tax By Individuals An on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The Simplest Method to Modify and Electronically Sign Form 5805 Underpayment Of Estimated Tax By Individuals And Fiduciaries Form 5805 Underpayment Of Estimated Tax By Individuals An Effortlessly

- Find Form 5805 Underpayment Of Estimated Tax By Individuals And Fiduciaries Form 5805 Underpayment Of Estimated Tax By Individuals An and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important parts of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Craft your electronic signature using the Sign tool, which takes only seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method of sending your document, through email, SMS, or an invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow manages all your document handling needs in just a few clicks from any device you prefer. Edit and electronically sign Form 5805 Underpayment Of Estimated Tax By Individuals And Fiduciaries Form 5805 Underpayment Of Estimated Tax By Individuals An to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 5805 underpayment of estimated tax by individuals and fiduciaries 2022 form 5805 underpayment of estimated tax by

Create this form in 5 minutes!

How to create an eSignature for the 2022 form 5805 underpayment of estimated tax by individuals and fiduciaries 2022 form 5805 underpayment of estimated tax by

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CA Form 5805?

The CA Form 5805 is a tax form used for businesses in California to report specific taxes. Understanding this form is essential for businesses to ensure compliance with state tax regulations. By using airSlate SignNow, you can easily access and eSign your CA Form 5805, streamlining your tax documentation process.

-

How does airSlate SignNow simplify the eSigning of CA Form 5805?

airSlate SignNow provides a user-friendly interface that allows for quick and secure eSigning of the CA Form 5805. With features like drag-and-drop document upload and customizable templates, you can efficiently prepare and sign your forms without the hassle of printing or scanning. This makes managing your tax documents much more manageable.

-

What features does airSlate SignNow offer for managing CA Form 5805?

airSlate SignNow offers various features to help you manage your CA Form 5805 effectively, including automated workflows, real-time tracking, and reminders for document signing. These features ensure that you never miss a deadline and can monitor the status of your forms easily. This level of organization streamlines your tax preparation efforts.

-

Is there a cost associated with eSigning CA Form 5805 using airSlate SignNow?

Yes, using airSlate SignNow incurs a subscription fee, which varies depending on the features you need. However, the cost is typically offset by the time saved and the increased efficiency gained when handling documents like the CA Form 5805. Consider the affordability and value that airSlate SignNow provides in managing your tax forms.

-

Can I integrate airSlate SignNow with other software for CA Form 5805 management?

Absolutely! airSlate SignNow integrates with various third-party applications like Google Drive, Dropbox, and Microsoft Office. This means you can import your CA Form 5805 documents directly from these platforms, making the entire process more seamless and convenient for your business needs.

-

What are the benefits of using airSlate SignNow for CA Form 5805?

Using airSlate SignNow for your CA Form 5805 provides signNow benefits, including increased efficiency, enhanced security, and improved tracking of your documents. The ability to eSign from anywhere, coupled with rigorous encryption standards, ensures that your sensitive information remains protected. Ultimately, it helps you save time while avoiding potential headaches during tax season.

-

Is airSlate SignNow user-friendly for first-time users filing CA Form 5805?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it suitable for first-time users handling the CA Form 5805. The intuitive layout and helpful tutorials guide you through each step of the eSigning process, ensuring you won’t feel lost. This makes it a great choice for businesses new to digital signing.

Get more for Form 5805 Underpayment Of Estimated Tax By Individuals And Fiduciaries Form 5805 Underpayment Of Estimated Tax By Individuals An

- Commercial rental lease application questionnaire south dakota form

- Apartment lease rental application questionnaire south dakota form

- Residential rental lease application south dakota form

- Salary verification form for potential lease south dakota

- Landlord agreement to allow tenant alterations to premises south dakota form

- Notice of default on residential lease south dakota form

- Landlord tenant lease co signer agreement south dakota form

- Application for sublease south dakota form

Find out other Form 5805 Underpayment Of Estimated Tax By Individuals And Fiduciaries Form 5805 Underpayment Of Estimated Tax By Individuals An

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word