Tax FormsMyBlue 2021

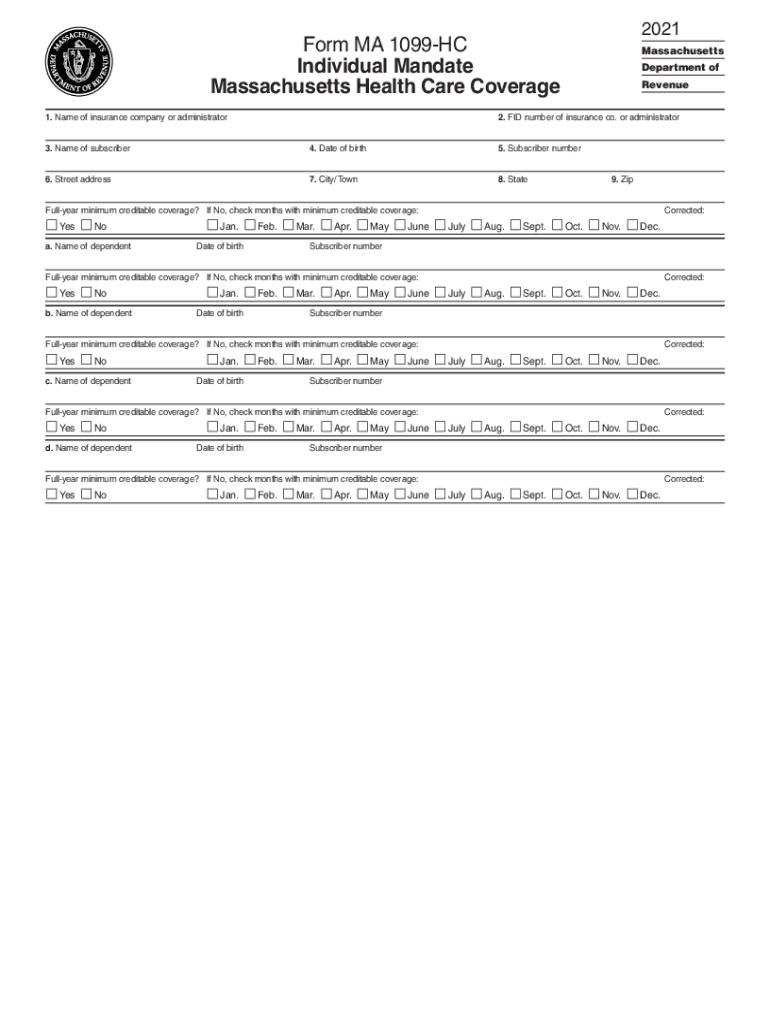

What is the 1099 HC Form?

The 1099 HC form is a tax document used in Massachusetts to report health insurance coverage. It is specifically designed for individuals who have received health insurance through their employer or purchased it independently. This form is essential for taxpayers to demonstrate compliance with the state's health insurance mandate, which requires residents to have health coverage. The 1099 HC provides important information regarding the type of health insurance coverage, the months covered, and the names of covered individuals. Proper completion of this form is necessary to avoid penalties associated with the state's health insurance requirements.

Steps to Complete the 1099 HC Form

Completing the 1099 HC form involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather necessary information, including your health insurance provider details and the coverage period.

- Fill out the form, ensuring you include all required personal information, such as your name, address, and Social Security number.

- List all individuals covered under your health insurance policy during the tax year.

- Review the form for completeness and accuracy before submission.

- Keep a copy of the completed form for your records and for filing with your state tax return.

Legal Use of the 1099 HC Form

The 1099 HC form holds legal significance as it serves as proof of health insurance coverage for Massachusetts residents. This documentation is vital for fulfilling the state's health insurance mandate. When properly filled out and submitted, it can protect taxpayers from potential penalties for non-compliance. Additionally, the form must be retained for at least three years in case of an audit or inquiry from tax authorities. Understanding its legal implications ensures that taxpayers are prepared and compliant with state regulations.

Filing Deadlines for the 1099 HC Form

Timely filing of the 1099 HC form is crucial to avoid penalties. The form must be submitted to the Massachusetts Department of Revenue by the same deadline as your state tax return. Typically, this deadline falls on April fifteenth, unless extended due to weekends or holidays. Taxpayers should ensure they have received their 1099 HC form from their health insurance provider before this deadline to allow for accurate reporting on their state tax return.

Who Issues the 1099 HC Form?

The 1099 HC form is issued by health insurance providers in Massachusetts. Employers who provide health insurance to their employees are also responsible for supplying this form. It is important for taxpayers to ensure they receive their 1099 HC form from their provider in a timely manner, as it contains essential information needed for state tax filings. If a taxpayer does not receive their form, they should contact their insurance provider or employer to request it.

Penalties for Non-Compliance

Failure to file the 1099 HC form or provide accurate information can result in penalties imposed by the Massachusetts Department of Revenue. Taxpayers who do not demonstrate compliance with the health insurance mandate may face fines. These penalties can accumulate, leading to significant financial repercussions. Therefore, it is essential for residents to understand their obligations regarding the 1099 HC form and ensure timely and accurate submission to avoid these consequences.

Quick guide on how to complete tax formsmyblue

Effortlessly Prepare Tax FormsMyBlue on Any Device

Managing documents online has gained signNow traction among companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to swiftly create, alter, and eSign your documents without any delays. Handle Tax FormsMyBlue on any platform using airSlate SignNow’s Android or iOS applications and simplify your document-related tasks today.

How to Edit and eSign Tax FormsMyBlue with Ease

- Obtain Tax FormsMyBlue and click Get Form to begin.

- Utilize the tools available to complete your form.

- Mark relevant parts of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, cumbersome form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Edit and eSign Tax FormsMyBlue while ensuring clear communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax formsmyblue

Create this form in 5 minutes!

How to create an eSignature for the tax formsmyblue

How to make an e-signature for your PDF file in the online mode

How to make an e-signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What is the 1099 hc form and why do I need it?

The 1099 hc form is a tax document that provides information about health coverage and is essential for reporting health insurance benefits. It's crucial for individuals to accurately complete and file this form to comply with the IRS requirements. Using airSlate SignNow helps streamline the signing and sharing process of the 1099 hc form, ensuring you meet deadlines efficiently.

-

How can airSlate SignNow assist with the 1099 hc form?

airSlate SignNow simplifies the process of managing and signing the 1099 hc form by allowing users to eSign documents electronically. This digital solution ensures that all signatures are compliant and secure. Additionally, it enables users to easily track the document's status, reducing the hassle of paperwork.

-

What features does airSlate SignNow offer for eSigning the 1099 hc form?

airSlate SignNow provides features like customizable templates, a user-friendly interface, and robust security measures for eSigning the 1099 hc form. The platform allows users to add fields for signatures, dates, and other necessary information efficiently. With these features, you can ensure your document is completed accurately and safely.

-

Is airSlate SignNow a cost-effective solution for managing the 1099 hc form?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses needing to manage the 1099 hc form. With various pricing plans available, organizations can select a package that fits their budget while ensuring essential features are included. By reducing time spent on paperwork, the platform ultimately saves money and resources.

-

How secure is airSlate SignNow when handling the 1099 hc form?

airSlate SignNow implements top-notch security protocols to protect sensitive information within the 1099 hc form. The platform uses encryption and follows strict compliance guidelines to ensure your data is safe from unauthorized access. You can confidently eSign and share documents knowing that your information is secure.

-

Can I integrate airSlate SignNow with other tools for the 1099 hc form?

Absolutely! airSlate SignNow seamlessly integrates with various tools and software that can enhance your workflow while handling the 1099 hc form. Whether it's cloud storage solutions or CRM systems, these integrations help automate processes and keep your documents organized.

-

What are the benefits of using airSlate SignNow for the 1099 hc form?

Using airSlate SignNow for the 1099 hc form offers numerous benefits, including increased efficiency, reduced paperwork, and improved tracking of document status. The ability to eSign and send documents electronically saves time and helps ensure compliance with tax regulations. Additionally, the user-friendly interface makes the process straightforward for everyone involved.

Get more for Tax FormsMyBlue

- Name affidavit of buyer massachusetts form

- Name affidavit of seller massachusetts form

- Non foreign affidavit under irc 1445 massachusetts form

- Owners or sellers affidavit of no liens massachusetts form

- Massachusetts affidavit 497309822 form

- Complex will with credit shelter marital trust for large estates massachusetts form

- Ma marital form

- Marital domestic separation and property settlement agreement minor children no joint property or debts where divorce action 497309827 form

Find out other Tax FormsMyBlue

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile