Ma 1099 Hc 2017

What is the MA 1099-HC?

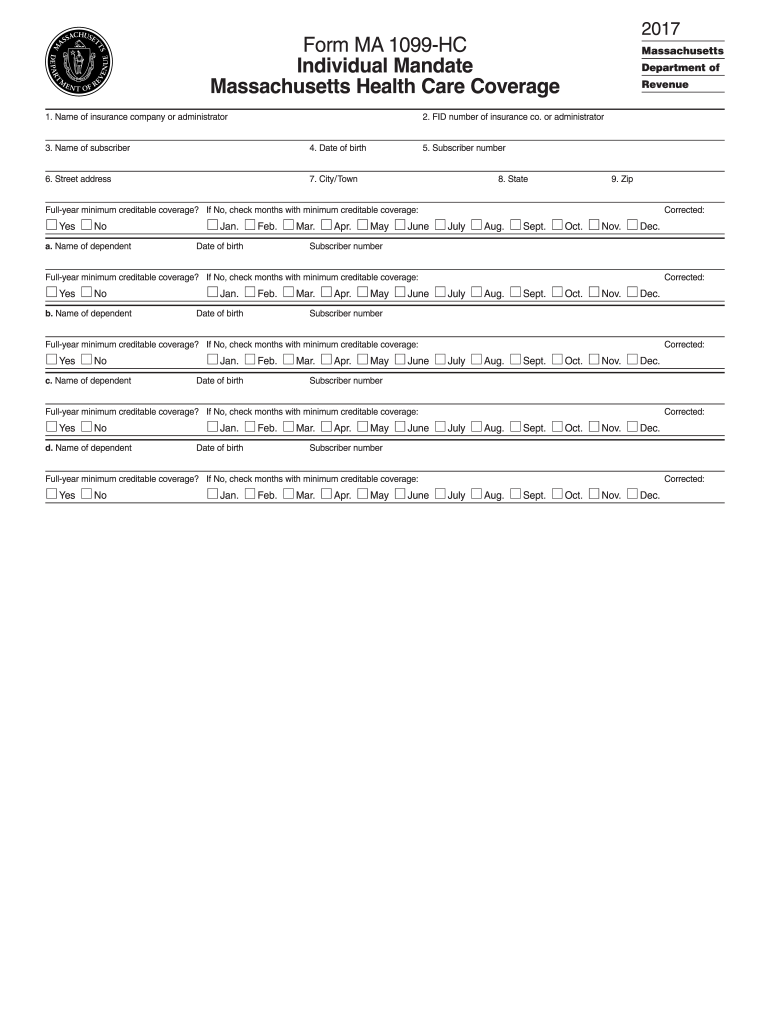

The Massachusetts Form MA 1099-HC is a tax document that serves as proof of health insurance coverage for residents of Massachusetts. This form is essential for individuals aged 18 and older, as it confirms compliance with the state's health insurance mandate. The MA 1099-HC must be submitted to the Massachusetts Department of Revenue (DOR) when filing state taxes. It provides necessary information regarding the insurance coverage held during the previous year, ensuring that taxpayers can verify their health insurance status.

Steps to Complete the MA 1099-HC

Completing the Massachusetts Form MA 1099-HC involves several straightforward steps. First, residents will receive this form from their health insurance provider if they were enrolled in a health plan during the previous year. The form includes essential details such as:

- Name of the insurance provider and their identification number.

- Personal information of the insured, including name, date of birth, and address.

- Coverage period, indicating whether it was for the entire year or specific months.

- Information about dependents, including their names, dates of birth, and coverage details.

Once the form is filled out, it should be submitted along with the state income tax return to the Massachusetts DOR. If filing online, the form can be sent separately.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the MA 1099-HC. Taxpayers must submit this form by January 31st of each year, ensuring that it is included with their state income tax return. Failure to meet this deadline may result in penalties or complications with tax filings. Keeping track of these dates helps maintain compliance with Massachusetts tax regulations.

Who Issues the Form

The MA 1099-HC is issued by health insurance providers in Massachusetts. This includes private insurers, employer-sponsored health plans, and government programs such as Medicaid. Each provider is responsible for sending the form to individuals who were covered under their plans during the previous year. It is important for taxpayers to ensure they receive this form to accurately report their health insurance coverage when filing taxes.

Key Elements of the MA 1099-HC

The MA 1099-HC contains several key elements that are important for both taxpayers and the Massachusetts DOR. These elements include:

- Insurance provider's name and identification number.

- Subscriber's personal information, including name, date of birth, and address.

- Coverage period, indicating the months of health insurance coverage.

- Details of dependents covered under the policy, if applicable.

Understanding these components is essential for accurately completing the form and ensuring compliance with state requirements.

Legal Use of the MA 1099-HC

The MA 1099-HC is legally required for Massachusetts residents to demonstrate compliance with the state's health insurance mandate. It serves as official documentation for health coverage when filing state taxes. Taxpayers must ensure that the information provided on the form is accurate and complete, as discrepancies may lead to penalties or issues with tax returns. Proper use of this form is essential for maintaining compliance with Massachusetts tax laws.

Quick guide on how to complete ma 1099 hc 2017 2019 form

Your assistance manual on how to prepare your Ma 1099 Hc

If you're curious about how to finalize and submit your Ma 1099 Hc, here are some straightforward guidelines to simplify the tax submission process.

To begin, you only need to set up your airSlate SignNow account to revolutionize the way you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to modify, draft, and finalize your income tax documents with ease. Utilizing its editor, you can toggle between text, check boxes, and eSignatures, while being able to revisit and update information as necessary. Enhance your tax administration with advanced PDF editing, eSigning, and user-friendly sharing features.

Follow the instructions below to complete your Ma 1099 Hc in a matter of minutes:

- Establish your account and commence working on PDFs in no time.

- Utilize our directory to locate any IRS tax form; browse through variations and schedules.

- Click Obtain form to access your Ma 1099 Hc in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Signature Tool to add your legally-recognized eSignature (if applicable).

- Examine your document and correct any errors.

- Preserve changes, print your copy, send it to your recipient, and save it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Be aware that submitting on paper can lead to return mistakes and delay refunds. It is essential that you review the IRS website for submitting regulations in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct ma 1099 hc 2017 2019 form

FAQs

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You’ll get a copy of the 1099-INT that they filed.

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the ma 1099 hc 2017 2019 form

How to generate an eSignature for the Ma 1099 Hc 2017 2019 Form in the online mode

How to make an eSignature for your Ma 1099 Hc 2017 2019 Form in Google Chrome

How to generate an eSignature for signing the Ma 1099 Hc 2017 2019 Form in Gmail

How to generate an electronic signature for the Ma 1099 Hc 2017 2019 Form right from your smartphone

How to create an eSignature for the Ma 1099 Hc 2017 2019 Form on iOS devices

How to make an eSignature for the Ma 1099 Hc 2017 2019 Form on Android devices

People also ask

-

What is the Massachusetts Form MA 1099 HC and why do I need it?

The Massachusetts Form MA 1099 HC is a tax form that provides proof of health insurance coverage. It is required for Massachusetts residents to show compliance with health insurance mandates. Businesses should use airSlate SignNow to send out this form efficiently to their employees.

-

How can airSlate SignNow help me with the Massachusetts Form MA 1099 HC?

airSlate SignNow provides an easy-to-use platform for sending and electronically signing the Massachusetts Form MA 1099 HC. With its cost-effective solution, you can streamline the process of distributing this form to ensure everyone receives it on time.

-

Is there a pricing plan for using airSlate SignNow for the Massachusetts Form MA 1099 HC?

Yes, airSlate SignNow offers various pricing plans that can accommodate businesses of all sizes. The plans are designed to be budget-friendly while providing the necessary features for handling forms like the Massachusetts Form MA 1099 HC efficiently.

-

What features does airSlate SignNow offer for managing the Massachusetts Form MA 1099 HC?

airSlate SignNow offers features such as eSignature capabilities, document tracking, and secure cloud storage specifically for the Massachusetts Form MA 1099 HC. These features ensure that your documents are handled securely and can be accessed easily whenever needed.

-

Can I integrate airSlate SignNow with my existing software for the Massachusetts Form MA 1099 HC?

Absolutely! airSlate SignNow offers integrations with a wide range of business tools, enabling seamless processing of the Massachusetts Form MA 1099 HC alongside your existing workflows. This ensures a smooth experience without disrupting your current operations.

-

What are the benefits of using airSlate SignNow for the Massachusetts Form MA 1099 HC?

The benefits of using airSlate SignNow include increased efficiency, reduced paperwork, and enhanced data security when handling the Massachusetts Form MA 1099 HC. Additionally, the platform helps businesses remain compliant with state regulations through prompt distribution of necessary tax forms.

-

Is airSlate SignNow user-friendly for preparing the Massachusetts Form MA 1099 HC?

Yes, airSlate SignNow is designed to be intuitive and user-friendly, making it easy to prepare the Massachusetts Form MA 1099 HC even for those with limited technical skills. Our platform guides users through each step, ensuring a smooth experience in document management.

Get more for Ma 1099 Hc

- Bohr model worksheet with answers form

- Chapter chapter test the first world war form

- Cleve bostick memorial scholarship bcfsganetb form

- Human body organization and homeostasis worksheet form

- Da form 759 1 2016 2019

- Haryana medical council registration number form

- Csd 43 form 2015 2019

- Revised child adaptive behavior summary providers performcare nj revised child adaptive behavior summary

Find out other Ma 1099 Hc

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors