FCHP Health Insurance Tax Forms 2023-2026

What is the FCHP Health Insurance Tax Form?

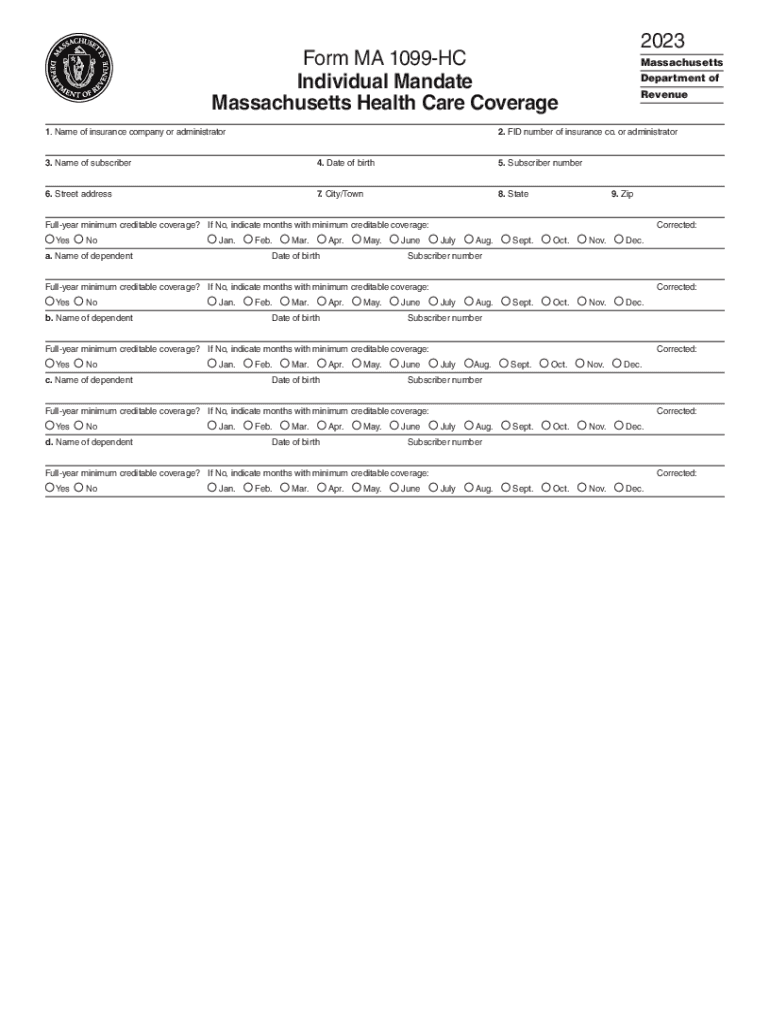

The FCHP Health Insurance Tax Form, also known as the 1099 HC form in Massachusetts, is a document that provides essential information regarding health insurance coverage. This form is required for individuals who had health insurance through the Massachusetts Health Connector or other qualifying plans during the tax year. It helps taxpayers report their health coverage to the state and ensures compliance with Massachusetts health care laws.

Steps to Complete the FCHP Health Insurance Tax Form

Completing the FCHP Health Insurance Tax Form involves several straightforward steps:

- Gather your health insurance information, including policy numbers and coverage dates.

- Locate the 1099 HC form, which may be provided by your insurance provider or can be downloaded from the Massachusetts Department of Revenue website.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the months you had health coverage during the tax year.

- Review the completed form for accuracy and ensure all required fields are filled.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the FCHP Health Insurance Tax Form. Typically, the form must be submitted along with your state tax return by April fifteenth of the following year. For the 2020 tax year, the deadline would be April fifteenth, 2021. Always check for any updates or changes in deadlines on the Massachusetts Department of Revenue website.

Who Issues the Form

The FCHP Health Insurance Tax Form is issued by health insurance providers, including private insurers and the Massachusetts Health Connector. If you had coverage through your employer, your employer may also provide this form. It is essential to ensure that you receive the correct form for the tax year you are filing.

Legal Use of the FCHP Health Insurance Tax Form

The FCHP Health Insurance Tax Form serves a legal purpose in documenting your health insurance coverage. It is required by Massachusetts law to verify compliance with the state's health insurance mandate. Failure to file this form can result in penalties, so it is important to complete and submit it accurately as part of your tax return.

Examples of Using the FCHP Health Insurance Tax Form

There are various scenarios in which the FCHP Health Insurance Tax Form is utilized:

- Individuals who purchased health insurance through the Massachusetts Health Connector will use the form to report their coverage.

- Taxpayers who received health insurance from their employer must include this form when filing their state taxes.

- Those who had a change in health coverage during the year, such as switching plans, will need to report the months of coverage accurately on the form.

Quick guide on how to complete fchp health insurance tax forms

Handle FCHP Health Insurance Tax Forms with ease on any device

Digital document management has become increasingly favored by companies and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage FCHP Health Insurance Tax Forms on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign FCHP Health Insurance Tax Forms effortlessly

- Find FCHP Health Insurance Tax Forms and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and then click the Done button to save your modifications.

- Select how you want to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign FCHP Health Insurance Tax Forms to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fchp health insurance tax forms

Create this form in 5 minutes!

How to create an eSignature for the fchp health insurance tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1099 HC form Massachusetts 2020 and why do I need it?

The 1099 HC form Massachusetts 2020 is a tax document that certifies your health insurance coverage during the previous year. It's essential for filing your state tax return, as it shows that you met the state's health insurance requirement. Ensuring you have the correct documentation, like the 1099 HC form Massachusetts 2020, can help avoid penalties.

-

How can airSlate SignNow help me with the 1099 HC form Massachusetts 2020?

airSlate SignNow allows you to easily send, receive, and eSign the 1099 HC form Massachusetts 2020. Our platform streamlines the document management process, making it simple to gather signatures and share forms securely. This efficiency can save you time during the busy tax season.

-

What are the pricing options for using airSlate SignNow for the 1099 HC form Massachusetts 2020?

airSlate SignNow offers several pricing plans tailored to different business needs, starting with a free trial. Our plans are cost-effective and designed to provide you with the tools necessary to manage forms like the 1099 HC form Massachusetts 2020 easily. Consider our features and integrations to find the best option for your workflow.

-

Is airSlate SignNow compliant with Massachusetts tax regulations for the 1099 HC form?

Yes, airSlate SignNow complies with the latest Massachusetts tax regulations, ensuring you can accurately manage the 1099 HC form Massachusetts 2020. Our platform stays updated on compliance requirements, providing peace of mind as you handle crucial tax documents. You can trust us to assist with your document needs.

-

How secure is the transmission of the 1099 HC form Massachusetts 2020 with airSlate SignNow?

The security of your documents, including the 1099 HC form Massachusetts 2020, is our top priority at airSlate SignNow. We use industry-standard encryption and secure servers to protect your sensitive information during transmission and storage. You can confidently send and eSign your documents without worrying about data bsignNowes.

-

Can I integrate other tools with airSlate SignNow for managing the 1099 HC form Massachusetts 2020?

Absolutely! airSlate SignNow offers integration with various tools and applications to enhance your document management process. You can seamlessly link it with your existing software to streamline the handling of the 1099 HC form Massachusetts 2020 and other important documents.

-

What advantages does airSlate SignNow offer for processing the 1099 HC form Massachusetts 2020?

With airSlate SignNow, you gain the ability to process the 1099 HC form Massachusetts 2020 quickly and efficiently. Our user-friendly interface allows you to generate, send, and receive eSigned documents in minutes. Additionally, you can track document status to ensure timely completion.

Get more for FCHP Health Insurance Tax Forms

- State of south carolina secretary of state application for an form

- Control number sc 00inc form

- Chapter 19 professional corporation justia law form

- Organized pursuant to the laws of the state of south carolina hereinafter quotcorporationquot form

- The initial registered office of the corporation is form

- A south carolina corporation form

- Fillable online sc articles of incorporation department of south form

- Free articles of organization 33 44 203 state of sou form

Find out other FCHP Health Insurance Tax Forms

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement