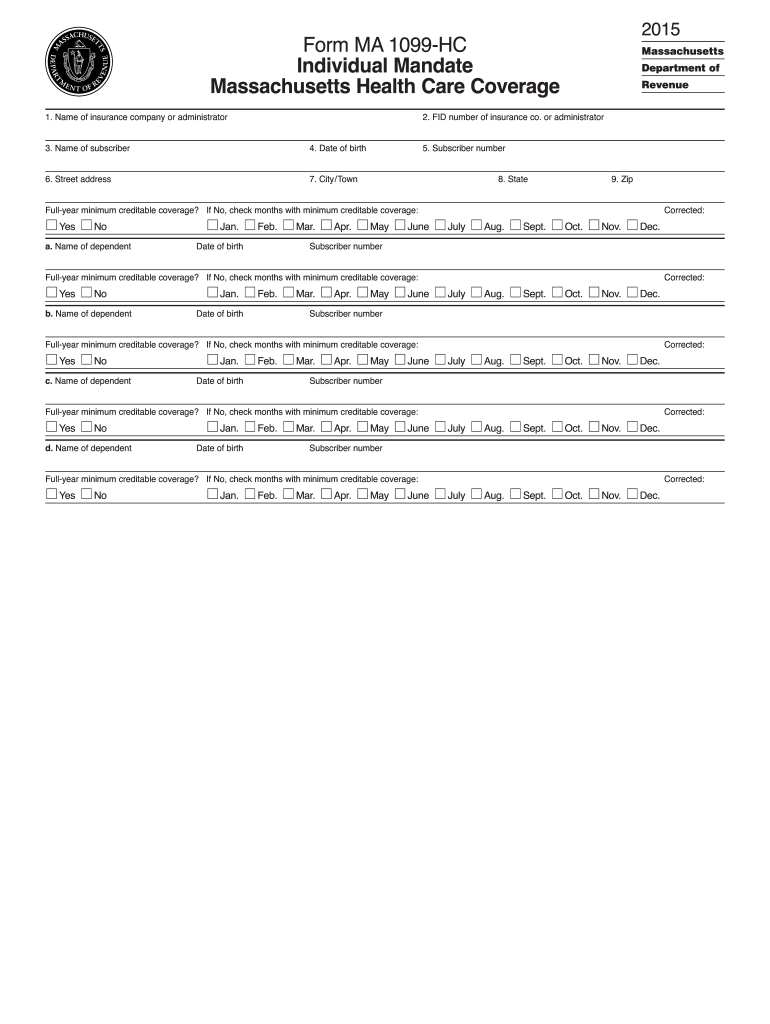

1099 Hc Form 2015

What is the 1099 HC Form

The 1099 HC Form is a tax document used in the United States to report health insurance coverage. This form is specifically designed for individuals who had health insurance coverage during the tax year. It serves as proof of health insurance for the purposes of the Affordable Care Act (ACA), helping taxpayers demonstrate compliance with the individual mandate. The form includes essential information such as the name of the insured, the policy number, and the period of coverage.

How to use the 1099 HC Form

Using the 1099 HC Form involves several straightforward steps. First, ensure you have received the form from your health insurance provider or employer. Once you have the form, review the information for accuracy, including your personal details and coverage dates. You will need to include this form when filing your federal tax return, as it provides necessary documentation of your health insurance status. Keep a copy for your records, as you may need it for future reference or in case of an audit.

Steps to complete the 1099 HC Form

Completing the 1099 HC Form requires careful attention to detail. Follow these steps:

- Gather necessary documents, including your health insurance policy details.

- Fill in your personal information, ensuring that your name and Social Security number are correct.

- Provide the details of your health insurance coverage, including the policy number and the period during which you were covered.

- Review the completed form for accuracy and completeness.

- Submit the form along with your tax return to the IRS.

Legal use of the 1099 HC Form

The 1099 HC Form is legally recognized as a valid document for reporting health insurance coverage. It is essential for compliance with the Affordable Care Act, which mandates that individuals maintain health insurance coverage. Failure to provide this form when required may result in penalties or fines from the IRS. Therefore, it is crucial to ensure that the form is accurately completed and submitted in accordance with federal regulations.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 HC Form align with the tax filing season. Typically, the form must be sent to the IRS by the end of February if filed by paper, or by the end of March if filed electronically. Taxpayers should also be aware of the general tax return filing deadline, which is usually April 15. It is advisable to keep track of these dates to avoid any late submission penalties.

Who Issues the Form

The 1099 HC Form is issued by health insurance providers, including private insurance companies and employers who provide health coverage. If you were covered under a health plan during the tax year, you should receive this form from your insurer or employer. It is important to ensure that you receive the form in a timely manner to facilitate your tax filing process.

Penalties for Non-Compliance

Failing to provide the 1099 HC Form when required can lead to various penalties. The IRS may impose fines for not complying with the health insurance reporting requirements. Additionally, taxpayers who do not demonstrate adequate health coverage may be subject to the individual mandate penalty, which can affect their overall tax liability. It is essential to understand these consequences and ensure compliance to avoid financial repercussions.

Quick guide on how to complete 1099 hc form 2015

Effortlessly Prepare 1099 Hc Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage 1099 Hc Form on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The Easiest Way to Modify and Electronically Sign 1099 Hc Form Effortlessly

- Find 1099 Hc Form and click Get Form to begin.

- Utilize the available tools to fill out your document.

- Emphasize important parts of the documents or redact sensitive information with the tools particularly designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to secure your modifications.

- Select the method of sharing your form: via email, text message (SMS), shareable link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign 1099 Hc Form while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099 hc form 2015

Create this form in 5 minutes!

How to create an eSignature for the 1099 hc form 2015

How to generate an eSignature for the 1099 Hc Form 2015 online

How to generate an eSignature for the 1099 Hc Form 2015 in Chrome

How to make an eSignature for putting it on the 1099 Hc Form 2015 in Gmail

How to generate an eSignature for the 1099 Hc Form 2015 from your smart phone

How to make an electronic signature for the 1099 Hc Form 2015 on iOS devices

How to create an electronic signature for the 1099 Hc Form 2015 on Android devices

People also ask

-

What is the 1099 HC Form?

The 1099 HC Form is a tax document used in Massachusetts to report information about health insurance coverage for the tax year. It includes details about the coverage provided to employees and whether it meets the minimum creditable coverage standards. Using airSlate SignNow can simplify the process of obtaining and signing this important document.

-

How does airSlate SignNow help with the 1099 HC Form?

With airSlate SignNow, businesses can easily send and eSign the 1099 HC Form electronically. This streamlines the process, reduces paperwork, and ensures that all signatures are securely collected. Our platform allows real-time tracking of document status, simplifying record-keeping for tax reporting.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides features such as secure document storage, customizable templates, and multi-party signing for documents like the 1099 HC Form. Users can also access robust integration with other software solutions, enhancing overall workflow efficiency. This makes it a powerful tool for managing all your eSignature needs.

-

Is airSlate SignNow affordable for businesses looking to handle the 1099 HC Form?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our pricing plans cater to various needs, ensuring you can find an option that fits your budget while managing important documents like the 1099 HC Form. Sign up for a free trial to explore the platform before making a commitment.

-

What are the benefits of using airSlate SignNow for the 1099 HC Form?

Using airSlate SignNow for the 1099 HC Form offers numerous benefits, including enhanced security, reduced processing time, and improved compliance with tax regulations. Our platform ensures that important documents are signed quickly and stored securely, making tax season much less stressful. Additionally, you’ll enjoy the convenience of managing forms from any device.

-

Can I integrate airSlate SignNow with other applications for the 1099 HC Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing for easy management of the 1099 HC Form and other essential documents. Whether you use CRM systems, cloud storage solutions, or accounting software, our integrations help streamline your workflow signNowly for efficient document management.

-

What support does airSlate SignNow provide for users handling the 1099 HC Form?

airSlate SignNow offers comprehensive support for users working with the 1099 HC Form. Our customer service team is available to assist you via chat, phone, or email, ensuring that you have the guidance needed to navigate any challenges. We also provide an extensive knowledge base and tutorial resources for troubleshooting and tips.

Get more for 1099 Hc Form

Find out other 1099 Hc Form

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online