TY 505NR TAX YEAR 505NR INDIVIDUAL TAXPAYER FORM 2021

What is the Maryland Form 505?

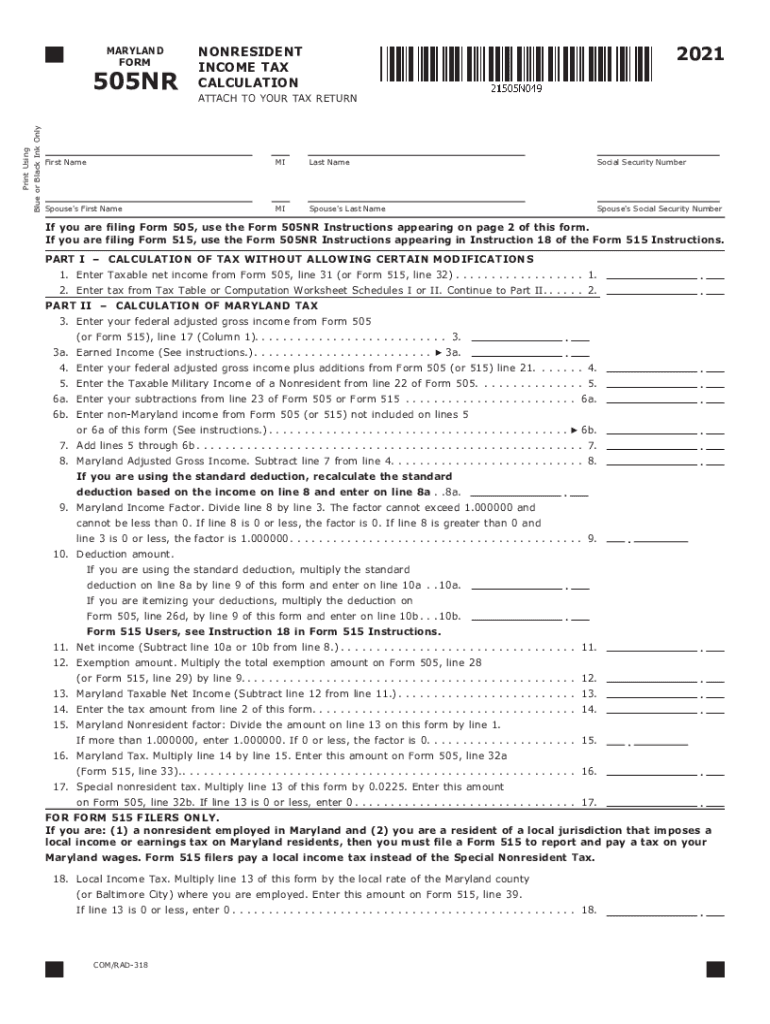

The Maryland Form 505, also known as the Maryland 505NR, is a tax form specifically designed for nonresident individuals who earn income in Maryland. This form is essential for those who need to report their Maryland-source income to the state and calculate their tax liability. It is crucial for individuals who do not reside in Maryland but have earned income from Maryland sources, such as wages, rental income, or business profits. The form helps ensure compliance with state tax laws and allows nonresidents to fulfill their tax obligations accurately.

How to Use the Maryland Form 505

Using the Maryland Form 505 involves several steps to ensure accurate reporting of income and tax calculations. First, gather all necessary documentation, including W-2 forms, 1099s, and records of any Maryland-source income. Next, fill out the form by providing your personal information, including your name, address, and Social Security number. Report your income earned in Maryland and any applicable deductions. Finally, calculate your tax liability based on the instructions provided with the form. Once completed, the form can be submitted either electronically or via mail.

Steps to Complete the Maryland Form 505

Completing the Maryland Form 505 requires careful attention to detail. Follow these steps:

- Gather all relevant income documentation, such as W-2s and 1099s.

- Provide your personal information at the top of the form.

- Report your total Maryland-source income in the designated section.

- Apply any deductions you are eligible for, such as personal exemptions.

- Calculate your total tax liability using the provided tax tables.

- Sign and date the form to certify its accuracy.

- Submit the completed form by the tax deadline.

Legal Use of the Maryland Form 505

The Maryland Form 505 is legally recognized as a valid document for reporting income and tax obligations for nonresidents. To ensure its legal standing, it must be filled out accurately and submitted within the required deadlines. Compliance with Maryland tax laws is essential, as failure to file or inaccuracies in reporting can lead to penalties. Using reliable digital tools for completion can enhance the form's legal validity, ensuring that all signatures and information are securely captured and stored.

Filing Deadlines for the Maryland Form 505

It is important to be aware of the filing deadlines associated with the Maryland Form 505. Typically, the form must be filed by April fifteenth of the year following the tax year for which the income is being reported. If April fifteenth falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be mindful of any potential extensions that may apply, which can provide additional time to file the form without incurring penalties.

Required Documents for the Maryland Form 505

When preparing to complete the Maryland Form 505, certain documents are required to ensure accurate reporting. These documents include:

- W-2 forms from employers showing Maryland-source income.

- 1099 forms for any freelance or contract work performed in Maryland.

- Records of any rental income earned from properties located in Maryland.

- Documentation of any deductions or credits you plan to claim.

Having these documents on hand will facilitate a smoother completion process and help ensure compliance with state tax regulations.

Quick guide on how to complete ty 2021 505nr tax year 2021 505nr individual taxpayer form

Easily Prepare TY 505NR TAX YEAR 505NR INDIVIDUAL TAXPAYER FORM on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly and without delays. Handle TY 505NR TAX YEAR 505NR INDIVIDUAL TAXPAYER FORM on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Way to Modify and eSign TY 505NR TAX YEAR 505NR INDIVIDUAL TAXPAYER FORM Effortlessly

- Find TY 505NR TAX YEAR 505NR INDIVIDUAL TAXPAYER FORM and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your PC.

Say goodbye to missing or lost files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign TY 505NR TAX YEAR 505NR INDIVIDUAL TAXPAYER FORM to ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ty 2021 505nr tax year 2021 505nr individual taxpayer form

Create this form in 5 minutes!

How to create an eSignature for the ty 2021 505nr tax year 2021 505nr individual taxpayer form

The best way to generate an electronic signature for your PDF online

The best way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What is the Maryland Form 505?

The Maryland Form 505 is a tax form used for filing the state's income tax returns. It is essential for residents and businesses in Maryland to accurately report their income and deductions. Using airSlate SignNow makes completing and submitting the Maryland Form 505 easier and more efficient.

-

How can airSlate SignNow help with the Maryland Form 505?

airSlate SignNow provides a user-friendly platform to electronically sign and manage the Maryland Form 505. Our solution allows users to fill out the form accurately and securely sign it, which streamlines the filing process. Plus, you can track the document's status in real-time.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored to meet the varying needs of users who need to work with the Maryland Form 505. You can choose from monthly or annual subscriptions, ensuring you find a plan that works within your budget. Each plan includes unlimited access to features like document signing and templates.

-

Is airSlate SignNow secure for sensitive documents like the Maryland Form 505?

Absolutely! AirSlate SignNow employs top-notch security measures to ensure that documents, including the Maryland Form 505, are protected. With features like encryption and secure data storage, users can confidently sign and send sensitive tax documents without worry.

-

Can I integrate airSlate SignNow with other tools for managing the Maryland Form 505?

Yes, airSlate SignNow offers integrations with various tools and platforms that can assist you in managing the Maryland Form 505 more efficiently. Whether you use CRM systems, cloud storage, or other document management software, our platform can seamlessly connect to enhance your workflow.

-

What features does airSlate SignNow offer for filling out the Maryland Form 505?

AirSlate SignNow comes equipped with features specifically designed to accommodate the completion of the Maryland Form 505, such as customizable templates, electronic signatures, and easy document sharing. These features simplify the process, allowing users to focus on filing accurately and promptly.

-

How do I get started with airSlate SignNow for the Maryland Form 505?

Getting started with airSlate SignNow for the Maryland Form 505 is simple! Just create an account on our website, choose the right subscription, and you'll gain immediate access to our toolset. You can then begin filling out and signing your Maryland Form 505 without delays.

Get more for TY 505NR TAX YEAR 505NR INDIVIDUAL TAXPAYER FORM

- 497310389 form

- Correction statement and agreement maryland form

- Closing statement maryland form

- Flood zone statement and authorization maryland form

- Name affidavit of buyer maryland form

- Name affidavit of seller maryland form

- Non foreign affidavit under irc 1445 maryland form

- Owners or sellers affidavit of no liens maryland form

Find out other TY 505NR TAX YEAR 505NR INDIVIDUAL TAXPAYER FORM

- How Can I Sign Wyoming Room lease agreement

- Sign Michigan Standard rental agreement Online

- Sign Minnesota Standard residential lease agreement Simple

- How To Sign Minnesota Standard residential lease agreement

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself