Form 505NR Non Resident Income Tax Calculation 505NR Non Resident Income Tax Calculation Comptroller of Maryland 2023-2026

Understanding the Maryland Form 505NR

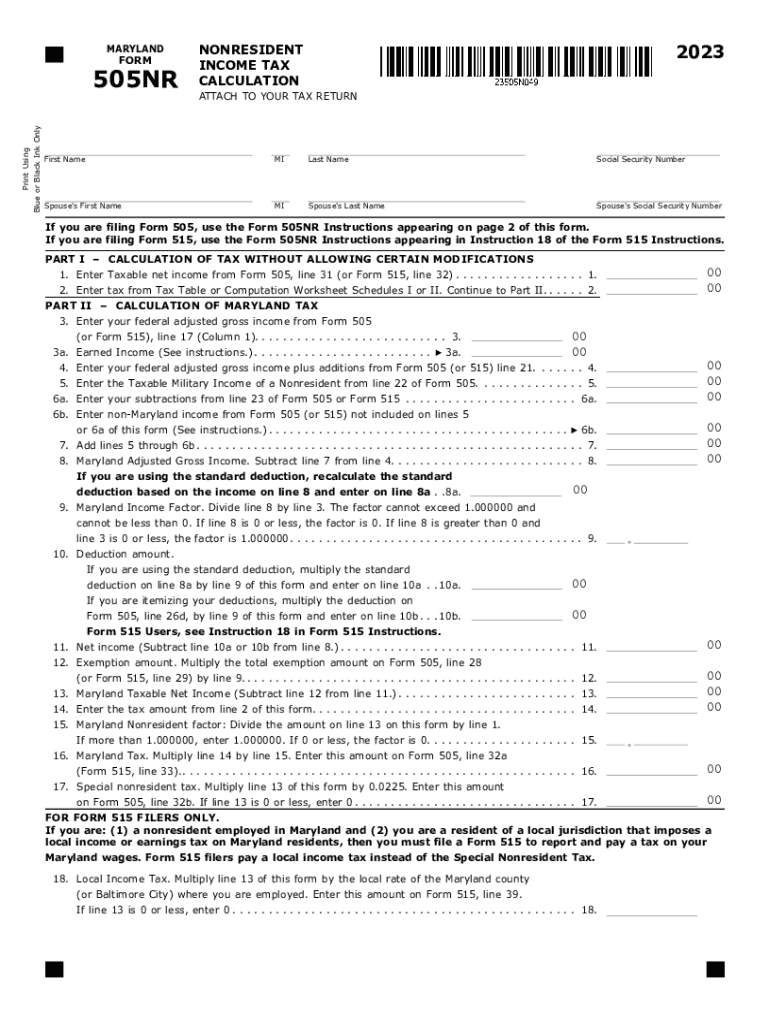

The Maryland Form 505NR is specifically designed for non-residents who earn income in Maryland. This form allows individuals to report their Maryland-source income and calculate the appropriate tax owed to the state. Non-residents must use this form to ensure compliance with Maryland tax laws while accurately reporting their income from various sources within the state.

Steps to Complete the Maryland Form 505NR

Completing the Maryland Form 505NR involves several steps to ensure accurate reporting of income and tax calculations. Begin by gathering all necessary documentation, including W-2s, 1099s, and any other income statements. Follow these steps:

- Fill out your personal information, including name, address, and Social Security number.

- Report your total income earned in Maryland, including wages, rental income, and business income.

- Calculate your deductions based on Maryland tax laws, which may include standard deductions or itemized deductions.

- Determine your tax liability using the tax tables provided by the Comptroller of Maryland.

- Sign and date the form before submitting it to the appropriate tax authority.

Obtaining the Maryland Form 505NR

The Maryland Form 505NR can be easily obtained through the official Maryland Comptroller's website. It is available for download in a printable format, allowing taxpayers to fill it out by hand or digitally. Additionally, local tax offices may provide physical copies of the form for those who prefer in-person assistance.

Key Elements of the Maryland Form 505NR

Understanding the key elements of the Maryland Form 505NR is crucial for accurate completion. Important components include:

- Personal Information: This section requires basic details about the taxpayer.

- Income Reporting: Non-residents must detail all income earned within Maryland.

- Deductions: Taxpayers can claim specific deductions allowed under Maryland law.

- Tax Calculation: This section outlines how to compute the total tax owed based on reported income.

Filing Deadlines for the Maryland Form 505NR

It is essential to be aware of the filing deadlines for the Maryland Form 505NR to avoid penalties. Generally, the deadline for filing is the same as the federal tax deadline, which is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should always verify current deadlines with the Maryland Comptroller's office.

Legal Use of the Maryland Form 505NR

The Maryland Form 505NR serves a legal purpose by ensuring that non-residents report their income accurately and pay the appropriate taxes. Failing to file this form can result in penalties, interest on unpaid taxes, and potential legal action by the state. It is crucial for non-residents to understand their obligations under Maryland tax law and to use this form correctly to avoid complications.

Quick guide on how to complete form 505nr non resident income tax calculation 505nr non resident income tax calculation comptroller of maryland

Complete Form 505NR Non Resident Income Tax Calculation 505NR Non Resident Income Tax Calculation Comptroller Of Maryland effortlessly on any gadget

Digital document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any holdups. Handle Form 505NR Non Resident Income Tax Calculation 505NR Non Resident Income Tax Calculation Comptroller Of Maryland on any gadget using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to edit and eSign Form 505NR Non Resident Income Tax Calculation 505NR Non Resident Income Tax Calculation Comptroller Of Maryland with ease

- Obtain Form 505NR Non Resident Income Tax Calculation 505NR Non Resident Income Tax Calculation Comptroller Of Maryland and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight relevant sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 505NR Non Resident Income Tax Calculation 505NR Non Resident Income Tax Calculation Comptroller Of Maryland to ensure excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 505nr non resident income tax calculation 505nr non resident income tax calculation comptroller of maryland

Create this form in 5 minutes!

How to create an eSignature for the form 505nr non resident income tax calculation 505nr non resident income tax calculation comptroller of maryland

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Maryland Form 505NR?

Maryland Form 505NR is a tax form specifically designed for non-resident individuals who earn income in the state of Maryland. This form allows non-residents to report their income and pay the corresponding taxes to the state. It’s essential for anyone earning income in Maryland while being a resident of another state.

-

How can airSlate SignNow help with Maryland Form 505NR?

airSlate SignNow streamlines the process of completing and eSigning your Maryland Form 505NR. With our easy-to-use platform, you can fill out the form digitally and securely send it to the relevant parties. This not only saves time but also ensures that your documents are legally compliant.

-

What features does airSlate SignNow offer for Maryland Form 505NR?

airSlate SignNow provides features such as customizable templates, cloud storage, and secure eSigning for Maryland Form 505NR. These features allow you to manage your documents efficiently, enhance collaboration, and keep your files organized and accessible from anywhere.

-

Is airSlate SignNow a cost-effective solution for managing Maryland Form 505NR?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing your Maryland Form 505NR and other documentation. Our pricing plans are competitive and offer value for individuals and businesses looking to streamline their signing and document management processes without breaking the bank.

-

Can I integrate airSlate SignNow with other software for filing Maryland Form 505NR?

Absolutely! airSlate SignNow offers a variety of integrations with popular software applications, making it easy to process your Maryland Form 505NR alongside other tools you may be using. This enables you to maintain a seamless workflow and enhance productivity.

-

What are the benefits of using airSlate SignNow for Maryland Form 505NR?

Using airSlate SignNow for your Maryland Form 505NR offers several benefits, including increased efficiency, improved accuracy, and reduced paperwork. Our platform helps you manage your tax forms more effectively, ensuring quick turnaround and compliance with state regulations.

-

How secure is airSlate SignNow when handling Maryland Form 505NR?

airSlate SignNow prioritizes security, ensuring that your Maryland Form 505NR and other documents are protected with high-level encryption and secure access controls. You can confidently eSign and send your sensitive tax information, knowing it’s safe from unauthorized access.

Get more for Form 505NR Non Resident Income Tax Calculation 505NR Non Resident Income Tax Calculation Comptroller Of Maryland

- Code pva amp oag form

- Q terminate q modify the order of q partial disability q disability entered on 2 form

- Application for appointment of fiduciary for disabled persons form

- Linking the kentucky k prep assessments to nwea map form

- Fillable online case no court fax email print pdffiller form

- Informal final settlement

- Affidavit of waiver of form

- In re estate of a unmarried minor under the age of 18 form

Find out other Form 505NR Non Resident Income Tax Calculation 505NR Non Resident Income Tax Calculation Comptroller Of Maryland

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement