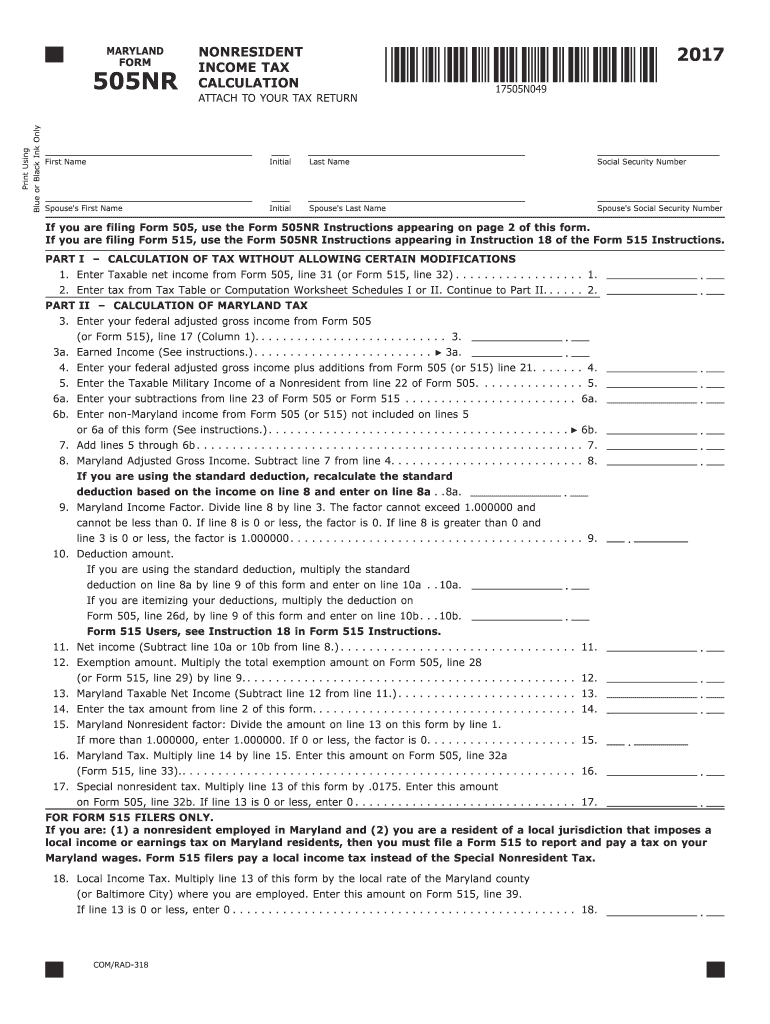

Enter Tax from Tax Table or Computation Worksheet Schedules I or II 2017

What is the Enter Tax From Tax Table Or Computation Worksheet Schedules I Or II

The Enter Tax From Tax Table Or Computation Worksheet Schedules I Or II is a crucial document used in the tax filing process. This form allows taxpayers to accurately report their tax obligations based on the information provided in the tax tables or computation worksheets. It is essential for ensuring that individuals and businesses comply with federal tax regulations. The form is typically used by various taxpayers, including employees, self-employed individuals, and business owners, to determine their tax liabilities for the year.

How to use the Enter Tax From Tax Table Or Computation Worksheet Schedules I Or II

Using the Enter Tax From Tax Table Or Computation Worksheet Schedules I Or II involves several steps. First, gather all necessary financial documents, including income statements and previous tax returns. Next, locate the appropriate tax table or computation worksheet that corresponds to your filing status and income level. Follow the instructions to enter your income figures into the form accurately. This process ensures that you calculate your tax liability correctly based on the current tax laws.

Steps to complete the Enter Tax From Tax Table Or Computation Worksheet Schedules I Or II

Completing the Enter Tax From Tax Table Or Computation Worksheet Schedules I Or II requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial documentation, including W-2s, 1099s, and other income statements.

- Identify your filing status (single, married filing jointly, etc.) and locate the corresponding tax table.

- Input your total income into the appropriate section of the form.

- Use the tax table or computation worksheet to determine your tax liability based on your income level.

- Double-check your entries for accuracy before submitting the form.

Legal use of the Enter Tax From Tax Table Or Computation Worksheet Schedules I Or II

The legal use of the Enter Tax From Tax Table Or Computation Worksheet Schedules I Or II is governed by federal tax laws. To ensure that the form is legally valid, it must be completed accurately and submitted by the appropriate deadlines. Additionally, taxpayers must retain copies of the completed form and any supporting documents for their records. Compliance with IRS regulations is essential to avoid potential penalties or audits.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the Enter Tax From Tax Table Or Computation Worksheet Schedules I Or II. These guidelines include instructions on how to fill out the form, deadlines for submission, and the consequences of non-compliance. Taxpayers are encouraged to refer to the IRS website or consult a tax professional for the most current information and guidance.

Filing Deadlines / Important Dates

Filing deadlines for the Enter Tax From Tax Table Or Computation Worksheet Schedules I Or II are typically aligned with the annual tax filing season. Generally, individual taxpayers must submit their forms by April fifteenth of each year. However, extensions may be available under certain circumstances. It is important for taxpayers to be aware of these deadlines to avoid late fees and penalties.

Required Documents

To complete the Enter Tax From Tax Table Or Computation Worksheet Schedules I Or II, several documents are required. These typically include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income sources.

- Previous year’s tax return for reference.

- Documentation of deductions or credits you plan to claim.

Quick guide on how to complete enter tax from tax table or computation worksheet schedules i or ii

Complete Enter Tax From Tax Table Or Computation Worksheet Schedules I Or II effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any hindrances. Manage Enter Tax From Tax Table Or Computation Worksheet Schedules I Or II on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Enter Tax From Tax Table Or Computation Worksheet Schedules I Or II with ease

- Obtain Enter Tax From Tax Table Or Computation Worksheet Schedules I Or II and click Get Form to begin.

- Use the tools we offer to submit your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your PC.

Leave behind the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device you prefer. Modify and eSign Enter Tax From Tax Table Or Computation Worksheet Schedules I Or II and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct enter tax from tax table or computation worksheet schedules i or ii

Create this form in 5 minutes!

How to create an eSignature for the enter tax from tax table or computation worksheet schedules i or ii

How to make an electronic signature for the Enter Tax From Tax Table Or Computation Worksheet Schedules I Or Ii online

How to create an eSignature for your Enter Tax From Tax Table Or Computation Worksheet Schedules I Or Ii in Google Chrome

How to create an electronic signature for putting it on the Enter Tax From Tax Table Or Computation Worksheet Schedules I Or Ii in Gmail

How to make an electronic signature for the Enter Tax From Tax Table Or Computation Worksheet Schedules I Or Ii right from your smart phone

How to create an eSignature for the Enter Tax From Tax Table Or Computation Worksheet Schedules I Or Ii on iOS devices

How to generate an eSignature for the Enter Tax From Tax Table Or Computation Worksheet Schedules I Or Ii on Android devices

People also ask

-

What is the process to enter tax from tax table or computation worksheet schedules I or II using airSlate SignNow?

To enter tax from tax table or computation worksheet schedules I or II in airSlate SignNow, you simply upload the document and use our intuitive interface to fill in the necessary fields. The platform guides you through entering tax details efficiently, ensuring compliance and accuracy in your submissions.

-

Can I customize forms for entering tax from tax table or computation worksheet schedules I or II?

Yes, airSlate SignNow allows you to customize your forms extensively. You can tailor the input fields, add checkboxes, and create dropdown menus to ensure an accurate entry of tax from tax table or computation worksheet schedules I or II according to your specific requirements.

-

What are the pricing options for using airSlate SignNow for tax document handling?

airSlate SignNow offers multiple pricing tiers to fit different business needs. Each plan provides varying features for entering tax from tax table or computation worksheet schedules I or II, ensuring that you have access to the tools necessary for efficient document management at an affordable rate.

-

Does airSlate SignNow integrate with other software for seamless tax processing?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to streamline entering tax from tax table or computation worksheet schedules I or II. This integration enhances your productivity by linking your tax processing with other business tools you may already be using.

-

What benefits can I expect from using airSlate SignNow to enter tax from tax table or computation worksheet schedules I or II?

Using airSlate SignNow to enter tax from tax table or computation worksheet schedules I or II increases your efficiency and accuracy. The platform automates repetitive tasks, reduces human errors, and speeds up document processing, allowing you to focus more on your core business operations.

-

Is airSlate SignNow user-friendly for beginners needing to enter tax from tax table or computation worksheet schedules I or II?

Yes, airSlate SignNow is designed with user-friendliness in mind. The platform features an intuitive interface that makes it straightforward for beginners to enter tax from tax table or computation worksheet schedules I or II without any technical expertise.

-

How can I ensure the security of my tax documents while using airSlate SignNow?

airSlate SignNow prioritizes the security of your documents. We implement advanced encryption and secure access protocols to protect your tax documents as you enter tax from tax table or computation worksheet schedules I or II, ensuring sensitive information is kept safe.

Get more for Enter Tax From Tax Table Or Computation Worksheet Schedules I Or II

Find out other Enter Tax From Tax Table Or Computation Worksheet Schedules I Or II

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form