505NR49 121622 a 505NR49 121622 a 2022

What is the Maryland Form 505?

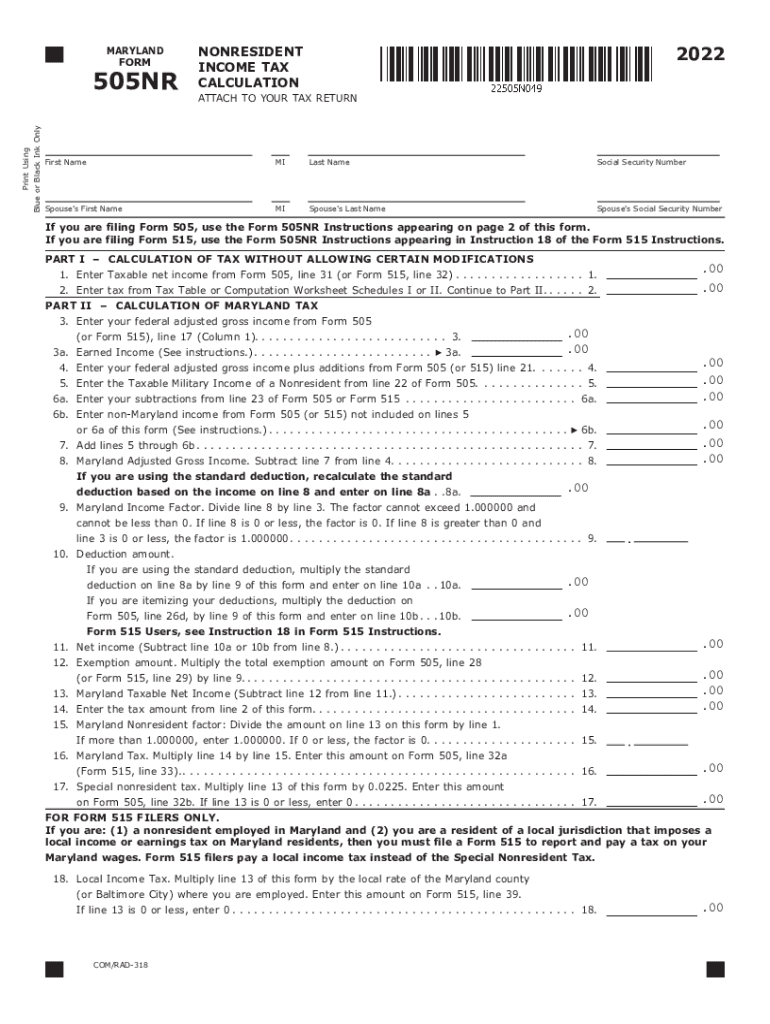

The Maryland Form 505 is a tax form specifically designed for non-resident individuals who earn income in Maryland. This form allows taxpayers to report their Maryland-source income and calculate the appropriate tax owed to the state. It is essential for individuals who do not reside in Maryland but have earned income from Maryland sources, such as wages, rental income, or business profits. Understanding this form is crucial for compliance with Maryland tax laws and ensuring that non-residents fulfill their tax obligations accurately.

Steps to Complete the Maryland Form 505

Completing the Maryland Form 505 involves several key steps to ensure accurate reporting of income and tax liability. The process typically includes:

- Gathering necessary documentation, such as W-2 forms, 1099s, and records of any Maryland-source income.

- Filling out the personal information section, including name, address, and Social Security number.

- Reporting all applicable Maryland-source income in the designated sections of the form.

- Calculating the tax owed using the provided tax tables and instructions.

- Reviewing the completed form for accuracy before submission.

Utilizing digital solutions can streamline this process, making it easier to fill out and sign the form securely.

Filing Deadlines / Important Dates

It is vital for non-residents to be aware of the filing deadlines associated with the Maryland Form 505. Typically, the form must be submitted by April 15 of the tax year following the income earned. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be mindful of any extensions that may apply, as well as specific deadlines for estimated tax payments if applicable.

Required Documents for Maryland Form 505

To complete the Maryland Form 505 accurately, taxpayers should prepare several key documents, including:

- W-2 forms from employers showing Maryland wages.

- 1099 forms for any other income received from Maryland sources.

- Records of any deductions or credits that may apply to Maryland taxes.

- Proof of residency in another state, if applicable.

Having these documents ready will facilitate a smoother filing process and help ensure compliance with state regulations.

Form Submission Methods

The Maryland Form 505 can be submitted through various methods, providing flexibility for non-residents. Taxpayers may choose to file:

- Online, using approved e-filing software that supports Maryland tax forms.

- By mail, sending the completed form to the appropriate Maryland tax office.

- In-person, at designated tax offices if assistance is needed.

Each submission method has its own guidelines and processing times, so it is essential to choose the one that best suits individual needs.

Legal Use of the Maryland Form 505

The Maryland Form 505 holds legal significance as it is used to report income and calculate tax liability for non-residents. Proper completion of this form ensures compliance with Maryland tax laws, which helps avoid penalties and interest for late or incorrect filings. Additionally, the form must be signed and dated to validate the submission, and electronic signatures are accepted when using secure digital platforms. Understanding the legal implications of this form is critical for maintaining compliance and protecting one’s financial interests.

Quick guide on how to complete 505nr49 121622 a 505nr49 121622 a

Complete 505NR49 121622 A 505NR49 121622 A seamlessly on any gadget

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can locate the right form and securely store it in the cloud. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents quickly without any holdups. Manage 505NR49 121622 A 505NR49 121622 A on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign 505NR49 121622 A 505NR49 121622 A with ease

- Locate 505NR49 121622 A 505NR49 121622 A and then click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this task.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select how you want to send your form, whether by email, SMS, or invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign 505NR49 121622 A 505NR49 121622 A and ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 505nr49 121622 a 505nr49 121622 a

Create this form in 5 minutes!

How to create an eSignature for the 505nr49 121622 a 505nr49 121622 a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland Form 505?

The Maryland Form 505 is a tax return form that businesses and individuals use to report income and calculate tax liabilities in the state of Maryland. Utilizing airSlate SignNow can simplify the signing and submission process of the Maryland Form 505, making it easier to stay compliant with state regulations.

-

How can airSlate SignNow help me with the Maryland Form 505?

airSlate SignNow provides a user-friendly platform for electronically signing and sending the Maryland Form 505. By using our service, you can streamline your filing process, reduce paper waste, and ensure that your documents are securely signed and submitted on time.

-

What are the pricing options for using airSlate SignNow for Maryland Form 505?

airSlate SignNow offers several pricing plans that cater to different business sizes and needs, making it cost-effective for handling the Maryland Form 505. You can choose a plan based on your frequency of use, features required, and budget, ensuring an affordable solution for your eSigning needs.

-

Is airSlate SignNow compliant with Maryland tax regulations?

Yes, airSlate SignNow is compliant with Maryland tax regulations, including those governing the Maryland Form 505. Our platform adheres to industry standards for electronic signatures, ensuring that your eSigned documents are legally valid and compliant with state requirements.

-

What features does airSlate SignNow offer for streamlining the Maryland Form 505 process?

airSlate SignNow offers features such as document templates, secure cloud storage, and audit trails that enhance the process of managing the Maryland Form 505. These tools help you prepare, sign, and track your documents efficiently, reducing the time spent on administrative tasks.

-

Can I integrate airSlate SignNow with other tools to complete the Maryland Form 505?

Absolutely! airSlate SignNow provides integrations with popular business tools such as Google Drive, Salesforce, and Microsoft Office, making it easier to access your documents for the Maryland Form 505. These integrations create a seamless workflow, allowing you to manage all your documentation in one place.

-

How does eSigning the Maryland Form 505 with airSlate SignNow work?

eSigning the Maryland Form 505 with airSlate SignNow is a straightforward process. After uploading your document, you can easily add the necessary signers, send the form for signature, and track the signing status in real-time, ensuring a quick and hassle-free experience.

Get more for 505NR49 121622 A 505NR49 121622 A

- Letter to landlord to extend tenancy agreement form

- Application for sublease south carolina form

- Inventory and condition of leased premises for pre lease and post lease south carolina form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out south carolina form

- Property manager agreement south carolina form

- Agreement for delayed or partial rent payments south carolina form

- Tenants maintenance repair request form south carolina

- Guaranty attachment to lease for guarantor or cosigner south carolina form

Find out other 505NR49 121622 A 505NR49 121622 A

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement