Form 505nr 2018

What is the Form 505nr

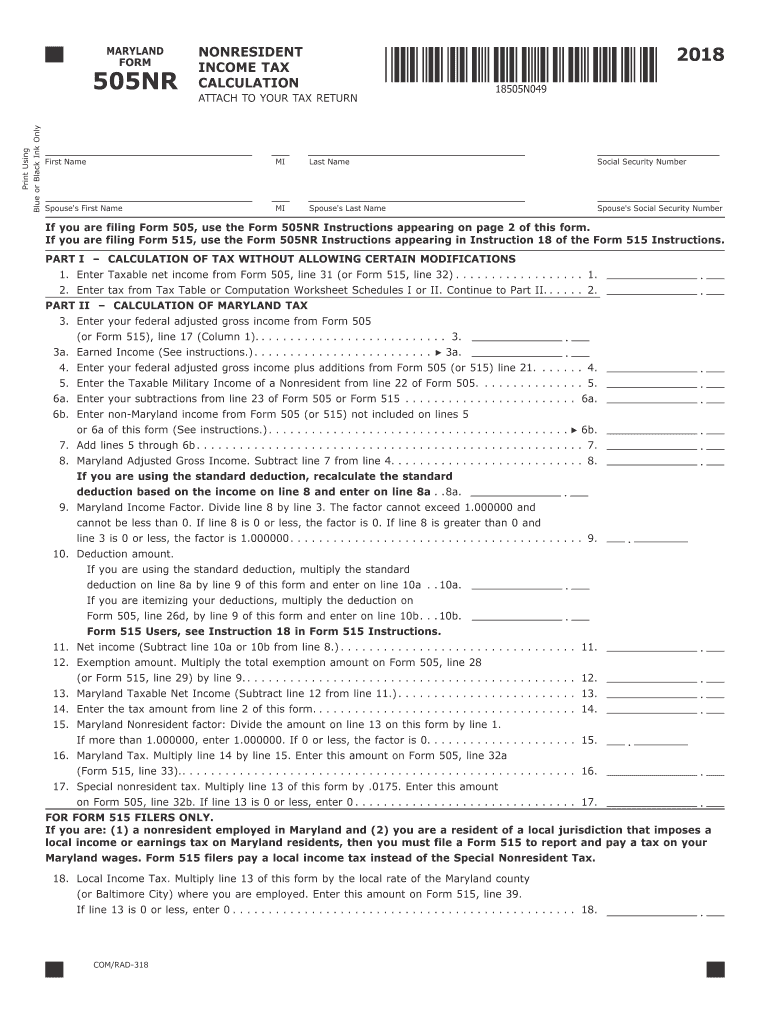

The Maryland 505nr form is a tax document specifically designed for non-residents who earn income in Maryland. This form allows individuals to report their Maryland-source income and calculate the appropriate tax liability. It is essential for non-residents to use this form to ensure compliance with state tax laws and to avoid potential penalties. The 505nr form is part of the Maryland tax system and is crucial for those who do not reside in the state but have earned income there.

How to use the Form 505nr

To effectively use the Maryland 505nr form, individuals must first gather all relevant financial documents, including W-2s, 1099s, and any other income statements related to earnings in Maryland. After obtaining these documents, taxpayers can fill out the form by entering their income, deductions, and credits applicable to non-residents. It is important to follow the instructions provided with the form closely to ensure accurate completion and submission.

Steps to complete the Form 505nr

Completing the Maryland 505nr form involves several key steps:

- Gather necessary documents, including income statements and previous tax returns.

- Fill out personal information, including name, address, and Social Security number.

- Report all Maryland-source income accurately in the designated sections.

- Claim any deductions or credits applicable to non-residents.

- Calculate the total tax owed or refund due based on the information provided.

- Review the completed form for accuracy before submission.

Legal use of the Form 505nr

The Maryland 505nr form is legally binding when completed and submitted in accordance with state regulations. For the form to be valid, it must be signed and dated by the taxpayer. Additionally, it is important to comply with all relevant tax laws and guidelines to ensure that the form is recognized by the Maryland State Comptroller. Using a reliable eSignature solution can enhance the legal standing of the document by providing a secure and verifiable signature.

Filing Deadlines / Important Dates

For the Maryland 505nr form, the filing deadline typically aligns with the federal tax deadline, which is usually April fifteenth. However, it is essential to verify the specific date each year, as it may change due to weekends or holidays. Taxpayers should also be aware of potential extensions that may apply, allowing additional time for submission under certain circumstances.

Form Submission Methods

The Maryland 505nr form can be submitted in several ways:

- Online: Taxpayers can file electronically using approved tax software that supports the Maryland tax system.

- Mail: The completed form can be printed and mailed to the Maryland State Comptroller's office.

- In-Person: Taxpayers may also choose to deliver the form directly to a local Maryland tax office.

Quick guide on how to complete sign your tax return in blue inkdonald marron

Complete Form 505nr effortlessly on any device

Web-based document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct form and securely save it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly and without delays. Manage Form 505nr on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to edit and eSign Form 505nr effortlessly

- Locate Form 505nr and click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Select relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature with the Sign tool, which takes just seconds and has the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Modify and eSign Form 505nr while ensuring effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sign your tax return in blue inkdonald marron

Create this form in 5 minutes!

How to create an eSignature for the sign your tax return in blue inkdonald marron

How to create an eSignature for the Sign Your Tax Return In Blue Inkdonald Marron in the online mode

How to make an eSignature for the Sign Your Tax Return In Blue Inkdonald Marron in Google Chrome

How to create an electronic signature for putting it on the Sign Your Tax Return In Blue Inkdonald Marron in Gmail

How to make an electronic signature for the Sign Your Tax Return In Blue Inkdonald Marron from your mobile device

How to create an electronic signature for the Sign Your Tax Return In Blue Inkdonald Marron on iOS devices

How to generate an eSignature for the Sign Your Tax Return In Blue Inkdonald Marron on Android

People also ask

-

What is the 505nr Maryland form and why is it important?

The 505nr Maryland form is essential for non-resident taxpayers who need to report their income earned in Maryland. Understanding this form is vital to ensure compliance with Maryland tax laws and avoid penalties. Utilizing efficient eSigning solutions like airSlate SignNow can streamline the process of submitting your 505nr Maryland documentation.

-

How can I effective eSign my 505nr Maryland documents?

With airSlate SignNow, you can easily eSign your 505nr Maryland documents online in a few simple steps. Our platform provides a user-friendly interface that makes it easy to upload, sign, and send documents securely. This ensures that your submissions are completed accurately and in a timely manner.

-

What features does airSlate SignNow offer for managing 505nr Maryland forms?

airSlate SignNow offers features such as customized templates, document tracking, and secure cloud storage, specifically tailored to manage your 505nr Maryland forms efficiently. You can set reminders for deadlines, and collaborate with other parties involved seamlessly. These features contribute to a smooth workflow for completing your tax responsibilities.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers competitive pricing options that can cater to various business needs and budgets when handling 505nr Maryland paperwork. Our plans range from individual to business tiers, allowing you to choose the right features based on your requirements. Sign up today to explore a cost-effective solution that simplifies your document management.

-

Is airSlate SignNow compliant with Maryland's legal requirements for eSigning 505nr documents?

Yes, airSlate SignNow is fully compliant with Maryland's electronic signature laws, ensuring that your signed 505nr Maryland documents are legally valid. Our platform follows industry standards to maintain the integrity and security of your eSigned documents. You can trust that your submissions meet all necessary legal requirements.

-

Can airSlate SignNow integrate with other applications for processing 505nr Maryland forms?

Absolutely, airSlate SignNow integrates seamlessly with a variety of applications, enhancing your experience when processing 505nr Maryland forms. Whether you use CRMs, cloud storage, or other document management tools, our integrations help streamline your workflow. This makes it easier to manage your documents and stay organized.

-

What are the benefits of using airSlate SignNow for my 505nr Maryland submissions?

Using airSlate SignNow for your 505nr Maryland submissions offers numerous benefits, including convenience, time savings, and enhanced security. You can easily eSign and send documents from anywhere, reducing delays and increasing efficiency in your tax reporting process. Our platform empowers you to manage documents effectively and with peace of mind.

Get more for Form 505nr

- Vanguard 529 form

- Ira transfers due to divorce vanguard form

- Lincoln request distribution form

- Medco 13 2009 form

- Twb 2 transitional work offer and acceptance form

- Medco 31 request for prior authorization of medication form

- The mt charitable foundation online application form

- Enrollment form for automatic payments mampt bank

Find out other Form 505nr

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document