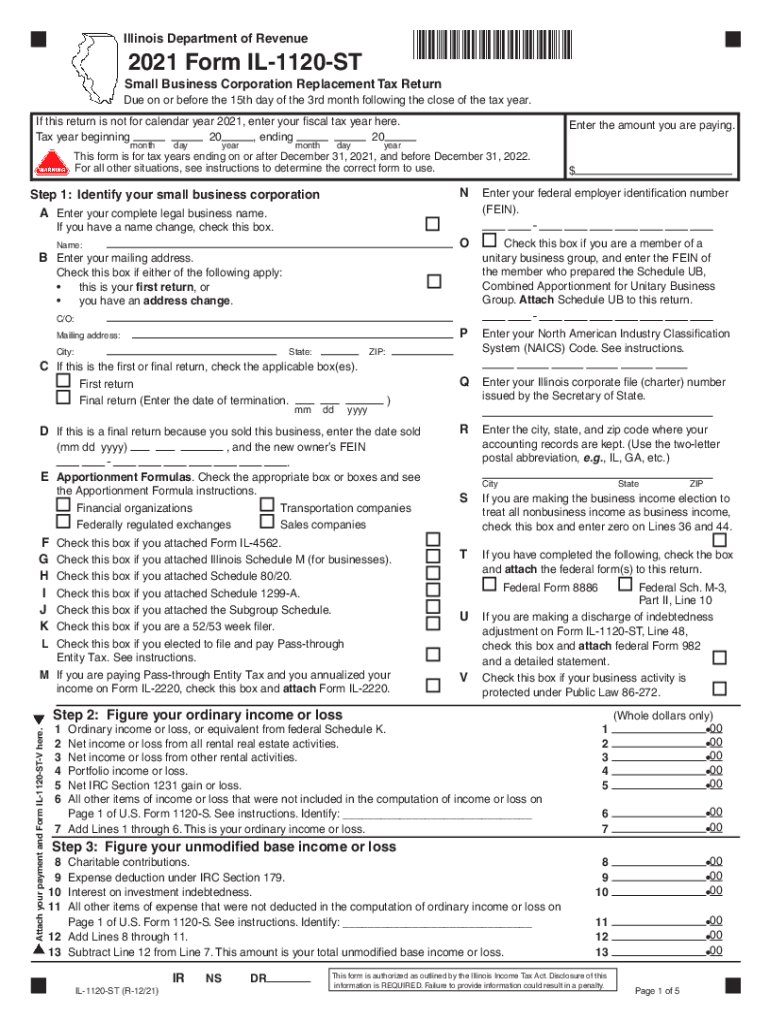

Form IL 1120 ST, Small Business Corporation Replacement Tax Return 2021

What is the Form IL 1120 ST?

The Form IL 1120 ST is a tax return specifically designed for small business corporations in Illinois. This form is used to report the replacement tax owed by corporations that elect to be taxed under the Illinois Small Business Corporation Replacement Tax Act. It is important for corporations to accurately complete this form to ensure compliance with state tax regulations.

Steps to complete the Form IL 1120 ST

Completing the Form IL 1120 ST involves several key steps to ensure accuracy and compliance:

- Gather necessary information: Collect financial records, including income statements and balance sheets, to provide accurate data.

- Fill out the form: Input the required information, such as total income, deductions, and tax calculations, in the appropriate sections of the form.

- Review for accuracy: Double-check all entries to ensure there are no errors or omissions that could lead to penalties.

- Sign and date the form: Ensure that the form is signed by an authorized individual within the corporation before submission.

Legal use of the Form IL 1120 ST

The legal use of the Form IL 1120 ST is critical for compliance with Illinois tax laws. This form must be filed by corporations that meet specific criteria under the Illinois Small Business Corporation Replacement Tax Act. Failure to file the form correctly can result in penalties, interest on unpaid taxes, and potential legal action. It is essential for businesses to understand their obligations and ensure that the form is submitted by the designated deadlines.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the Form IL 1120 ST to avoid penalties. Typically, the form is due on the 15th day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is generally due by March 15. It is advisable for corporations to mark their calendars with important dates to ensure timely submission.

Form Submission Methods

The Form IL 1120 ST can be submitted through various methods, offering flexibility for businesses:

- Online submission: Corporations can file the form electronically through the Illinois Department of Revenue's online portal.

- Mail submission: The form can be printed and mailed to the appropriate address as specified in the form instructions.

- In-person submission: Corporations may also choose to deliver the completed form in person at designated state revenue offices.

Eligibility Criteria

To be eligible to file the Form IL 1120 ST, a corporation must meet specific criteria set by the Illinois Department of Revenue. Generally, this includes being classified as a small business corporation under the Illinois Small Business Corporation Replacement Tax Act. Additionally, the corporation must have a valid Illinois business registration and comply with state tax laws. Understanding these eligibility requirements is crucial for ensuring proper filing.

Quick guide on how to complete 2021 form il 1120 st small business corporation replacement tax return

Prepare Form IL 1120 ST, Small Business Corporation Replacement Tax Return effortlessly on any device

Online document handling has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents quickly without any delays. Manage Form IL 1120 ST, Small Business Corporation Replacement Tax Return on any platform with airSlate SignNow Android or iOS applications and simplify any document-centric process today.

The easiest way to modify and eSign Form IL 1120 ST, Small Business Corporation Replacement Tax Return without hassle

- Locate Form IL 1120 ST, Small Business Corporation Replacement Tax Return and then click Get Form to begin.

- Utilize the tools we provide to submit your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the concerns of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Update and eSign Form IL 1120 ST, Small Business Corporation Replacement Tax Return and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form il 1120 st small business corporation replacement tax return

Create this form in 5 minutes!

How to create an eSignature for the 2021 form il 1120 st small business corporation replacement tax return

The way to generate an electronic signature for a PDF online

The way to generate an electronic signature for a PDF in Google Chrome

The way to create an e-signature for signing PDFs in Gmail

The best way to create an e-signature straight from your smartphone

The best way to make an e-signature for a PDF on iOS

The best way to create an e-signature for a PDF document on Android

People also ask

-

What is the il 1120 st form used for?

The il 1120 st form is a streamlined tax return designed for S corporations in Illinois. It allows businesses to report their income, deductions, and credits while ensuring compliance with state tax laws. Understanding how to properly fill out this form can greatly benefit your tax filing process.

-

How can airSlate SignNow help with filing the il 1120 st?

AirSlate SignNow simplifies the process of preparing and signing documents like the il 1120 st form. With electronic signatures and efficient document management, you can ensure your tax returns are signature-ready and submitted promptly without any hassles.

-

Is airSlate SignNow cost-effective for businesses filing the il 1120 st?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to eSign important documents, including the il 1120 st. With various pricing plans available, you can choose one that fits your budget and signNowly streamline your tax-related workflows.

-

What features does airSlate SignNow offer for handling the il 1120 st?

AirSlate SignNow provides features such as document templates, automated workflows, and secure eSigning, all geared towards facilitating processes like filing the il 1120 st. These features not only save time but also enhance accuracy and compliance for your tax submissions.

-

Can I integrate airSlate SignNow with other software for managing the il 1120 st?

Absolutely! AirSlate SignNow offers integrations with various accounting and document management software that can assist with the il 1120 st form preparation. This ensures a seamless workflow, enabling you to connect all your necessary tools for efficient tax management.

-

What are the benefits of using airSlate SignNow for the il 1120 st?

Using airSlate SignNow for your il 1120 st form offers several benefits, including enhanced security, faster processing, and improved collaboration. These advantages help businesses efficiently navigate their tax obligations, ensuring timely submissions and reducing the risk of errors.

-

Is the il 1120 st form electronic filing supported by airSlate SignNow?

Yes, airSlate SignNow fully supports electronic filing for the il 1120 st form. By providing a platform for secure eSigning, it facilitates smooth electronic submissions, allowing businesses to meet deadlines without the stress of traditional paper filing.

Get more for Form IL 1120 ST, Small Business Corporation Replacement Tax Return

Find out other Form IL 1120 ST, Small Business Corporation Replacement Tax Return

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement