Form IL 1120 ST, Small Business Corporation Replacement Tax Return 2023-2026

What is the Form IL 1120 ST, Small Business Corporation Replacement Tax Return

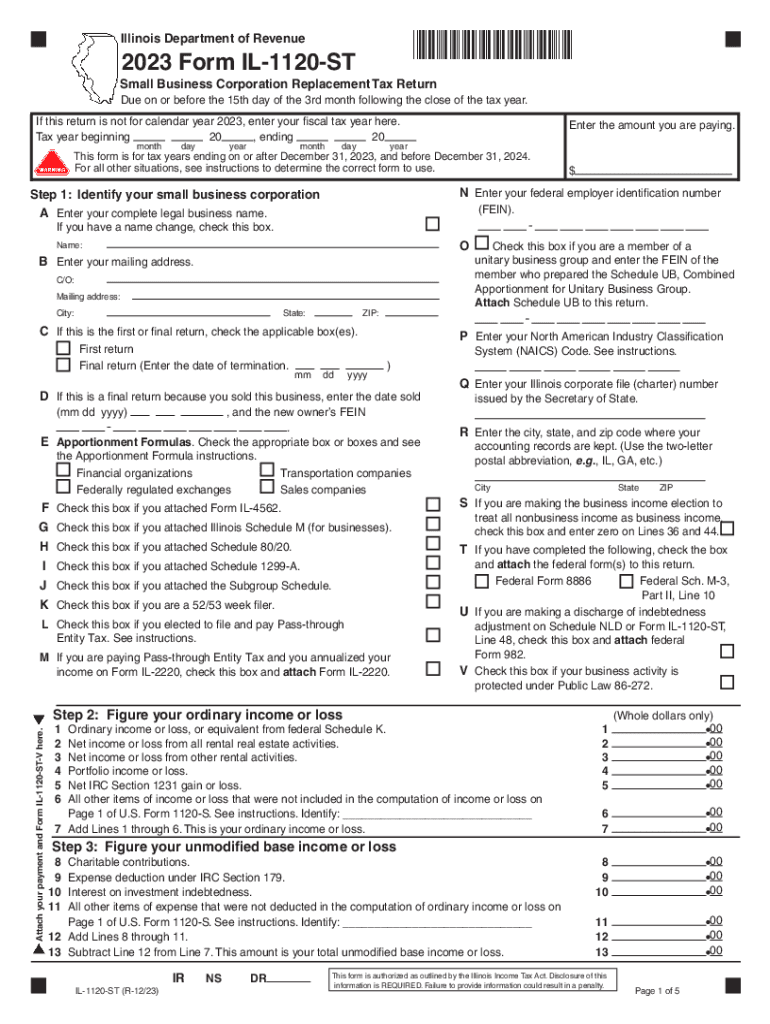

The Form IL 1120 ST is used by small business corporations in Illinois to report their income and calculate the replacement tax owed to the state. This form is specifically designed for corporations that meet the criteria of a small business as defined by Illinois law. The replacement tax is a tax imposed on corporations in lieu of the corporate income tax. Understanding the purpose of this form is essential for compliance with state tax regulations.

Steps to complete the Form IL 1120 ST, Small Business Corporation Replacement Tax Return

Completing the Form IL 1120 ST involves several key steps to ensure accurate reporting and compliance. Begin by gathering necessary financial documents, including income statements and balance sheets. Next, fill out the identification section with your corporation's name, address, and federal employer identification number (EIN). Proceed to report your total income and allowable deductions, which will help calculate your taxable income. Finally, compute the replacement tax based on the taxable income and submit the form by the designated deadline.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Form IL 1120 ST to avoid penalties. Generally, the form is due on the 15th day of the third month following the close of your corporation's tax year. For corporations operating on a calendar year, this means the form is typically due by March 15. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Keeping track of these dates helps ensure timely submission and compliance with state tax laws.

Key elements of the Form IL 1120 ST, Small Business Corporation Replacement Tax Return

The Form IL 1120 ST includes several key elements that are essential for accurate completion. These elements consist of the corporation's identification information, income reporting sections, and deduction categories. Additionally, the form requires calculations for the replacement tax based on the reported taxable income. It is important to review each section carefully and ensure that all information is complete and accurate to prevent delays in processing.

How to obtain the Form IL 1120 ST, Small Business Corporation Replacement Tax Return

The Form IL 1120 ST can be obtained through the Illinois Department of Revenue's official website. It is available for download in a printable format, allowing businesses to fill it out manually. Additionally, the form may be available at local tax offices or through tax professionals who assist with corporate tax filings. Ensuring that you have the correct and most current version of the form is vital for compliance.

Penalties for Non-Compliance

Failing to file the Form IL 1120 ST on time can result in penalties imposed by the Illinois Department of Revenue. These penalties may include late filing fees, interest on unpaid taxes, and additional charges for failure to comply with state tax regulations. Understanding these potential consequences emphasizes the importance of timely and accurate filing to avoid unnecessary financial burdens.

Quick guide on how to complete form il 1120 st small business corporation replacement tax return 708770280

Effortlessly Prepare Form IL 1120 ST, Small Business Corporation Replacement Tax Return on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers a perfect environmentally friendly alternative to conventional printed and signed papers, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents promptly without delays. Manage Form IL 1120 ST, Small Business Corporation Replacement Tax Return on any device with the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to Edit and eSign Form IL 1120 ST, Small Business Corporation Replacement Tax Return with Ease

- Find Form IL 1120 ST, Small Business Corporation Replacement Tax Return and then select Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Accentuate pertinent sections of your documents or black out sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form IL 1120 ST, Small Business Corporation Replacement Tax Return and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form il 1120 st small business corporation replacement tax return 708770280

Create this form in 5 minutes!

How to create an eSignature for the form il 1120 st small business corporation replacement tax return 708770280

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2023 form IL 1120 ST?

The 2023 form IL 1120 ST is a tax form used by S corporations in Illinois to report their income, deductions, and tax obligations. It's essential for maintaining compliance with state tax regulations. Using electronic solutions like airSlate SignNow can simplify the process of preparing and submitting this form.

-

How can airSlate SignNow assist with the 2023 form IL 1120 ST?

AirSlate SignNow provides users with tools to easily prepare, sign, and send the 2023 form IL 1120 ST electronically. This makes the filing process more efficient and reduces the risk of errors. The platform is particularly helpful for businesses looking for an organized way to manage their tax documents.

-

Is there a cost associated with using airSlate SignNow for the 2023 form IL 1120 ST?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. The cost varies based on the features you choose, but it is designed to be cost-effective, ensuring you get value for your investment, especially when managing forms like the 2023 form IL 1120 ST.

-

What features of airSlate SignNow are beneficial for submitting the 2023 form IL 1120 ST?

AirSlate SignNow comes equipped with features such as document templates, eSignature capabilities, and secure document storage. These tools streamline the submission of the 2023 form IL 1120 ST, making it quicker and less stressful for users, while ensuring compliance with state regulations.

-

How does airSlate SignNow ensure the security of the 2023 form IL 1120 ST?

Security is a priority at airSlate SignNow, which uses advanced encryption and secure cloud storage to protect sensitive tax information. When preparing and submitting the 2023 form IL 1120 ST, businesses can rest assured their data is safe, maintaining confidentiality and integrity.

-

Can I integrate airSlate SignNow with other software for the 2023 form IL 1120 ST?

Absolutely! AirSlate SignNow offers integrations with various accounting and business software solutions. This means you can easily sync data and documents related to the 2023 form IL 1120 ST, streamlining your workflow and improving efficiency.

-

How quickly can I complete the 2023 form IL 1120 ST using airSlate SignNow?

Using airSlate SignNow can signNowly reduce the time it takes to complete the 2023 form IL 1120 ST. With user-friendly features, such as document templates and automated workflows, many businesses find they can prepare and submit their tax forms much more efficiently than traditional methods.

Get more for Form IL 1120 ST, Small Business Corporation Replacement Tax Return

Find out other Form IL 1120 ST, Small Business Corporation Replacement Tax Return

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter