Form Il 1120 St 2016

What is the Form IL 1120 ST

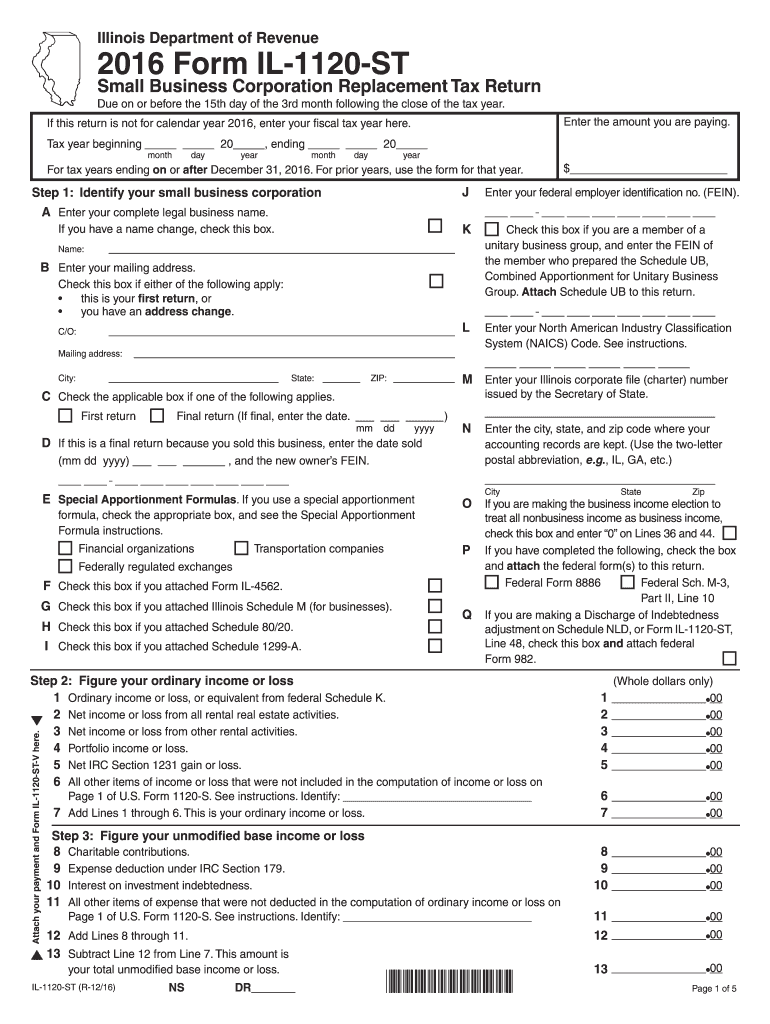

The Form IL 1120 ST is a state tax form used by small business corporations in Illinois to report their income, deductions, and tax liabilities. This form is specifically designed for corporations that are subject to the Illinois Replacement Tax, which is a tax on the income of corporations operating within the state. The IL 1120 ST is essential for ensuring compliance with state tax regulations and accurately reporting financial information to the Illinois Department of Revenue.

How to Use the Form IL 1120 ST

Using the Form IL 1120 ST involves several steps to ensure accurate completion. Taxpayers must first gather all necessary financial documents, including income statements, expense reports, and any other relevant financial records. Once the required information is collected, the taxpayer can begin filling out the form. It is important to follow the instructions provided with the form carefully, as each section requires specific information. After completing the form, it should be reviewed for accuracy before submission to avoid any potential penalties.

Steps to Complete the Form IL 1120 ST

Completing the Form IL 1120 ST involves a systematic approach:

- Gather Documentation: Collect all financial records, including income and expenses.

- Fill Out the Form: Input the required information in each section, ensuring accuracy.

- Calculate Tax Liability: Determine the amount of tax owed based on the reported income.

- Review the Form: Check for any errors or omissions to ensure compliance.

- Submit the Form: File the completed form with the Illinois Department of Revenue by the specified deadline.

Legal Use of the Form IL 1120 ST

The Form IL 1120 ST is legally binding when completed and submitted according to Illinois state tax laws. It must be signed by an authorized representative of the corporation, which may include an officer or director. The form serves as an official declaration of the corporation's financial status and tax obligations. Failure to file the form accurately and on time can result in penalties, including fines and interest on unpaid taxes.

Filing Deadlines / Important Dates

Timely filing of the Form IL 1120 ST is crucial for compliance. The due date for submitting the form is typically the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year basis, this means the form is due by March 15. It is important to be aware of any changes to filing deadlines, especially in light of potential extensions or adjustments made by the Illinois Department of Revenue.

Form Submission Methods

The Form IL 1120 ST can be submitted through various methods to accommodate different preferences:

- Online Submission: Corporations can file electronically through the Illinois Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address specified in the form instructions.

- In-Person Submission: Taxpayers may also choose to deliver the form directly to a local Department of Revenue office.

Quick guide on how to complete 2018 form il 1120 st small business corporation replacement tax return 396727012

Effortlessly Prepare Form Il 1120 St on Any Device

Online document management has increasingly gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents quickly and without delays. Manage Form Il 1120 St on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

How to Edit and Electronically Sign Form Il 1120 St with Ease

- Find Form Il 1120 St and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature with the Sign tool, which takes only a few seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form Il 1120 St to ensure excellent communication at every stage of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2018 form il 1120 st small business corporation replacement tax return 396727012

Create this form in 5 minutes!

How to create an eSignature for the 2018 form il 1120 st small business corporation replacement tax return 396727012

How to create an eSignature for the 2018 Form Il 1120 St Small Business Corporation Replacement Tax Return 396727012 online

How to make an eSignature for your 2018 Form Il 1120 St Small Business Corporation Replacement Tax Return 396727012 in Google Chrome

How to generate an electronic signature for signing the 2018 Form Il 1120 St Small Business Corporation Replacement Tax Return 396727012 in Gmail

How to generate an electronic signature for the 2018 Form Il 1120 St Small Business Corporation Replacement Tax Return 396727012 straight from your smartphone

How to create an eSignature for the 2018 Form Il 1120 St Small Business Corporation Replacement Tax Return 396727012 on iOS devices

How to create an electronic signature for the 2018 Form Il 1120 St Small Business Corporation Replacement Tax Return 396727012 on Android

People also ask

-

What is form il 1120 st?

Form IL 1120 ST is a short form used by corporations in Illinois to report income, gains, losses, credits, and payments. This simplified form is designed for eligible corporations, making the filing process easier and more efficient.

-

How can airSlate SignNow help me with form il 1120 st?

airSlate SignNow allows you to easily eSign and send your form IL 1120 ST, ensuring fast and secure submission. With our platform, you can streamline the document process, reducing the time spent on filing tax forms.

-

What features does airSlate SignNow offer for electronic signatures?

Our platform enables you to create templates, collect signatures, and store documents securely. With airSlate SignNow, you can enhance your efficiency when dealing with important documents like form IL 1120 ST, all from an intuitive interface.

-

Is there a cost associated with using airSlate SignNow for form il 1120 st?

Yes, airSlate SignNow offers various pricing plans to fit different business needs. The cost of using our service can often be justified by the time and effort saved when eSigning important documents such as form IL 1120 ST.

-

Can I integrate airSlate SignNow with other software for handling taxes?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software. This integration allows users to directly manage documents like form IL 1120 ST from their preferred platforms, enhancing workflow and efficiency.

-

What benefits does eSigning provide for form il 1120 st?

eSigning your form IL 1120 ST accelerates the filing process and enhances compliance by ensuring accurate and timely submissions. Moreover, electronic signatures provide a legally binding method to sign, reducing the risk of paper-related errors.

-

Are my documents secure when using airSlate SignNow for form il 1120 st?

Yes, security is a top priority at airSlate SignNow. All documents, including form IL 1120 ST, are encrypted and securely stored, ensuring that sensitive information remains protected throughout the signing process.

Get more for Form Il 1120 St

Find out other Form Il 1120 St

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document