Form IL 1120 ST 2020

What is the Form IL 1120 ST

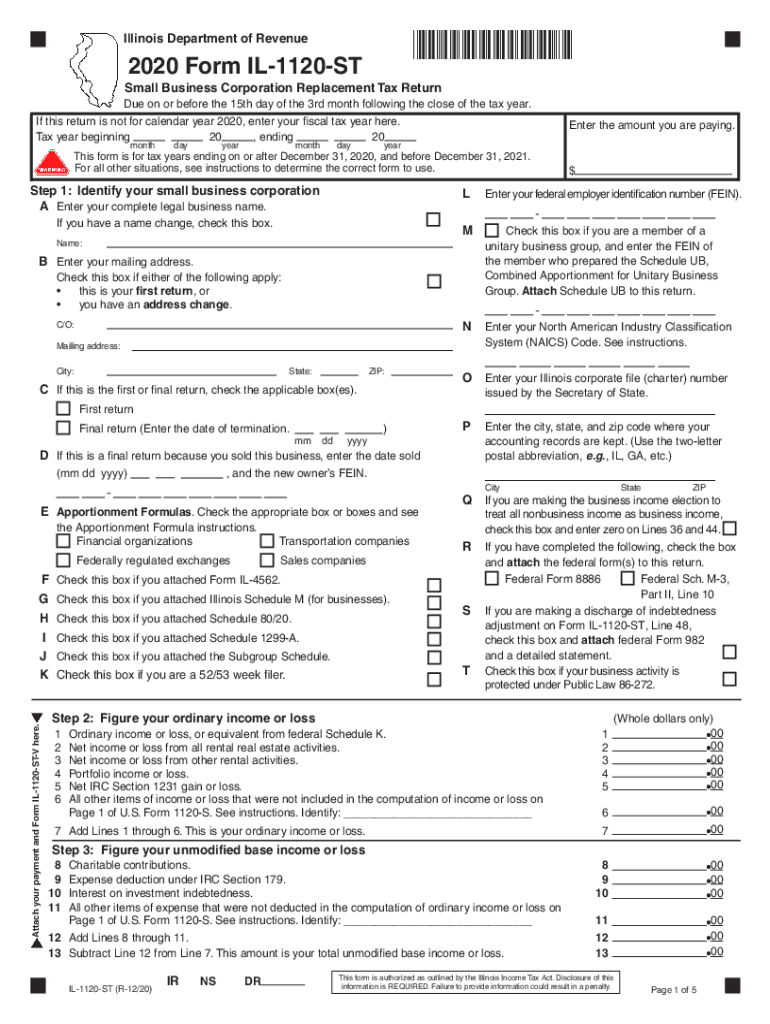

The Form IL 1120 ST is a state income tax return specifically designed for S corporations operating in Illinois. This form is essential for reporting income, deductions, and credits for S corporations that have elected to be taxed under Subchapter S of the Internal Revenue Code. It allows the corporation to calculate its state tax liability accurately and ensures compliance with Illinois tax laws.

How to use the Form IL 1120 ST

To use the Form IL 1120 ST, businesses must first gather all necessary financial documents, including income statements, deduction records, and any applicable credits. The form must be completed accurately, reflecting the corporation's financial activities for the tax year. After filling out the form, it should be submitted to the Illinois Department of Revenue, either electronically or via mail, depending on the corporation's preference.

Steps to complete the Form IL 1120 ST

Completing the Form IL 1120 ST involves several key steps:

- Gather necessary financial documents, including income statements and deduction records.

- Fill out the form accurately, ensuring all required sections are completed.

- Calculate total income, deductions, and credits to determine the tax liability.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or by mail to the Illinois Department of Revenue.

Filing Deadlines / Important Dates

The filing deadline for the Form IL 1120 ST typically aligns with the federal tax return deadline for S corporations. Generally, this means the form is due on the 15th day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by March 15. It's important to stay informed about any changes to these deadlines to avoid penalties.

Legal use of the Form IL 1120 ST

The Form IL 1120 ST is legally binding when completed and submitted according to Illinois tax laws. Proper execution of the form ensures that the S corporation complies with state tax regulations. Failure to file or inaccuracies in the form can result in penalties, interest, and potential legal issues. Therefore, it is crucial for corporations to understand the legal implications of their filings.

Required Documents

When completing the Form IL 1120 ST, several documents are required to ensure accurate reporting. These include:

- Income statements detailing revenue generated during the tax year.

- Records of deductions, such as business expenses and credits.

- Previous tax returns, if applicable, for reference.

- Any supporting documentation for claimed credits or deductions.

Who Issues the Form

The Form IL 1120 ST is issued by the Illinois Department of Revenue. This state agency is responsible for administering tax laws and collecting taxes in Illinois. The department provides guidance and resources to assist S corporations in completing their tax returns accurately and in compliance with state regulations.

Quick guide on how to complete 2020 form il 1120 st

Prepare Form IL 1120 ST effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to craft, modify, and eSign your documents swiftly and without hindrances. Manage Form IL 1120 ST on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Form IL 1120 ST without difficulty

- Locate Form IL 1120 ST and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important parts of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal standing as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, invite link, or download it to your computer.

Forget about misplaced or lost documents, exhausting form searches, or errors requiring new document copies. airSlate SignNow caters to your document management needs in just a few clicks from your preferred device. Modify and eSign Form IL 1120 ST while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form il 1120 st

Create this form in 5 minutes!

How to create an eSignature for the 2020 form il 1120 st

The way to make an eSignature for a PDF file in the online mode

The way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

How to make an electronic signature for a PDF on Android

People also ask

-

What are the state of Illinois income tax forms 2019 required for businesses?

Businesses in Illinois typically need to submit the IL-1040 form for individual income tax filings, along with any applicable schedules. The state of Illinois income tax forms 2019 must accurately reflect earnings and deductions for compliance with state regulations. It's vital to ensure that all submissions are completed on time to avoid penalties.

-

How can airSlate SignNow help me with state of Illinois income tax forms 2019?

AirSlate SignNow offers a streamlined process to electronically sign and send all required state of Illinois income tax forms 2019. With its user-friendly interface, you can quickly fill out and securely send your forms, ensuring compliance with state regulations while saving time. This makes tax season much less stressful for you and your business.

-

What features does airSlate SignNow offer for handling state of Illinois income tax forms 2019?

AirSlate SignNow provides features such as document templates, reminders, and secure storage to manage state of Illinois income tax forms 2019 efficiently. With the ability to easily track document status and automate workflows, it simplifies the entire eSigning process. This ensures your tax forms are always up-to-date and securely stored.

-

Is airSlate SignNow cost-effective for small businesses processing state of Illinois income tax forms 2019?

Yes, airSlate SignNow offers competitive pricing plans that cater to small businesses managing state of Illinois income tax forms 2019. By utilizing this electronic signature solution, businesses can save on printing, shipping, and processing costs associated with traditional methods. It's a budget-friendly option that adds signNow value to your operations.

-

Can I integrate airSlate SignNow with other software to manage state of Illinois income tax forms 2019?

Absolutely! AirSlate SignNow integrates seamlessly with various accounting and financial software, allowing businesses to manage state of Illinois income tax forms 2019 with greater efficiency. These integrations help automate data entry and reduce the risk of errors, streamlining the entire tax preparation process.

-

What benefits does using airSlate SignNow provide for filing state of Illinois income tax forms 2019?

Using airSlate SignNow to file state of Illinois income tax forms 2019 offers several benefits, including increased speed, compliance, and document security. This platform enhances collaboration among team members while reducing the time spent on administrative tasks. Additionally, it ensures that your documentation is always accessible and organized.

-

How secure is airSlate SignNow for processing state of Illinois income tax forms 2019?

AirSlate SignNow prioritizes security when handling sensitive documents like state of Illinois income tax forms 2019. The platform uses advanced encryption protocols and secure cloud storage, ensuring your information is safe from unauthorized access. Compliance with industry standards guarantees peace of mind for users.

Get more for Form IL 1120 ST

Find out other Form IL 1120 ST

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed