Colorado Form DR 0204 Estimated Tax TaxFormFinder 2021

What is the Colorado Form DR 0204?

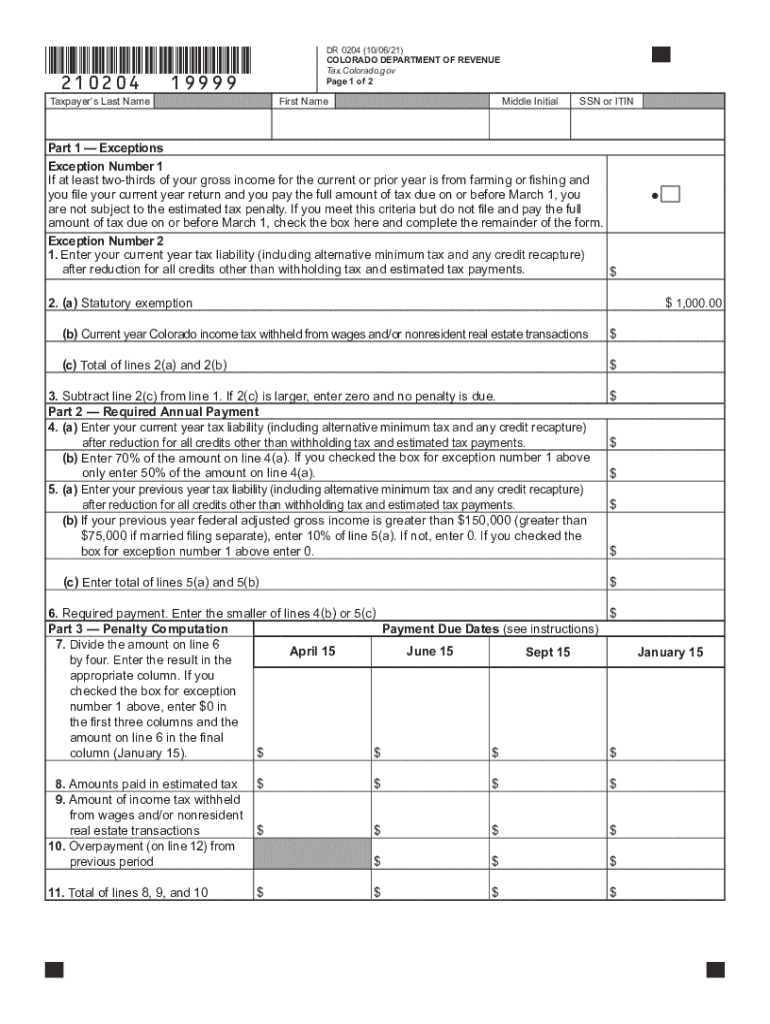

The Colorado Form DR 0204 is the state's estimated tax form used by individuals and businesses to report their expected income tax liability for the year. This form is essential for taxpayers who anticipate owing tax at the end of the year, allowing them to pay estimated taxes in quarterly installments. Completing the DR 0204 accurately ensures compliance with Colorado tax laws and helps avoid penalties for underpayment.

Steps to Complete the Colorado Form DR 0204

Completing the Colorado Form DR 0204 involves several key steps:

- Gather relevant financial information, including income sources, deductions, and credits.

- Calculate your expected taxable income for the year.

- Determine your estimated tax liability using the appropriate tax rates.

- Fill out the DR 0204 form, entering your calculated figures in the designated fields.

- Review the form for accuracy and completeness before submission.

Legal Use of the Colorado Form DR 0204

The Colorado Form DR 0204 is legally recognized as a valid document for reporting estimated taxes. To ensure its legal standing, the form must be completed in accordance with state tax regulations. Using a reliable eSignature platform, like airSlate SignNow, can enhance the legal validity of the form by providing a secure method for signing and storing documents electronically.

Filing Deadlines for the Colorado Form DR 0204

Taxpayers must be aware of the filing deadlines associated with the Colorado Form DR 0204. Generally, estimated tax payments are due on the following dates:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

Meeting these deadlines is crucial to avoid penalties and interest on unpaid taxes.

Required Documents for the Colorado Form DR 0204

When preparing to complete the Colorado Form DR 0204, certain documents are necessary to ensure accurate reporting. These may include:

- Previous year’s tax return for reference

- Income statements, such as W-2s and 1099s

- Documentation of any deductions or credits you plan to claim

Having these documents on hand will streamline the process and help ensure compliance with tax regulations.

Penalties for Non-Compliance with the Colorado Form DR 0204

Failing to file the Colorado Form DR 0204 or underpaying estimated taxes can result in significant penalties. Taxpayers may face:

- Interest on unpaid taxes

- Late filing penalties

- Additional charges for underpayment

Understanding these potential penalties emphasizes the importance of timely and accurate filing.

Quick guide on how to complete colorado form dr 0204 estimated tax taxformfinder

Easily Prepare Colorado Form DR 0204 Estimated Tax TaxFormFinder on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to access the appropriate format and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and eSign your documents quickly without delays. Manage Colorado Form DR 0204 Estimated Tax TaxFormFinder on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The Simplest Way to Amend and eSign Colorado Form DR 0204 Estimated Tax TaxFormFinder Effortlessly

- Obtain Colorado Form DR 0204 Estimated Tax TaxFormFinder and then click Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes a matter of seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your modifications.

- Select how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow manages all your document management needs in just a few clicks from a device of your choice. Adjust and eSign Colorado Form DR 0204 Estimated Tax TaxFormFinder and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct colorado form dr 0204 estimated tax taxformfinder

Create this form in 5 minutes!

How to create an eSignature for the colorado form dr 0204 estimated tax taxformfinder

The way to make an electronic signature for your PDF in the online mode

The way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an e-signature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

The best way to make an e-signature for a PDF on Android OS

People also ask

-

What is airSlate SignNow and how does it help with Colorado estimated document management?

airSlate SignNow is an innovative eSignature platform that simplifies document management for businesses. With its robust features, you can easily send, sign, and manage documents online, making it an ideal solution for managing Colorado estimated documents efficiently.

-

How much does airSlate SignNow cost for Colorado businesses?

The pricing for airSlate SignNow varies based on the plan you choose. For Colorado businesses looking for a cost-effective solution, we offer various subscription options to fit your budget and needs, ensuring you get maximum value for managing Colorado estimated documents.

-

What features does airSlate SignNow offer for managing Colorado estimated documents?

airSlate SignNow includes features such as customizable templates, real-time collaboration, and advanced security options. These tools facilitate a smooth workflow, making it easier for Colorado businesses to handle their estimated documents promptly and securely.

-

Can I integrate airSlate SignNow with other tools for managing Colorado estimated documents?

Yes, airSlate SignNow integrates seamlessly with various software applications commonly used by Colorado businesses. This integration capability allows you to streamline your processes and effectively manage Colorado estimated documents alongside your existing tools.

-

What are the benefits of using airSlate SignNow for Colorado estimated?

Using airSlate SignNow for your Colorado estimated documents offers numerous benefits including reduced turnaround times, enhanced security, and increased efficiency. By digitizing your document processes, you can focus more on your business growth while ensuring compliance.

-

Is airSlate SignNow user-friendly for Colorado businesses?

Absolutely! airSlate SignNow is designed with user experience in mind, ensuring that even those with minimal technical knowledge can easily navigate the platform. Colorado businesses will find it straightforward to send and eSign their estimated documents in no time.

-

How does airSlate SignNow ensure the security of Colorado estimated documents?

airSlate SignNow prioritizes the security of your documents with advanced encryption and secure cloud storage. For Colorado estimated documents, you can rest assured that your information is protected against unauthorized access and data bsignNowes.

Get more for Colorado Form DR 0204 Estimated Tax TaxFormFinder

- Amendment to prenuptial or premarital agreement missouri form

- Financial statements only in connection with prenuptial premarital agreement missouri form

- Revocation of premarital or prenuptial agreement missouri form

- Mo dissolution marriage form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497312999 form

- Missouri corporation form

- Mo corporation form

- Mo agreement form

Find out other Colorado Form DR 0204 Estimated Tax TaxFormFinder

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online