Colorado Dr0204 2019

What is the Colorado DR 0204?

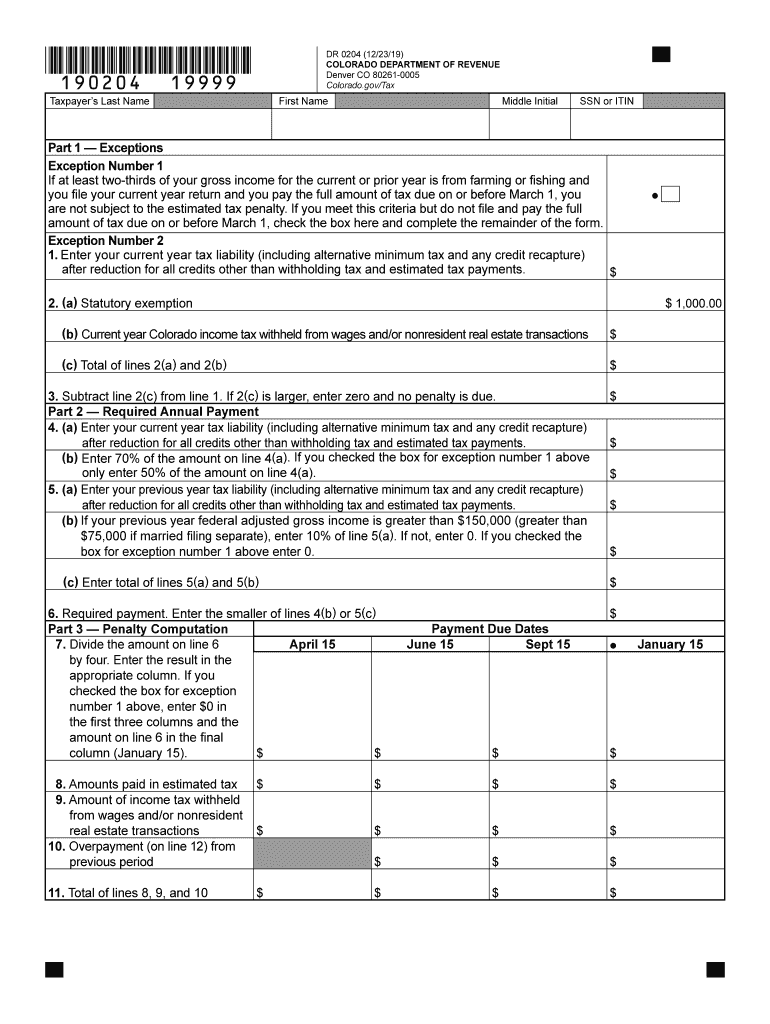

The Colorado DR 0204 form is a tax document used by individuals and businesses in Colorado to report specific tax information. This form is essential for taxpayers who need to provide details regarding their income, deductions, and tax liabilities to the Colorado Department of Revenue. The DR 0204 is particularly relevant for those who are filing their state income tax returns, ensuring compliance with state tax regulations.

How to use the Colorado DR 0204

Using the Colorado DR 0204 involves several key steps. First, gather all necessary financial documents, such as W-2s, 1099s, and any relevant receipts for deductions. Next, accurately fill out the form, ensuring all information is complete and correct. It is crucial to double-check calculations to avoid errors that could lead to delays or penalties. Once completed, the form can be submitted either electronically or via mail, depending on the taxpayer's preference.

Steps to complete the Colorado DR 0204

Completing the Colorado DR 0204 requires careful attention to detail. Follow these steps:

- Start by entering your personal information, including your name, address, and Social Security number.

- Report your income by including all sources of earnings, such as wages, interest, and dividends.

- List any deductions you are eligible for, which may include medical expenses, mortgage interest, and charitable contributions.

- Calculate your total tax liability based on the provided income and deductions.

- Review the form for accuracy and completeness before submission.

Legal use of the Colorado DR 0204

The legal use of the Colorado DR 0204 is governed by state tax laws. To ensure that the form is legally binding, it must be filled out truthfully and submitted within the designated deadlines. Additionally, electronic submissions must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act, allowing for secure and valid eSignatures. Utilizing a reliable platform for digital signing can enhance the legal validity of the form.

Filing Deadlines / Important Dates

Taxpayers must be aware of filing deadlines associated with the Colorado DR 0204. Typically, the deadline for submitting this form aligns with the federal tax deadline, which is usually April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the Colorado Department of Revenue's website for any updates or changes to filing dates each tax year.

Form Submission Methods (Online / Mail / In-Person)

The Colorado DR 0204 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Taxpayers can complete and submit the form electronically through the Colorado Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the Department of Revenue.

- In-Person: Taxpayers may also choose to deliver the form in person at designated state tax offices.

Quick guide on how to complete dr 0204 122319

Complete Colorado Dr0204 effortlessly on any device

Managing documents online has become favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents rapidly and without delays. Handle Colorado Dr0204 across any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Colorado Dr0204 with ease

- Obtain Colorado Dr0204 and click on Get Form to begin.

- Use the tools at your disposal to fill out your form.

- Emphasize essential sections of the documents or black out sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Alter and eSign Colorado Dr0204 and ensure outstanding communication at every point of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dr 0204 122319

Create this form in 5 minutes!

How to create an eSignature for the dr 0204 122319

How to create an eSignature for the Dr 0204 122319 online

How to create an electronic signature for the Dr 0204 122319 in Google Chrome

How to make an electronic signature for signing the Dr 0204 122319 in Gmail

How to create an eSignature for the Dr 0204 122319 right from your smart phone

How to create an electronic signature for the Dr 0204 122319 on iOS devices

How to generate an electronic signature for the Dr 0204 122319 on Android devices

People also ask

-

What is the DR 0204 Colorado tax form?

The DR 0204 Colorado tax form is a crucial document used for reporting your income and calculating your state tax liability. It is essential for individuals and businesses to complete this form accurately to comply with Colorado tax regulations. Using airSlate SignNow can simplify the signing and submission process for your DR 0204 Colorado tax form.

-

How can airSlate SignNow help with the DR 0204 Colorado tax form?

airSlate SignNow offers a straightforward solution for electronically signing and sending your DR 0204 Colorado tax form. This service allows you to handle all your documentation digitally, reducing the hassle of physical paperwork. Plus, the platform ensures that your forms are securely stored and easily accessible.

-

Is there a cost associated with using airSlate SignNow for the DR 0204 Colorado tax form?

Yes, airSlate SignNow operates on a subscription-based pricing model, which is still cost-effective compared to traditional methods. Depending on the plan you choose, you'll have access to various features that can assist you in managing your DR 0204 Colorado tax form efficiently. The investment can save you time and enhance productivity.

-

Are there any integrations available for airSlate SignNow that support the DR 0204 Colorado tax form process?

Absolutely! airSlate SignNow seamlessly integrates with various applications like Google Drive, Dropbox, and CRM software, facilitating a smooth workflow for handling your DR 0204 Colorado tax form. These integrations enhance collaboration and ensure that you can access your documents from multiple platforms.

-

What are the benefits of using airSlate SignNow for my tax forms?

Using airSlate SignNow for your tax forms, including the DR 0204 Colorado tax form, offers numerous benefits such as electronic signatures for faster approvals, enhanced document security, and an organized management system for storing tax documents. This not only streamlines your filing process but also ensures compliance with state regulations.

-

Can I use airSlate SignNow on mobile devices while filling the DR 0204 Colorado tax form?

Yes, airSlate SignNow is mobile-friendly, allowing you to fill out your DR 0204 Colorado tax form from any device. This means you can eSign or send your forms on the go, making it convenient for busy professionals. The mobile app provides a user-friendly interface for easy navigation.

-

How secure is using airSlate SignNow for the DR 0204 Colorado tax form?

Security is a top priority at airSlate SignNow. When handling your DR 0204 Colorado tax form, your information is protected through bank-level encryption and secure cloud storage. This ensures that your sensitive tax data remains safe from unauthorized access.

Get more for Colorado Dr0204

- Dcsc form petition for permission to participate forms

- Iowa damage disclosure statement form

- Printable employee record form

- Navy southwest internal application form

- Dmepos medicare provider surety bond application suretec form

- Rental application amp information release form rentlinx

- Rent linx form

- Fnma short sale form

Find out other Colorado Dr0204

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF