DR 0204 Tax Year Ending Computation of Penalty Due Based on Underpayment of Colorado Individual Estimated Tax 2024-2026

Understanding the DR 0204 Form

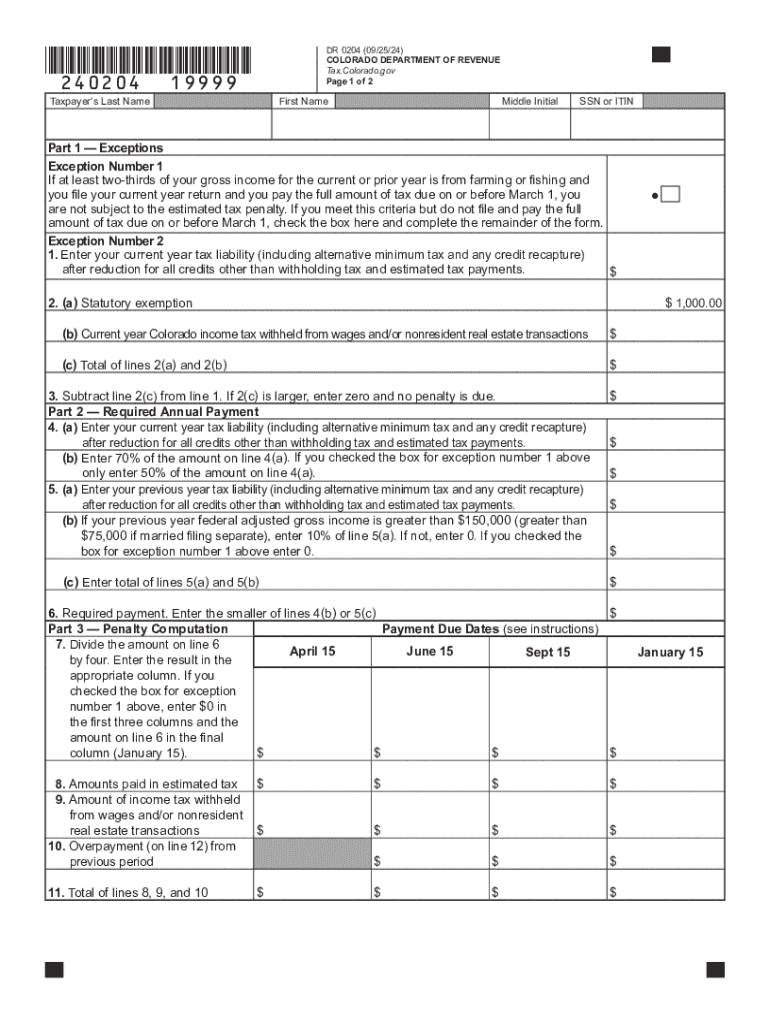

The DR 0204 form, known as the Tax Year Ending Computation of Penalty Due Based on Underpayment of Colorado Individual Estimated Tax, is a crucial document for Colorado taxpayers. It is specifically designed for individuals who may have underpaid their estimated state taxes throughout the year. This form helps calculate any penalties owed due to underpayment, ensuring compliance with Colorado tax laws.

Steps to Complete the DR 0204 Form

Completing the DR 0204 form involves several key steps:

- Gather your financial records, including income statements and previous tax returns.

- Determine your total estimated tax liability for the year.

- Calculate the amount of estimated tax payments you made during the year.

- Use the form to compute any penalties based on the difference between your estimated payments and your total tax liability.

- Review the completed form for accuracy before submission.

Legal Use of the DR 0204 Form

The DR 0204 form is legally required for individuals who have underpaid their estimated taxes in Colorado. Failure to submit this form can result in additional penalties and interest on unpaid taxes. It is important to understand that this form is part of the state’s tax compliance framework, and accurate completion is necessary to avoid legal repercussions.

Key Elements of the DR 0204 Form

Several key elements are essential for understanding the DR 0204 form:

- Tax Year: The specific year for which the penalties are being calculated.

- Estimated Tax Payments: The total amount of estimated tax payments made throughout the year.

- Tax Liability: The total tax owed for the year, which is used to determine underpayment.

- Penalty Calculation: The method used to compute any penalties due based on the underpayment.

Obtaining the DR 0204 Form

The DR 0204 form can be obtained through the Colorado Department of Revenue's website or by contacting their office directly. It is available in both digital and paper formats, allowing taxpayers to choose the method that best suits their needs. Ensure you have the latest version of the form to comply with current tax regulations.

Filing Deadlines for the DR 0204 Form

Timely filing of the DR 0204 form is critical. The form must be submitted by the tax filing deadline, which typically aligns with the federal tax deadline. Taxpayers should be aware of any extensions or specific state deadlines that may apply to ensure compliance and avoid penalties.

Create this form in 5 minutes or less

Find and fill out the correct dr 0204 tax year ending computation of penalty due based on underpayment of colorado individual estimated tax

Create this form in 5 minutes!

How to create an eSignature for the dr 0204 tax year ending computation of penalty due based on underpayment of colorado individual estimated tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the dr 0204 form and how can airSlate SignNow help?

The dr 0204 form is a crucial document used for various business purposes, including tax reporting. airSlate SignNow simplifies the process of completing and signing the dr 0204 form by providing an intuitive platform that allows users to fill out, eSign, and send documents securely.

-

Is there a cost associated with using airSlate SignNow for the dr 0204 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that streamline the completion and signing of the dr 0204 form, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing the dr 0204 form?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage, all designed to enhance the management of the dr 0204 form. These tools help users save time and reduce errors when preparing and signing documents.

-

Can I integrate airSlate SignNow with other applications for the dr 0204 form?

Absolutely! airSlate SignNow offers seamless integrations with popular applications like Google Drive, Dropbox, and CRM systems. This allows users to easily access and manage the dr 0204 form alongside their other business tools.

-

How does airSlate SignNow ensure the security of the dr 0204 form?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption and complies with industry standards to protect your data, ensuring that the dr 0204 form and other sensitive documents are safe from unauthorized access.

-

Can I track the status of the dr 0204 form once sent for signing?

Yes, airSlate SignNow provides real-time tracking for documents, including the dr 0204 form. Users can easily monitor the signing process, receive notifications, and ensure that all parties have completed their actions promptly.

-

Is it easy to use airSlate SignNow for the dr 0204 form?

Yes, airSlate SignNow is designed with user-friendliness in mind. The platform's intuitive interface makes it easy for anyone to create, fill out, and eSign the dr 0204 form without needing extensive technical knowledge.

Get more for DR 0204 Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Individual Estimated Tax

- Fgcu transcript request form

- Form 63 pennsylvania housing finance agency phfa

- Sol review packet us history 1865 present answer key form

- Cryptoquotes online form

- Income based gas conversion program application form

- The energy efficiency rebate programwny residences form

- Media stay request form

- Consent form sponsored medical treatment abroad gov mt

Find out other DR 0204 Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Individual Estimated Tax

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast