Tax Year Ending Computation of Penalty Due Based on Underpayment of Colorado Corporate Estimated Tax and DR 0205 2021

Understanding the Tax Year Ending Computation of Penalty Due Based on Underpayment of Colorado Corporate Estimated Tax and DR 0205

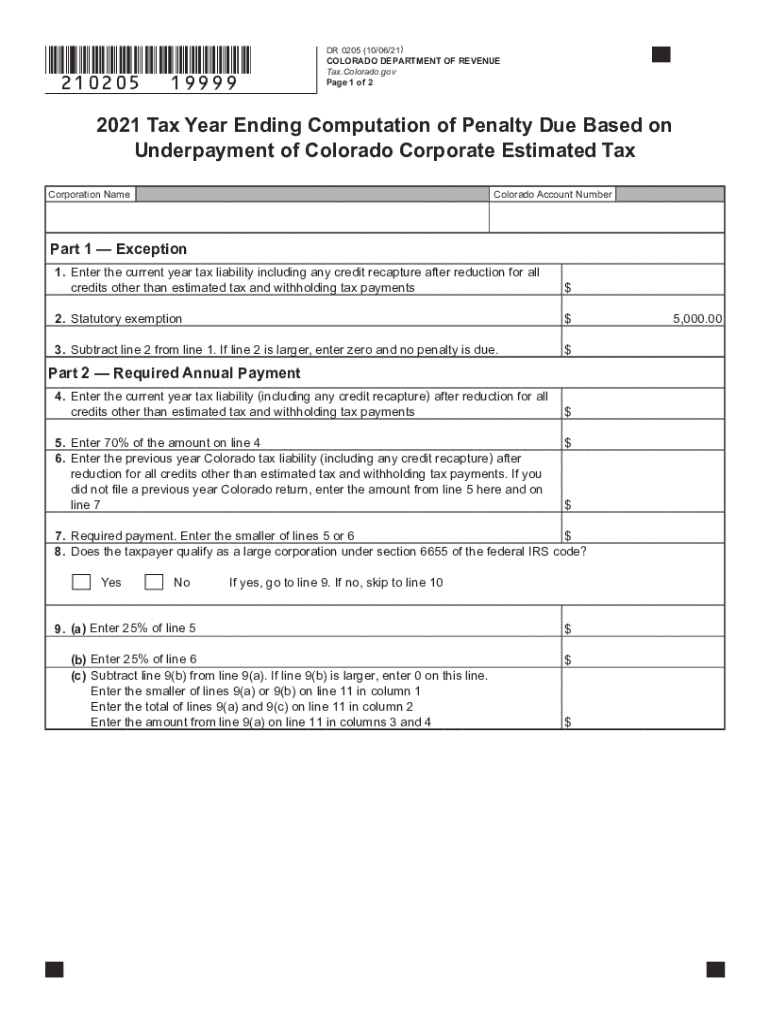

The Tax Year Ending Computation of Penalty Due Based on Underpayment of Colorado Corporate Estimated Tax and DR 0205 is a crucial form for businesses operating in Colorado. This form helps corporations calculate any penalties incurred due to underpayment of estimated taxes throughout the tax year. Understanding this form is essential for compliance with state tax regulations and for avoiding additional fines. It outlines the necessary calculations and provides a framework for determining the total penalty based on the amount of tax owed and the payments made during the year.

Steps to Complete the Tax Year Ending Computation of Penalty Due Based on Underpayment of Colorado Corporate Estimated Tax and DR 0205

Completing the Tax Year Ending Computation of Penalty Due requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial documents, including income statements and prior tax filings.

- Calculate the total estimated tax liability for the year.

- Review the estimated tax payments made throughout the year.

- Determine the difference between the estimated tax liability and the payments made.

- Use the form to calculate any penalties based on the underpayment amount.

- Ensure all calculations are accurate and complete.

- Sign and date the form before submission.

Key Elements of the Tax Year Ending Computation of Penalty Due Based on Underpayment of Colorado Corporate Estimated Tax and DR 0205

Several key elements are essential when filling out the Tax Year Ending Computation of Penalty Due. These include:

- Estimated Tax Liability: The total amount of tax that the corporation expects to owe for the tax year.

- Payments Made: All estimated tax payments submitted during the year.

- Penalty Calculation: The method used to determine the penalty based on the underpayment.

- Signature: A valid signature is required to certify the accuracy of the information provided.

Legal Use of the Tax Year Ending Computation of Penalty Due Based on Underpayment of Colorado Corporate Estimated Tax and DR 0205

The legal use of this form is vital for ensuring compliance with Colorado tax laws. The form must be completed accurately to avoid penalties and legal repercussions. It serves as an official document that can be used to justify the corporation's tax position in case of audits or disputes with tax authorities. Proper execution of the form, including adherence to submission deadlines, is necessary to maintain its legal standing.

Filing Deadlines and Important Dates

Corporations must be aware of specific filing deadlines associated with the Tax Year Ending Computation of Penalty Due. Typically, this form must be submitted by the state’s tax deadline, which aligns with the federal tax filing date. Keeping track of these dates is essential to avoid late fees and additional penalties. It is advisable to consult the Colorado Department of Revenue for the most current deadlines and any changes that may occur from year to year.

Obtaining the Tax Year Ending Computation of Penalty Due Based on Underpayment of Colorado Corporate Estimated Tax and DR 0205

The form can be obtained directly from the Colorado Department of Revenue's website or through their offices. It is available in both digital and paper formats, allowing businesses to choose the method that best suits their needs. For digital completion, utilizing a reliable eSignature platform can streamline the process, ensuring that the form is filled out correctly and submitted on time.

Quick guide on how to complete 2021 tax year ending computation of penalty due based on underpayment of colorado corporate estimated tax and dr 0205

Effortlessly Create Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents since you can access the necessary form and securely save it online. airSlate SignNow offers all the resources you need to produce, modify, and eSign your documents promptly without delays. Handle Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205 on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The Simplest Way to Modify and eSign Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205 with Ease

- Find Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205 and click Acquire Form to initiate the process.

- Make use of the tools available to fill out your form.

- Emphasize important sections of the documents or obscure sensitive details with tools provided by airSlate SignNow specifically for this purpose.

- Generate your signature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and then click the Finished button to retain your modifications.

- Choose how you would like to send your form, whether via email, SMS, or a share link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that require printing new versions. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your preference. Modify and eSign Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205 and ensure exceptional communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 tax year ending computation of penalty due based on underpayment of colorado corporate estimated tax and dr 0205

Create this form in 5 minutes!

How to create an eSignature for the 2021 tax year ending computation of penalty due based on underpayment of colorado corporate estimated tax and dr 0205

The way to make an e-signature for a PDF online

The way to make an e-signature for a PDF in Google Chrome

The way to create an e-signature for signing PDFs in Gmail

The best way to make an e-signature straight from your smartphone

The way to make an e-signature for a PDF on iOS

The best way to make an e-signature for a PDF document on Android

People also ask

-

What is the Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205?

The Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205 refers to the calculations required by businesses to assess penalties for insufficient estimated tax payments. This process is important to ensure compliance with Colorado’s tax laws and to avoid unnecessary fines.

-

How can airSlate SignNow assist with the Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205?

airSlate SignNow streamlines the documentation process for the Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205 by allowing users to eSign and manage documents efficiently. This saves time and ensures accuracy in submitting required tax forms, reducing the risk of penalties.

-

What features does airSlate SignNow offer for corporate tax compliance?

With airSlate SignNow, features such as secure eSigning, document templates, and cloud storage support businesses in maintaining accurate records for tax compliance. This includes easy access to documents related to the Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205, facilitating smoother audits and financial reporting.

-

Is there any pricing information available for airSlate SignNow specific to corporate tax solutions?

Yes, airSlate SignNow offers various pricing tiers to accommodate different business needs. Each plan includes features that can aid in the Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205, ensuring you have the right tools for compliance at a competitive price.

-

Are there integrations available with accounting software for managing tax-related documents?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, enhancing your workflow for the Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205. This helps in syncing financial data and streamlining processes between platforms.

-

How does eSigning improve the process of filing corporate taxes?

eSigning simplifies the filing process by allowing multiple stakeholders to sign documents remotely and securely. For the Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205, this means faster approvals and reducing the risk of late submissions.

-

Can airSlate SignNow help in mitigating potential penalties for corporate taxes?

Yes, by using airSlate SignNow's tools for accuracy and efficiency, businesses can signNowly mitigate the risk of penalties for the Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205. Proper documentation and timely eSignatures can help ensure compliance.

Get more for Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205

Find out other Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement