DR 0205 Tax Year Ending Computation of Penalty Due Based 2022

What is the DR 0205 Tax Year Ending Computation of Penalty Due Based

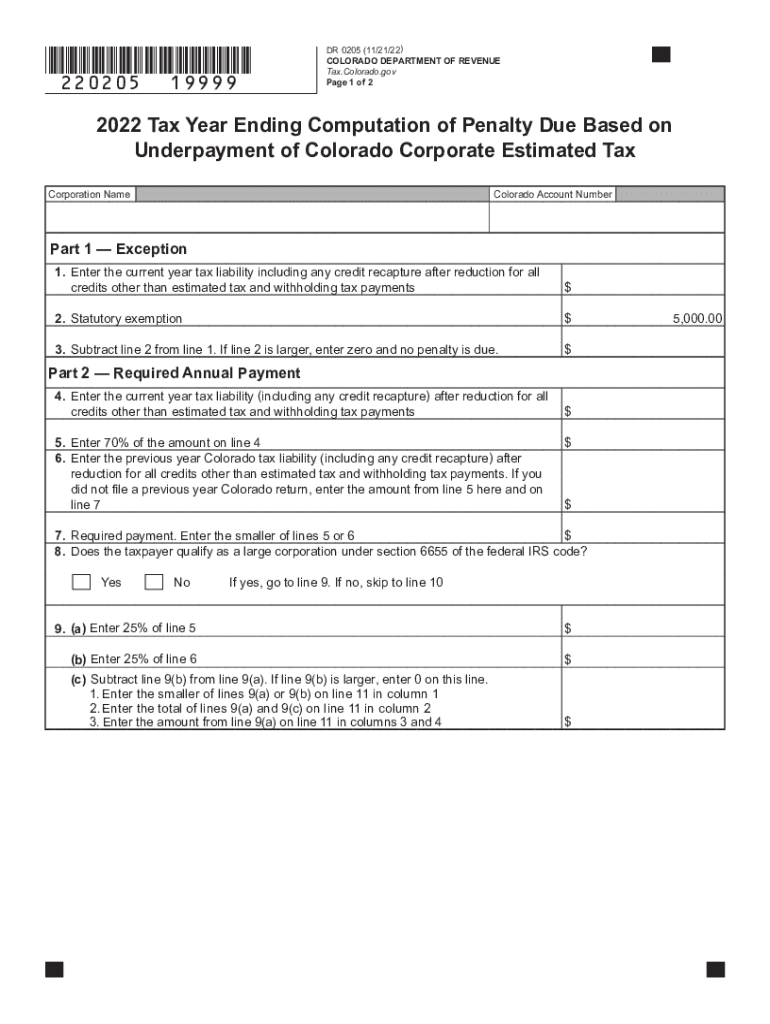

The DR 0205 form is specifically designed for calculating penalties due based on the tax year ending computations in Colorado. It serves as a crucial tool for taxpayers who need to determine their financial obligations accurately. This form is particularly relevant for individuals and businesses that may have underreported income or failed to meet tax obligations in previous years. Understanding the DR 0205 is essential for ensuring compliance with state tax laws and avoiding potential legal issues.

How to use the DR 0205 Tax Year Ending Computation of Penalty Due Based

Using the DR 0205 form involves several steps that ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and previous tax returns. Next, carefully follow the instructions provided on the form to input your financial data. It's important to double-check all entries for accuracy to prevent any discrepancies that could lead to additional penalties. Once completed, the form can be submitted electronically or via mail, depending on your preference.

Steps to complete the DR 0205 Tax Year Ending Computation of Penalty Due Based

Completing the DR 0205 form requires a systematic approach. Start by filling in your personal information, including your name and taxpayer identification number. Next, calculate your total income for the tax year and report any deductions or credits you may qualify for. After determining your total tax liability, use the guidelines on the form to calculate any penalties based on your reported figures. Finally, review the entire form for accuracy before submitting it to the appropriate tax authority.

Legal use of the DR 0205 Tax Year Ending Computation of Penalty Due Based

The legal use of the DR 0205 form is governed by Colorado state tax laws. This form must be completed accurately to ensure compliance with state regulations. Failing to submit the form correctly can result in penalties or legal repercussions. It is important to retain a copy of the completed form for your records, as it may be required for future reference or in case of an audit. Adhering to the legal stipulations surrounding this form helps protect taxpayers from potential disputes with tax authorities.

Penalties for Non-Compliance

Non-compliance with the requirements associated with the DR 0205 form can lead to significant penalties. These penalties may include fines, interest on unpaid taxes, and potential legal action from the state. It is crucial for taxpayers to understand the implications of not filing the form or providing inaccurate information. By ensuring timely and correct submissions, individuals and businesses can avoid the financial burden associated with non-compliance.

Filing Deadlines / Important Dates

Filing deadlines for the DR 0205 form are critical for taxpayers to observe. Typically, the form must be submitted by a specific date following the end of the tax year. Failing to meet these deadlines can result in additional penalties. It is advisable to mark your calendar with important dates related to the form's submission and to stay informed about any changes in filing requirements that may occur from year to year.

Quick guide on how to complete dr 0205 2022 tax year ending computation of penalty due based

Prepare DR 0205 Tax Year Ending Computation Of Penalty Due Based effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle DR 0205 Tax Year Ending Computation Of Penalty Due Based on any device with airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to modify and eSign DR 0205 Tax Year Ending Computation Of Penalty Due Based with ease

- Locate DR 0205 Tax Year Ending Computation Of Penalty Due Based and then click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign DR 0205 Tax Year Ending Computation Of Penalty Due Based and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dr 0205 2022 tax year ending computation of penalty due based

Create this form in 5 minutes!

How to create an eSignature for the dr 0205 2022 tax year ending computation of penalty due based

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Colorado penalty for late document submissions?

The Colorado penalty for late document submissions can lead to fines and other penalties. It's essential to use e-signature solutions like airSlate SignNow to ensure timely submission and compliance. Our service helps you manage and send documents promptly, minimizing any risk of incurring a Colorado penalty.

-

How can airSlate SignNow help avoid penalties in Colorado?

airSlate SignNow streamlines the process of document management and e-signing, signNowly reducing the chances of missing deadlines. By using our platform, businesses can complete and send their documents efficiently, ensuring they remain compliant and avoid any potential Colorado penalty. Timely e-signatures can save you from unnecessary fines.

-

What features does airSlate SignNow offer to ensure compliance with Colorado regulations?

airSlate SignNow provides several features designed to ensure compliance with Colorado regulations, thereby mitigating any risk of Colorado penalties. Our platform includes secure storage, audit trails, and reminders, helping you stay on track and compliant with legal requirements. By using our solution, you can navigate the regulatory landscape with ease.

-

Are there any pricing tiers for airSlate SignNow designed for small businesses in Colorado?

Yes, airSlate SignNow offers flexible pricing tiers suitable for small businesses in Colorado. Our cost-effective solutions are designed to help you manage your documents without incurring excessive costs. By choosing the right plan, you can protect yourself from financial strains arising from Colorado penalties.

-

Can airSlate SignNow integrate with other software to manage compliance in Colorado?

Absolutely! airSlate SignNow easily integrates with a wide range of software solutions, helping you manage compliance tasks and reduce the likelihood of a Colorado penalty. This integration capability allows for a seamless workflow, ensuring all your documents are handled correctly and efficiently.

-

What benefits does airSlate SignNow provide for reducing risks associated with Colorado penalties?

By utilizing airSlate SignNow, you gain increased efficiency in document management, which signNowly reduces risks associated with Colorado penalties. Our intuitive platform makes it easier to track document statuses, receive timely notifications, and ensure everything is done punctually. This proactive approach helps safeguard your business against unnecessary fines.

-

How secure is airSlate SignNow for handling sensitive documents in Colorado?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents in Colorado. Our platform employs state-of-the-art encryption and complies with all regulatory requirements, helping to protect against data bsignNowes and compliance issues that could result in a Colorado penalty. Your documents remain safe and secure at all times.

Get more for DR 0205 Tax Year Ending Computation Of Penalty Due Based

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children texas form

- Tx letter form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497327505 form

- Assumed name certificate texas form

- Tx failure form

- Assumed name 497327508 form

- Tx codes form

- Texas note 497327510 form

Find out other DR 0205 Tax Year Ending Computation Of Penalty Due Based

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast