DR 0205 Tax Year Ending Computation of Penalty Due Based on Underpayment of Colorado Corporate Estimated Tax and DR 0205 2024-2026

Understanding the DR 0205 Tax Year Ending Computation of Penalty

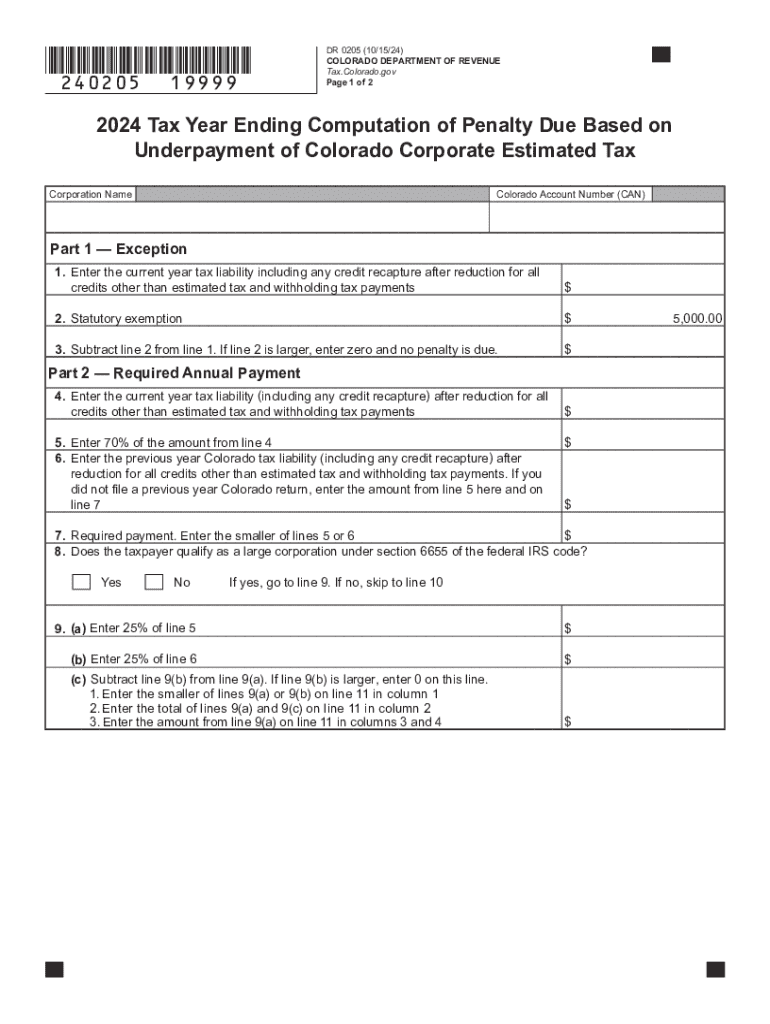

The DR 0205 form is essential for businesses in Colorado to calculate the penalty due based on underpayment of corporate estimated tax. This form helps corporations determine if they have underpaid their estimated tax obligations throughout the year. If the calculated penalty exceeds a certain threshold, businesses must take corrective actions to remain compliant with state tax regulations. Understanding this form is crucial for accurate tax reporting and avoiding unnecessary penalties.

Steps to Complete the DR 0205 Form

Completing the DR 0205 form involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate your total estimated tax liability for the year.

- Determine the amount of tax you have already paid through estimated payments.

- Subtract the total payments from your estimated tax liability to find any underpayment.

- Use the provided tables on the form to calculate the penalty based on the amount of underpayment.

- Complete the form by filling in all required fields accurately.

Each step is vital to ensure that the calculations are correct and that the form is completed in compliance with Colorado tax laws.

Legal Use of the DR 0205 Form

The DR 0205 form is legally required for corporations that have underpaid their estimated tax in Colorado. Filing this form accurately is essential for maintaining compliance with state tax regulations. Failure to submit the form may result in additional penalties and interest charges. It is important for businesses to understand their obligations under Colorado tax law and to use this form as part of their overall tax strategy.

Key Elements of the DR 0205 Form

The DR 0205 form includes several key elements that are crucial for accurate completion:

- Tax Year: Indicate the specific tax year for which the penalty is being calculated.

- Estimated Tax Liability: Total estimated tax owed for the year.

- Payments Made: Amount of estimated tax payments already submitted.

- Penalty Calculation: Detailed breakdown of how the penalty is determined based on underpayment.

Understanding these elements helps ensure that businesses provide complete and accurate information on the form.

Filing Deadlines for the DR 0205 Form

Timely filing of the DR 0205 form is critical to avoid additional penalties. The form must be submitted by the deadline specified by the Colorado Department of Revenue. Generally, this deadline aligns with the annual corporate tax filing deadline, which is typically the fifteenth day of the fourth month following the end of the tax year. Businesses should keep track of these deadlines to ensure compliance and avoid unnecessary penalties.

Examples of Using the DR 0205 Form

Understanding practical scenarios can clarify how to use the DR 0205 form effectively. For instance, a corporation that estimated its tax liability at $10,000 but only paid $8,000 would need to fill out the DR 0205 form to calculate the penalty on the $2,000 underpayment. Another example is a corporation that made timely estimated payments but still underpaid due to increased revenue, necessitating the use of the form to assess penalties accurately. These examples illustrate the form's importance in various business situations.

Create this form in 5 minutes or less

Find and fill out the correct dr 0205 tax year ending computation of penalty due based on underpayment of colorado corporate estimated tax and dr 0205

Create this form in 5 minutes!

How to create an eSignature for the dr 0205 tax year ending computation of penalty due based on underpayment of colorado corporate estimated tax and dr 0205

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the DR 0205 Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205?

The DR 0205 Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205 is a form used by Colorado corporations to calculate penalties for underpayment of estimated taxes. It helps businesses ensure compliance with state tax regulations and avoid unnecessary penalties.

-

How can airSlate SignNow assist with the DR 0205 form?

airSlate SignNow provides an efficient platform for businesses to complete and eSign the DR 0205 Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205. Our solution simplifies the document management process, making it easy to fill out and submit the form electronically.

-

What are the pricing options for using airSlate SignNow for DR 0205?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our cost-effective solution allows you to manage the DR 0205 Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205 without breaking the bank, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing tax documents like DR 0205?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like the DR 0205 Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205. These tools streamline the process and enhance productivity.

-

Can I integrate airSlate SignNow with other software for tax management?

Yes, airSlate SignNow offers seamless integrations with various accounting and tax management software. This allows you to efficiently manage the DR 0205 Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205 alongside your existing tools, enhancing your workflow.

-

What are the benefits of using airSlate SignNow for the DR 0205 form?

Using airSlate SignNow for the DR 0205 Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205 provides numerous benefits, including time savings, reduced errors, and improved compliance. Our platform ensures that your documents are handled securely and efficiently.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that all documents, including the DR 0205 Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205, are protected with advanced encryption and secure storage. Your sensitive information is safe with us.

Get more for DR 0205 Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205

- The matchmakers playbook pdf form

- Hw052 form

- Distracted driving pledge form

- Form c see section 7 3 and section 12 from of medical certificate in respect of an applicant for a licence to drive any

- U s dod form dod navpers 1070 10 u s federal forms

- Business partner separation agreement template form

- Business partners agreement template form

- Business payment agreement template form

Find out other DR 0205 Tax Year Ending Computation Of Penalty Due Based On Underpayment Of Colorado Corporate Estimated Tax And DR 0205

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien