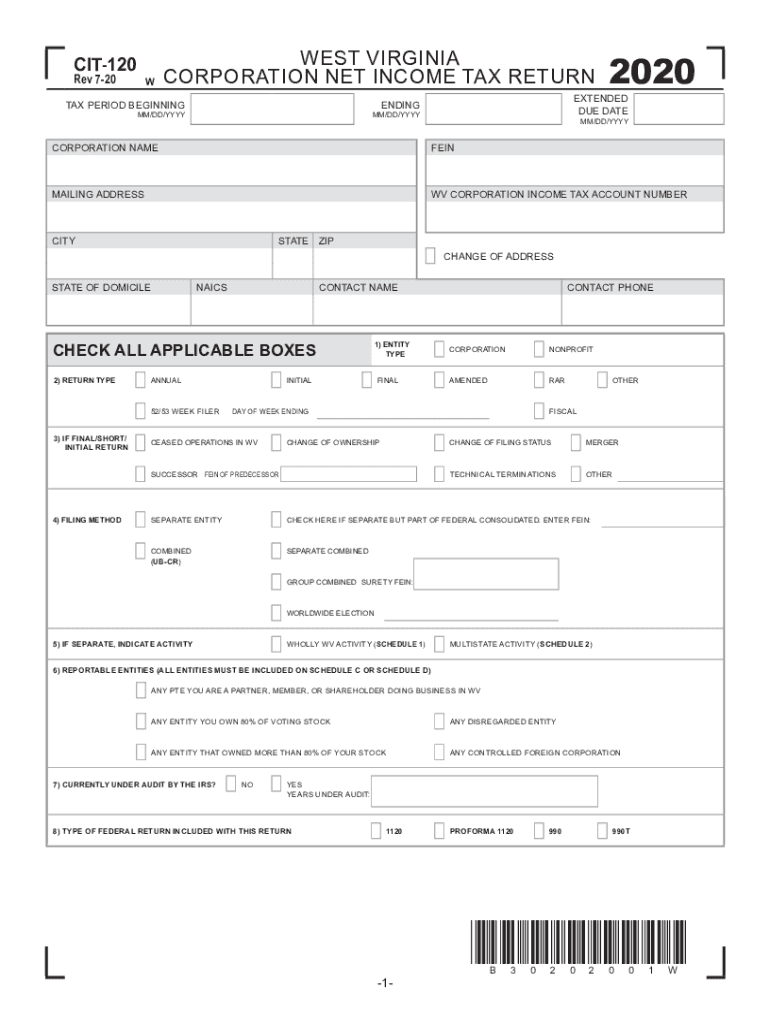

CIT 120 2020

What is the CIT 120

The CIT 120 is a tax form used by corporations in West Virginia to report their income and calculate the amount of corporate net income tax owed to the state. This form is essential for businesses operating within West Virginia, as it ensures compliance with state tax regulations. The CIT 120 requires detailed financial information, including revenue, deductions, and credits, to accurately assess the corporation's tax liability.

How to obtain the CIT 120

To obtain the CIT 120, businesses can visit the West Virginia State Tax Department's official website, where the form is available for download. Additionally, the form can often be requested by contacting the tax department directly. It is important to ensure that you are using the most current version of the form, as updates may occur annually.

Steps to complete the CIT 120

Completing the CIT 120 involves several key steps:

- Gather all necessary financial documents, including income statements and balance sheets.

- Fill out the form accurately, ensuring that all income, deductions, and credits are reported.

- Calculate the total corporate net income tax owed based on the information provided.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated filing deadline, either electronically or by mail.

Legal use of the CIT 120

The CIT 120 must be completed and filed in accordance with West Virginia state law. It is legally binding and serves as an official record of the corporation's income and tax obligations. Failure to use the form correctly can result in penalties, including fines or additional tax assessments. Therefore, it is crucial for businesses to adhere to all legal requirements when using the CIT 120.

Filing Deadlines / Important Dates

Corporations must be aware of specific filing deadlines for the CIT 120. Generally, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For most corporations operating on a calendar year, this means the form is due by April 15. It is advisable to check for any changes or extensions that may apply to specific tax years.

Required Documents

When completing the CIT 120, several documents are typically required to support the information reported on the form. These may include:

- Income statements and balance sheets for the tax year.

- Documentation of any deductions or credits claimed.

- Previous tax returns for reference.

- Any additional schedules or forms that may be required by the state.

Form Submission Methods

The CIT 120 can be submitted using various methods, including:

- Online submission through the West Virginia State Tax Department's e-filing system.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax department locations.

Quick guide on how to complete cit 120

Complete CIT 120 effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without delays. Manage CIT 120 on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign CIT 120 with ease

- Obtain CIT 120 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools designed by airSlate SignNow for that specific purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Modify and eSign CIT 120 and ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cit 120

Create this form in 5 minutes!

How to create an eSignature for the cit 120

How to generate an electronic signature for your PDF online

How to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the WV tax form CIT 120?

The WV tax form CIT 120 is a corporate income tax return required for businesses operating in West Virginia. It needs to be filed annually to report income, calculate tax obligations, and ensure compliance with state laws.

-

How can airSlate SignNow help with the WV tax form CIT 120?

airSlate SignNow simplifies the process of preparing and submitting the WV tax form CIT 120 by allowing you to eSign and send documents quickly and securely. This feature helps you stay organized and ensures that you meet all filing deadlines without hassle.

-

Is airSlate SignNow affordable for small businesses handling the WV tax form CIT 120?

Yes, airSlate SignNow offers a cost-effective solution for small businesses managing the WV tax form CIT 120 and other document-signing needs. Our pricing plans are designed to fit various budgets, making electronic signatures accessible for everyone.

-

What features does airSlate SignNow provide for eSigning the WV tax form CIT 120?

airSlate SignNow provides features such as secure eSigning, document templates, and real-time tracking for the WV tax form CIT 120. These tools streamline the signing process, help maintain compliance, and enhance collaboration among team members.

-

Can airSlate SignNow integrate with other software for filing the WV tax form CIT 120?

Yes, airSlate SignNow offers various integrations with popular accounting and tax preparation software. This feature simplifies the process of collecting signatures for the WV tax form CIT 120 by allowing seamless data transfer between platforms.

-

What are the benefits of using airSlate SignNow for the WV tax form CIT 120?

Using airSlate SignNow for the WV tax form CIT 120 offers numerous benefits, including time savings, enhanced security, and improved accuracy in document handling. Our platform ensures that your documents are securely stored and easily accessible whenever you need them.

-

How does airSlate SignNow enhance compliance when filing the WV tax form CIT 120?

airSlate SignNow enhances compliance when filing the WV tax form CIT 120 by providing a clear audit trail, secure storage, and automated reminders for deadlines. This helps ensure that all necessary signatures are obtained, reducing the risk of errors.

Get more for CIT 120

- Mo deed beneficiary form

- Quitclaim deed husband and wife to three individuals missouri form

- Quitclaim deed from limited liability company to limited liability company missouri form

- Deed beneficiary form 497313094

- Irrevocable 497313095 form

- Transfer death deed 497313096 form

- Missouri beneficiary deed form

- Transfer death deed 497313098 form

Find out other CIT 120

- How Can I Electronic signature Tennessee Sublease Agreement Template

- Electronic signature Maryland Roommate Rental Agreement Template Later

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast