Wv Cnf 120 2018

What is the Wv Cnf 120

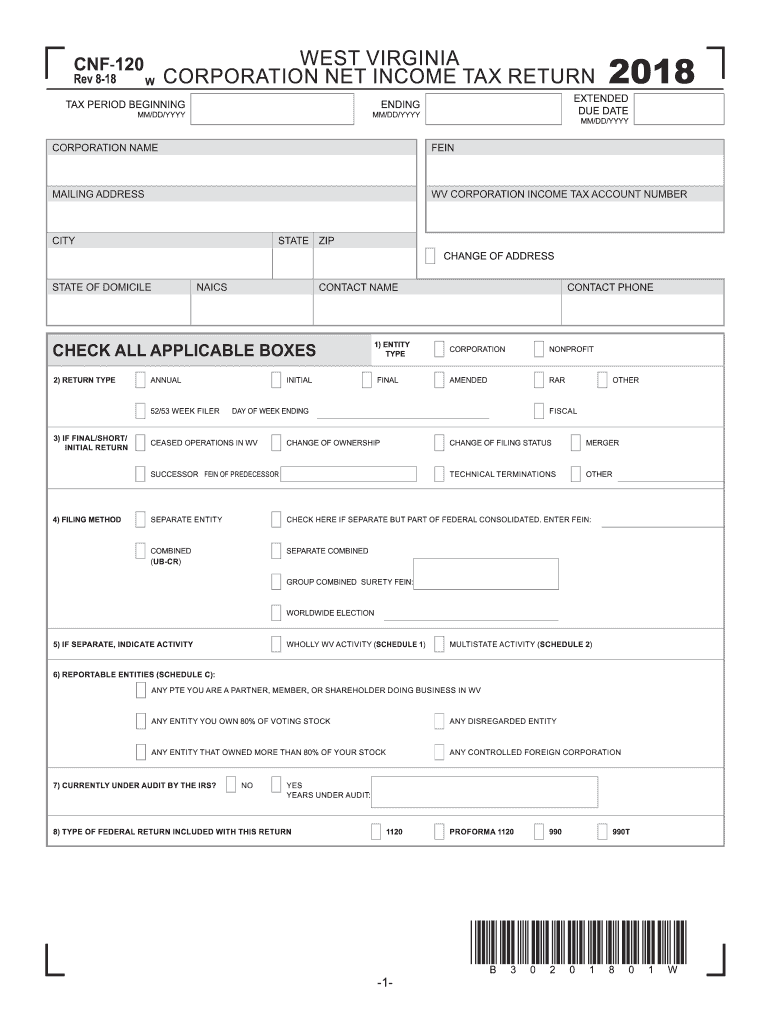

The Wv Cnf 120 is a specific form used in West Virginia for tax reporting purposes. This form is designed to assist individuals and businesses in reporting their income accurately to the state. It is essential for ensuring compliance with state tax regulations and for calculating any owed taxes or refunds. The Wv Cnf 120 must be filled out with precise information regarding income, deductions, and other relevant financial data to meet legal requirements.

How to use the Wv Cnf 120

Using the Wv Cnf 120 involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and previous tax returns. Next, access the fillable version of the form online, which allows for easy entry of information. As you complete the form, be sure to follow the instructions closely, ensuring that all fields are filled out correctly. After completing the form, review all entries for accuracy before submitting it to the appropriate state tax authority.

Steps to complete the Wv Cnf 120

Completing the Wv Cnf 120 requires a systematic approach. Start by downloading the fillable form from a reliable source. Then, follow these steps:

- Enter your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, including wages, self-employment earnings, and any other income.

- List any deductions you are eligible for, such as business expenses or educational credits.

- Calculate your total tax liability based on the provided guidelines.

- Sign and date the form, confirming that the information provided is accurate.

Legal use of the Wv Cnf 120

The Wv Cnf 120 is legally recognized by the state of West Virginia as a valid document for tax reporting. It must be completed in accordance with state laws to ensure compliance and avoid penalties. The form serves as an official record of income and tax obligations, making it crucial for both individuals and businesses to use it correctly. Failure to use the form as required can result in legal repercussions, including fines or audits.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Wv Cnf 120. Generally, the form must be submitted by April fifteenth of each year for the previous tax year. However, if the deadline falls on a weekend or holiday, the due date may be extended to the next business day. Keeping track of these dates is essential to avoid late fees and ensure timely processing of your tax return.

Required Documents

To complete the Wv Cnf 120, certain documents are required. These include:

- W-2 forms from employers, detailing annual earnings.

- 1099 forms for any freelance or contract work.

- Documentation for any deductions claimed, such as receipts for business expenses.

- Previous year’s tax return for reference.

Form Submission Methods (Online / Mail / In-Person)

The Wv Cnf 120 can be submitted through various methods to accommodate different preferences. You can file the form online using the state tax authority's website, which often provides a streamlined process. Alternatively, you may choose to print the completed form and mail it to the designated tax office. In-person submissions are also accepted at local tax offices, allowing for direct interaction with tax officials if needed.

Quick guide on how to complete 2 wv state tax department wvgov

Your assistance manual on how to prepare your Wv Cnf 120

If you’re wondering how to finalize and submit your Wv Cnf 120, here are a few concise guidelines to simplify tax submission.

To begin, you only need to create your airSlate SignNow account to revolutionize your document management online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to modify, generate, and finalize your income tax documents with ease. With its editor, you can toggle between text, check boxes, and eSignatures and revisit to adjust information as necessary. Optimize your tax administration with advanced PDF editing, eSigning, and intuitive sharing.

Follow the instructions below to finalize your Wv Cnf 120 in just minutes:

- Establish your account and start working on PDFs within moments.

- Utilize our library to obtain any IRS tax form; explore various versions and schedules.

- Click Get form to access your Wv Cnf 120 in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to append your legally-recognized eSignature (if required).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Make use of this manual to file your taxes digitally with airSlate SignNow. Please remember that paper filing can increase errors and delay refunds. Additionally, before e-filing your taxes, check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2 wv state tax department wvgov

FAQs

-

How could the federal government and state governments make it easier to fill out tax returns?

Individuals who don't own businesses spend tens of billions of dollars each year (in fees and time) filing taxes. Most of this is unnecessary. The government already has most of the information it asks us to provide. It knows what are wages are, how much interest we earn, and so on. It should provide the information it has on the right line of an electronic tax return it provides us or our accountant. Think about VISA. VISA doesn't send you a blank piece of paper each month, and ask you to list all your purchases, add them up and then penalize you if you get the wrong number. It sends you a statement with everything it knows on it. We are one of the only countries in the world that makes filing so hard. Many companies send you a tentative tax return, which you can adjust. Others have withholding at the source, so the average citizen doesn't file anything.California adopted a form of the above -- it was called ReadyReturn. 98%+ of those who tried it loved it. But the program was bitterly opposed by Intuit, makers of Turbo Tax. They went so far as to contribute $1 million to a PAC that made an independent expenditure for one candidate running for statewide office. The program was also opposed by Rush Limbaugh and Grover Norquist. The stated reason was that the government would cheat taxpayers. I believe the real reason is that they want tax filing to be painful, since they believe that acts as a constraint on government programs.

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

I worked in two different states this year (and two different companies), will I have to fill out state income tax forms for both?

A2A BUT We need more information to give you an accurate answer. There are 50 different states and 43 of them have some form of individual income tax laws, so that is 1,849 different possibilities of how to answer this question. That is before we even factor in that you did not tell us how long you lived in either state, which could be a day or 364 days.I can give you the probably answer which is yes you will most likely need to file with two states this year. Take a look at your two W2’s and at the bottom you will see what state(s) your earnings were reported to. If the W2’s have different states then absolutely you should file a return with both states, because what is on the W2 will be presumed to be accurate, even if your presence in the state did not actually rise to the level of needing to file. The biggest question will become if you are filing as a resident, non-resident or part-year resident. Your filing status can make a difference in how much tax you owe and unfortunately it is not as simple as just thinking you lived in a place for only part of the year so you were automatically a part-year resident.This is one of those situations where I would advise you that your taxes this year are complex enough that you really need to go to a professional to have your taxes done. That person should be able to review the specifics of your situation and advise you how to file.

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

Create this form in 5 minutes!

How to create an eSignature for the 2 wv state tax department wvgov

How to create an eSignature for the 2 Wv State Tax Department Wvgov online

How to make an electronic signature for the 2 Wv State Tax Department Wvgov in Google Chrome

How to generate an electronic signature for putting it on the 2 Wv State Tax Department Wvgov in Gmail

How to generate an electronic signature for the 2 Wv State Tax Department Wvgov straight from your mobile device

How to create an eSignature for the 2 Wv State Tax Department Wvgov on iOS devices

How to make an electronic signature for the 2 Wv State Tax Department Wvgov on Android

People also ask

-

What is the fillable IT 210 WV 2018 form?

The fillable IT 210 WV 2018 form is a tax document used by West Virginia residents to report income and calculate state taxes. It is crucial for individuals to complete this form accurately to ensure compliance with state tax regulations. Utilizing airSlate SignNow allows users to fill out and eSign this form seamlessly.

-

How do I access the fillable IT 210 WV 2018 form?

You can easily access the fillable IT 210 WV 2018 form through airSlate SignNow. Simply create an account and navigate to the forms section, where you can find and fill out the document online. This convenience ensures that you can complete your tax filings promptly.

-

Can I eSign the fillable IT 210 WV 2018 form?

Yes, airSlate SignNow allows you to eSign the fillable IT 210 WV 2018 form electronically. This feature not only simplifies the signing process but also enhances the security and authenticity of your document. eSigning is fast and efficient, making tax filing easier.

-

Is airSlate SignNow cost-effective for filing my fillable IT 210 WV 2018?

Absolutely! airSlate SignNow offers affordable pricing plans that cater to various business needs, making it a cost-effective choice for filing your fillable IT 210 WV 2018 form. You can choose a plan that best fits your requirements without breaking the bank.

-

What features does airSlate SignNow offer for the fillable IT 210 WV 2018 form?

AirSlate SignNow provides a rich set of features to streamline the completion of the fillable IT 210 WV 2018 form. These features include easy document editing, signing, collaboration, and secure cloud storage. This comprehensive suite ensures a hassle-free experience for users.

-

Can I integrate airSlate SignNow with other software for handling the fillable IT 210 WV 2018?

Yes, airSlate SignNow offers integrations with various software applications, making it easier to manage your fillable IT 210 WV 2018 forms alongside other business tools. These integrations enhance productivity and ensure a smoother workflow, especially during tax season.

-

What are the benefits of using airSlate SignNow for the fillable IT 210 WV 2018?

Using airSlate SignNow for the fillable IT 210 WV 2018 comes with numerous benefits, such as increased efficiency, reduced paperwork, and enhanced security. The platform's user-friendly interface makes filling out and submitting the form quick and uncomplicated, helping you meet deadlines with ease.

Get more for Wv Cnf 120

- Appendix i 3 medicare confidential reporting information form

- In 111 vermont form

- Pet purchase agreement v1 form

- Step 1 to be completed by parentguardian please print form

- 1583 river walk drive fortuna ca 707 725 7025 fax 707 725 7088 form

- Owner certification of smoke carbon monoxide detector form

- Annual report for electronic wastes handling and recycling activity annual report for electronic wastes handling and recycling form

- Arrowhead woods architectural committee form

Find out other Wv Cnf 120

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile