CNF 120 West Virginia Tax Wv Gov 2016

What is the CNF 120 West Virginia Tax wv gov

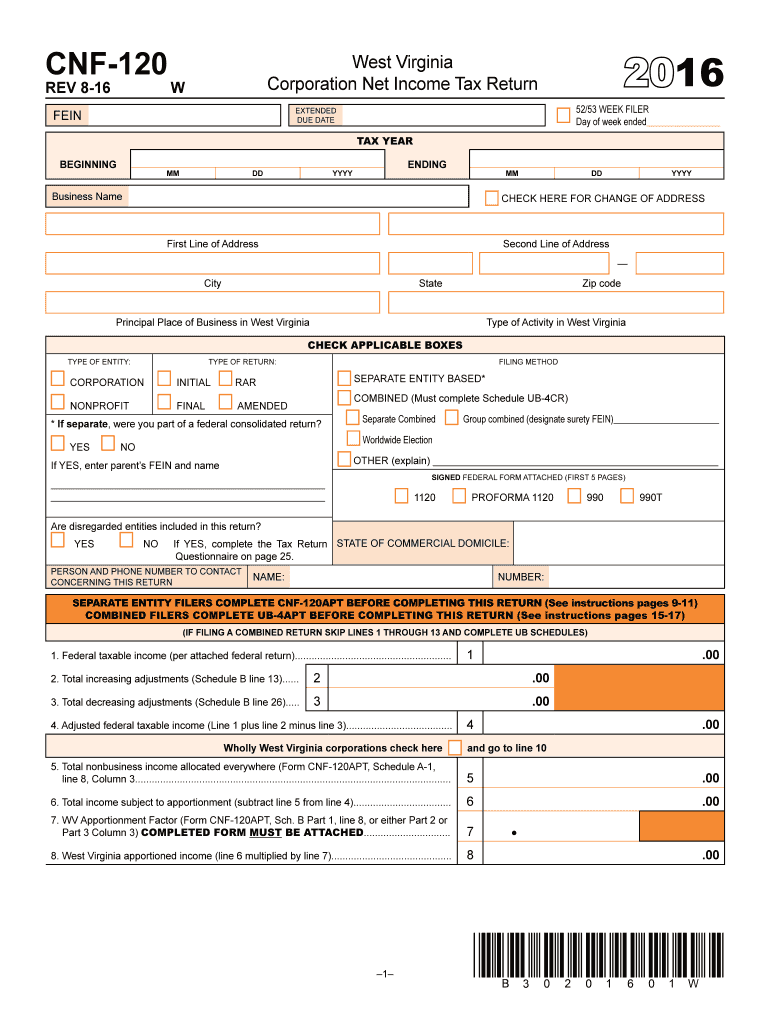

The CNF 120 West Virginia Tax form is an essential document used for reporting various tax obligations within the state of West Virginia. This form is specifically designed for businesses and individuals to declare their income, deductions, and credits accurately. It is crucial for ensuring compliance with state tax laws and regulations. The CNF 120 helps streamline the tax reporting process, making it easier for taxpayers to fulfill their obligations while minimizing errors.

How to use the CNF 120 West Virginia Tax wv gov

Using the CNF 120 West Virginia Tax form involves several straightforward steps. First, gather all necessary financial documents, including income statements, expense receipts, and any relevant tax information. Next, access the form through the official state tax website or other authorized platforms. Fill in the required fields with accurate information, ensuring that all calculations are correct. Once completed, review the form for any errors before submitting it electronically or via mail, depending on your preference.

Steps to complete the CNF 120 West Virginia Tax wv gov

Completing the CNF 120 West Virginia Tax form requires careful attention to detail. Follow these steps for a successful submission:

- Gather all necessary financial documents, including income and expense records.

- Access the CNF 120 form online or obtain a physical copy.

- Fill in your personal and business information accurately.

- Declare your income, deductions, and any applicable credits.

- Double-check all entries for accuracy.

- Sign the form electronically or manually, as required.

- Submit the completed form by the designated deadline.

Legal use of the CNF 120 West Virginia Tax wv gov

The CNF 120 West Virginia Tax form is legally recognized for reporting income and tax obligations in the state. It complies with state tax laws and regulations, ensuring that taxpayers can fulfill their responsibilities without legal repercussions. Proper use of this form is essential for maintaining compliance and avoiding potential penalties for inaccurate reporting. It is advisable to consult with a tax professional if there are any uncertainties regarding the legal aspects of completing this form.

Filing Deadlines / Important Dates

Filing deadlines for the CNF 120 West Virginia Tax form are crucial for taxpayers to observe. Typically, the form must be submitted by the annual tax deadline, which is usually April 15 for individual taxpayers. Businesses may have different deadlines based on their fiscal year. It is important to stay informed about any changes to these dates, as late submissions can result in penalties and interest charges. Mark your calendar to ensure timely filing and compliance with state tax regulations.

Required Documents

To complete the CNF 120 West Virginia Tax form accurately, certain documents are required. These typically include:

- Income statements, such as W-2s or 1099s.

- Records of business expenses and deductions.

- Previous year’s tax return for reference.

- Any supporting documentation for credits claimed.

Having these documents ready will facilitate a smoother and more efficient filing process.

Quick guide on how to complete cnf 120 west virginia 2016 taxwvgov

Your assistance manual on how to prepare your CNF 120 West Virginia Tax wv gov

If you’re wondering how to complete and submit your CNF 120 West Virginia Tax wv gov, here are a few straightforward instructions on how to simplify tax filing.

To begin, you only need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is a highly intuitive and robust document solution that enables you to edit, draft, and finalize your tax documents effortlessly. Using its editor, you can toggle between text, checkboxes, and eSignatures and return to modify information as necessary. Streamline your tax management with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to complete your CNF 120 West Virginia Tax wv gov in just a few minutes:

- Set up your account and begin working on PDFs in minutes.

- Utilize our directory to obtain any IRS tax form; browse through different versions and schedules.

- Click Get form to load your CNF 120 West Virginia Tax wv gov in our editor.

- Fill in the mandatory fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Use this manual to file your taxes electronically with airSlate SignNow. Keep in mind that filing on paper can increase return errors and delay refunds. Before e-filing your taxes, please consult the IRS website for submission rules in your state.

Create this form in 5 minutes or less

Find and fill out the correct cnf 120 west virginia 2016 taxwvgov

Create this form in 5 minutes!

How to create an eSignature for the cnf 120 west virginia 2016 taxwvgov

How to make an electronic signature for your Cnf 120 West Virginia 2016 Taxwvgov online

How to create an electronic signature for the Cnf 120 West Virginia 2016 Taxwvgov in Google Chrome

How to generate an eSignature for putting it on the Cnf 120 West Virginia 2016 Taxwvgov in Gmail

How to create an eSignature for the Cnf 120 West Virginia 2016 Taxwvgov right from your mobile device

How to generate an eSignature for the Cnf 120 West Virginia 2016 Taxwvgov on iOS devices

How to generate an eSignature for the Cnf 120 West Virginia 2016 Taxwvgov on Android devices

People also ask

-

What is the CNF 120 West Virginia Tax wv gov form?

The CNF 120 West Virginia Tax wv gov form is a crucial document that businesses in West Virginia use to report their corporate net income. This form provides the necessary information to the state tax authorities, enabling them to assess and collect the appropriate taxes owed. Properly completing the CNF 120 is essential to maintain compliance with state tax regulations.

-

How can airSlate SignNow help with submitting the CNF 120 West Virginia Tax wv gov form?

AirSlate SignNow simplifies the process of submitting the CNF 120 West Virginia Tax wv gov form by allowing users to create, sign, and send documents quickly and securely. Our platform's eSignature feature ensures that all submitted forms are legally binding and compliant with state requirements. You can easily manage submissions and track their status through our user-friendly interface.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow offers competitive pricing options to fit various business needs, including monthly and annual plans. Each plan includes access to features that can facilitate the completion of essential tax forms like the CNF 120 West Virginia Tax wv gov. You can choose a plan that aligns with your document signing and management requirements.

-

What features does airSlate SignNow provide for handling tax documents?

AirSlate SignNow provides a suite of features tailored for tax documents, including customizable templates, advanced eSignature capabilities, and document storage. These tools ensure that forms like the CNF 120 West Virginia Tax wv gov are easy to complete and manage. Additionally, our platform supports secure sharing and storage of sensitive tax-related documents.

-

Can airSlate SignNow integrate with other accounting software?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, enhancing your workflow for handling documents like the CNF 120 West Virginia Tax wv gov. By integrating with platforms your business already uses, you can streamline the process of preparing and submitting your tax documents. Check our integration page to see all supported applications.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms, including the CNF 120 West Virginia Tax wv gov, offers numerous benefits, such as reduced turnaround time, increased accuracy, and enhanced privacy. The electronic process minimizes errors associated with paper forms while providing a secure way to sign and store important tax documents. Enjoy the convenience of tracking your submissions in real-time.

-

Is airSlate SignNow secure for handling sensitive tax information?

Absolutely! AirSlate SignNow employs top-level security protocols to protect all sensitive tax information, including the CNF 120 West Virginia Tax wv gov form. Our platform uses advanced encryption and complies with regulatory standards for data protection, ensuring your documents are safe from unauthorized access. Feel confident that your tax information remains confidential.

Get more for CNF 120 West Virginia Tax wv gov

Find out other CNF 120 West Virginia Tax wv gov

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement